Introduction

In the rapidly evolving world of cryptocurrency trading, liquidity is a crucial factor that investors need to understand. With over $4.1 billion lost to DeFi hacks in 2024, traders are increasingly wary of where they invest their assets. This underscores the importance of liquidity ratios in assessing the safety and viability of trading platforms.

As Vietnam continues to embrace digital assets, understanding Vietnam crypto exchange liquidity ratios becomes essential for traders and investors alike. In this article, we will delve into what liquidity ratios are, how they operate in the context of Vietnam’s crypto exchanges, and why they matter for your investment strategy.

The Basics of Liquidity Ratios

Liquidity ratios are financial metrics that measure the ease with which an asset can be converted into cash without affecting its market price. In the context of cryptocurrency exchanges, these ratios reflect how well an exchange can handle trades without significant delays or price slippage.

- High Liquidity: Indicates that a large number of buyers and sellers are present, allowing for quick transaction execution.

- Low Liquidity: May lead to longer wait times and potential losses for traders due to price fluctuations.

Why Liquidity Matters for Vietnamese Traders

With Vietnam’s crypto user growth rate soaring, reaching approximately 12% in 2024, having access to liquid exchanges is pivotal for successful trading. A liquid exchange not only allows for lower transaction costs but also lessens the risks associated with volatility.

Much like a bank vault for digital assets, a highly liquid exchange ensures minimal risk when moving in and out of investments. Therefore, understanding liquidity ratios can lead to more informed trading decisions.

Key Liquidity Ratios to Monitor

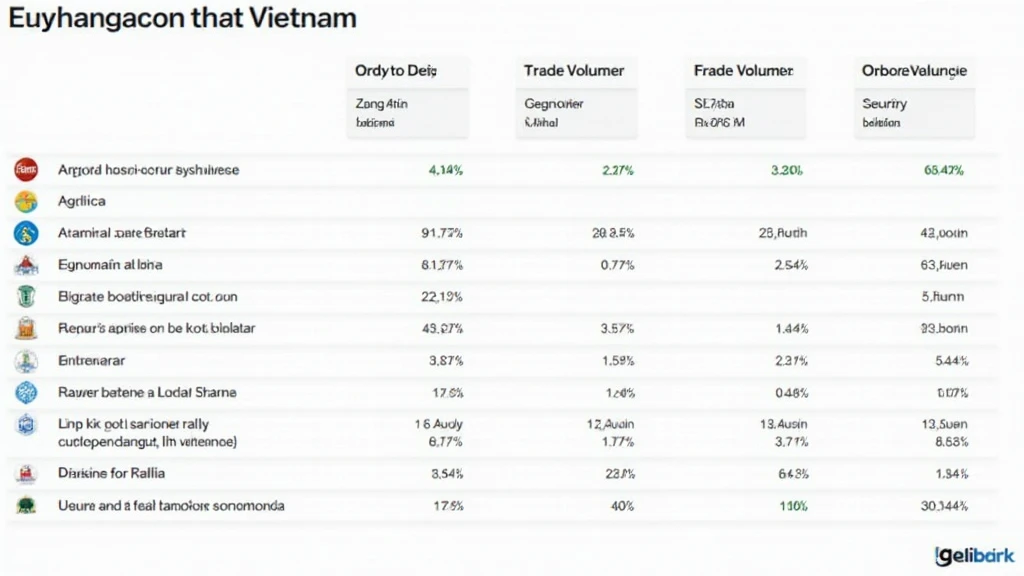

When evaluating crypto exchanges in Vietnam, consider the following liquidity ratios:

- Order Book Depth: Assesses the number of buy and sell orders at various price levels.

- Trade Volume: Indicates the total amount of cryptocurrency traded within a specific period.

- Market Spread: Reflects the difference between the highest bid price and the lowest ask price.

By monitoring these metrics, traders can gain insight into an exchange’s liquidity health.

Case Studies: Vietnam Crypto Exchanges

To further illustrate the importance of liquidity ratios, let’s examine a few Vietnamese exchanges:

- Exchange A: With an order book depth of 15 BTC at the current price, traders can enter or exit positions swiftly without significant slippage.

- Exchange B: Exhibits a narrow market spread of just 0.1%, making it cheaper for traders to make transactions.

- Exchange C: However, this platform experiences low trade volumes, resulting in high slippage costs for bigger orders.

These examples highlight how different liquidity ratios can impact trading strategies in Vietnam.

Long-Term Trends in Vietnam’s Crypto Market

As of 2025, projections indicate that Vietnamese crypto exchanges will need to enhance liquidity to meet growing demand. According to a recent report from Chainalysis, liquidity will play a vital role in the future, with online transactions expected to account for 70% of total trading activity.

This growth not only highlights the emergence of decentralized finance in the region but also emphasizes the need for robust liquidity across platforms. Utilizing liquidity metrics will help traders adapt to these shifts effectively.

Adapting Investment Strategies

To capitalize on Vietnam’s burgeoning cryptocurrency market, consider adopting these strategies:

- Choose Exchanges Wisely: Compare liquidity ratios across platforms before making any decisions.

- Stay Informed: Regularly check updates on trade volumes and market spreads.

- Utilize Tools: Platforms like Ticker and FTX can provide real-time insights into liquidity conditions.

These actionable tips can enhance your trading efficiency and profitability in the evolving market landscape.

The Future of Crypto Exchange Liquidity in Vietnam

As we look ahead, the Vietnam crypto market is poised for significant transformation, especially regarding liquidity. Emerging regulations and technological advancements can both enhance liquidity ratios and lead to a more stable trading environment.

However, traders must be cautious. While higher liquidity typically ensures smoother transactions, it’s essential to keep abreast of market shifts and remain adaptable.

Conclusion

In summary, an understanding of Vietnam crypto exchange liquidity ratios is critical for any investor or trader looking to navigate this dynamic market effectively. By prioritizing liquidity, traders can protect their assets, reduce transaction costs, and position themselves for future opportunities.

As Vietnam embraces digital transformation, let’s leverage these liquidity insights to craft smarter trading strategies that maximize profits while mitigating risk.

For further information and resources on cryptocurrency trading, feel free to explore additional resources at cryptosalaryincubator.

About the Author

Dr. Nguyen Minh Tu is a renowned blockchain consultant with over 15 research papers published in the field of cryptocurrency economics. She has successfully led several audits for popular blockchain projects.