Understanding Vietnam Crypto Market Liquidity

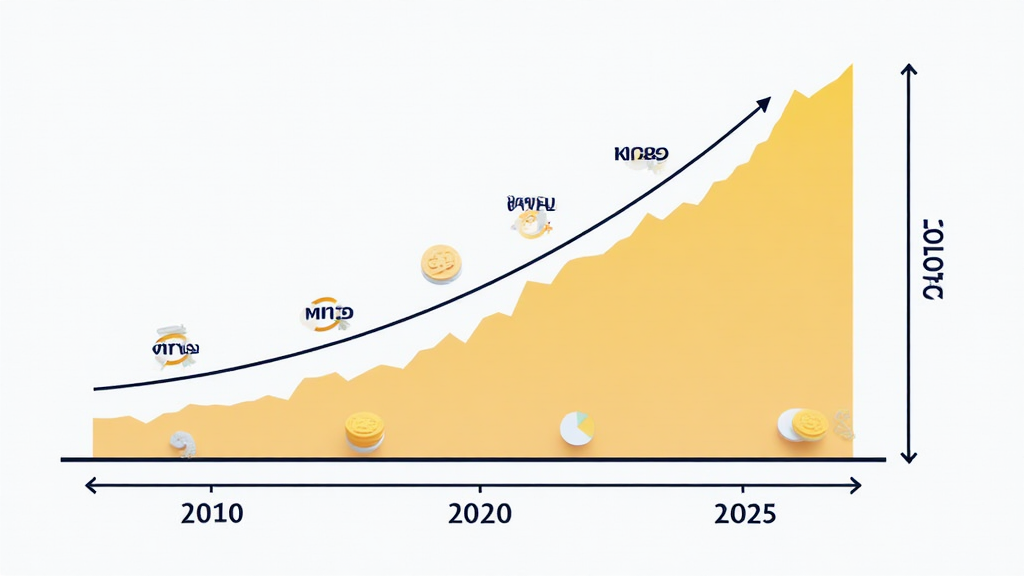

As the world continues to embrace digital currencies, the Vietnam crypto market liquidity has emerged as a significant area of interest for both investors and traders. With the crypto landscape evolving rapidly, one might wonder how liquidity in this market impacts investment opportunities, price stability, and overall user engagement. Before diving deeper, consider this: according to a recent study, Vietnam has witnessed a remarkable increase in crypto users, growing by over 300% in the past year alone.

Introduction: The Rise of Cryptocurrency in Vietnam

In recent years, Vietnam has gained notoriety as one of the fastest-growing markets for cryptocurrency. With a burgeoning population of tech-savvy individuals and an increasing acceptance of blockchain technology, the country has positioned itself as a significant player in the global crypto ecosystem. However, this rapid growth has brought forth challenges, particularly regarding market liquidity.

Liquidity refers to the ease with which assets can be bought or sold in the market without affecting their price. In the context of cryptocurrencies, this means how quickly a trader can convert their digital assets into cash or other cryptocurrencies without experiencing significant price changes.

The Importance of Liquidity in Crypto Markets

The liquidity of a market plays a crucial role in determining the overall health and stability of that market. In highly liquid markets, buyers and sellers can transact seamlessly, reducing price volatility and enhancing investor confidence. Conversely, low liquidity can result in increased price swings, making it challenging for investors to execute trades at desired prices.

Market Trends and Liquidity

- Despite a global decline in interest for direct crypto investments, Vietnam’s market has bucked the trend, demonstrating resilience and growth.

- Local exchanges are experiencing higher trading volumes, particularly with Bitcoin and Ethereum, further enhancing liquidity.

- As more investors seek opportunities within the realm of decentralized finance (DeFi), liquidity pools have become essential.

Factors Affecting Liquidity in Vietnam’s Crypto Market

Several factors contribute to the liquidity levels in Vietnam’s crypto market. These factors include:

- Regulatory Environment: Government regulations play a pivotal role in shaping the crypto landscape. The Vietnamese government has expressed its interest in developing a comprehensive framework for cryptocurrency, which could lead to increased trust and participation in the market.

- User Adoption: The rise in crypto users has propelled demand, leading to higher trading volumes on local exchanges.

- Exchange Security: The security of cryptocurrency exchanges greatly impacts liquidity. For instance, after a series of hacks in 2023, user confidence was shaken, temporarily reducing liquidity levels.

The Role of DeFi in Enhancing Liquidity

Decentralized Finance, popularly known as DeFi, has significantly transformed the liquidity landscape in the Vietnam crypto market. DeFi platforms offer users the ability to lend, borrow, and trade their assets without relying on traditional financial intermediaries. This peer-to-peer mechanism enhances liquidity by enabling users to participate in various financial activities seamlessly.

Benefits of DeFi for Liquidity

- Increased Participation: DeFi protocols attract a diverse user base, contributing to improved liquidity.

- Automated Market Making: Platforms that utilize liquidity pools facilitate easier trading, allowing users to swap assets efficiently.

- Yield Farming Opportunities: Users can earn passive income through liquidity provision, incentivizing more participants to engage in the market.

Challenges Facing Liquidity in Vietnam’s Crypto Market

While the liquidity in Vietnam’s crypto market shows promise, several challenges remain:

- Volatility: Cryptocurrencies are inherently volatile, and sharp price fluctuations can deter potential investors, resulting in limited buying or selling activity.

- Market Manipulation: Low liquidity markets are susceptible to manipulation tactics, which can lead to price distortions.

- Lack of Transparency: Many local exchanges lack audits or security certifications, raising concerns among users and affecting overall trust.

Future Outlook for Vietnam Crypto Market Liquidity

As we look ahead, the future of liquidity in Vietnam’s crypto market appears promising. With ongoing development by regulatory bodies and increasing user engagement, the market is poised for further growth. According to recent data, notable increases in the number of registered crypto wallets are expected, which can facilitate more extensive trading activities.

Key Factors to Watch

- **Regulatory Developments:** Keep an eye on potential regulations that might enhance or restrict market activities.

- **Technological Advancements:** Innovations in blockchain technology and wallet security can boost user confidence and liquidity.

- **Global Market Trends:** Following global crypto trends can help local investors make informed decisions, impacting liquidity on both local and international stages.

Conclusion

In summary, understanding the mechanisms and implications of Vietnam crypto market liquidity is crucial for anyone looking to invest in this dynamic environment. As more people become aware of the opportunities within the crypto space, liquidity will likely continue to improve, paving the way for a more robust and sustainable market. While challenges remain, the overall trajectory shows promise for enthusiastic investors.

For anyone interested in exploring the Vietnamese crypto landscape further, resources such as hibt.com offer detailed insights and market analysis to guide investment strategies.

Dr. Tran Minh Tam, a renowned expert in blockchain technology, has authored over 15 papers in the field and led major audits of various high-profile projects. His insights lend authority to discussions surrounding Vietnam’s crypto market.