Introduction: A Shift in Financial Paradigms

In recent years, blockchain technology has surged, creating numerous opportunities and challenges for governments and financial institutions worldwide. In 2024 alone, the global loss due to DeFi hacks reached a staggering $4.1 billion, highlighting the urgent need for secure financial solutions. One of the most promising developments in this landscape is Vietnam’s initiatives towards central bank digital bonds (CBDBs). These initiatives signify a pivotal move towards leveraging blockchain for increased transparency, efficiency, and security in financial transactions.

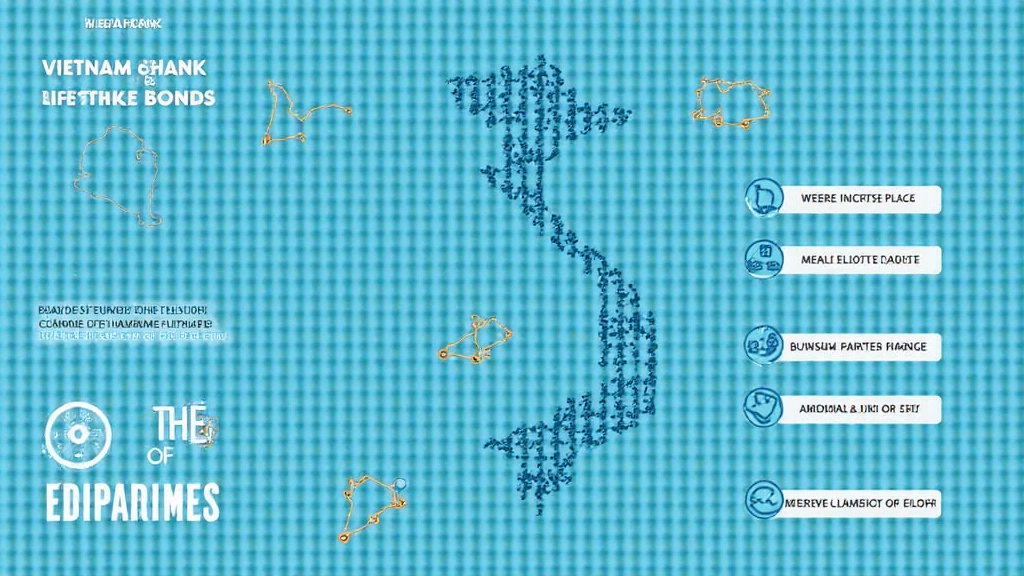

Understanding Vietnam’s Digital Bond Initiatives

The government of Vietnam, through its central bank, has embarked on several digital bond initiatives aimed at modernizing its financial system. These initiatives fall under the broader strategy of integrating digital currencies and blockchain technology to match the pace of the evolving financial landscape.

- As of 2025, Vietnam’s digital economy is projected to reach USD 57 billion, a clear indicator of its growing market potential.

- The central bank is focusing on several key areas: transparency improvements, investor confidence, and reduced transaction costs.

Significance of Digital Bonds

Digital bonds issued by the central bank can be likened to traditional bonds but are intricately tied with blockchain technology, providing robust security mechanisms such as tiêu chuẩn an ninh blockchain (blockchain security standards). These advantages include:

- Real-time transaction processing, similar to the speed one experiences in online banking.

- Enhanced traceability of transactions, akin to the accountability demanded in traditional banking.

- Lower operational costs, as blockchain minimizes intermediary involvement.

Implementation Strategies for Digital Bonds

The practical implementation of Vietnam’s CBDB initiatives involves several strategic steps:

1. Regulatory Framework Development

The first step is establishing a legal and regulatory framework that supports the issuance and trading of digital bonds. This includes:

- Defining legal parameters for digital bond ownership.

- Creating guidelines for secondary market trading.

- Incorporating consumer protection laws to ensure investor safety.

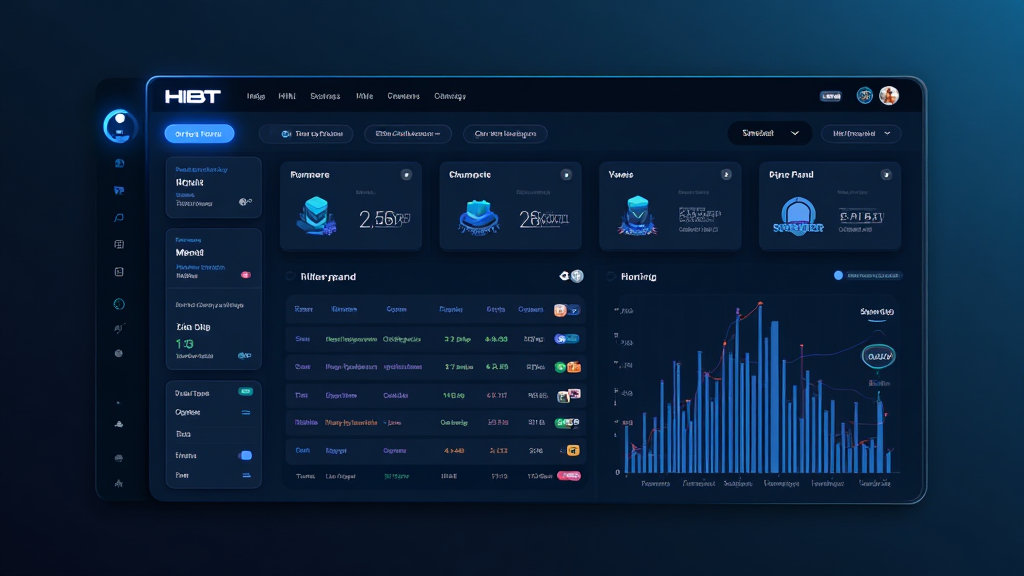

2. Collaborations with Technology Providers

Partnering with tech firms that specialize in blockchain technology will be crucial. For instance:

- Identifying reliable blockchain platforms for secure bond issuance.

- Utilizing technology for data encryption and secure transaction records.

3. Public Awareness and Financial Literacy

Educating the public about these initiatives is essential. Here’s how:

- Conducting seminars to explain the benefits of digital bonds.

- Utilizing social media campaigns to reach younger demographics, crucial as Vietnam boasts a youthful, tech-savvy population.

Challenges Facing CBDBs in Vietnam

While the promise of CBDBs is significant, several challenges need to be addressed:

- Compliance Issues: Adhering to international regulations can be challenging, especially as blockchain technology remains nascent.

- Technological Barriers: The need for robust infrastructure to support blockchain transactions is critical.

- Cultural Acceptance: Encouraging traditional investors to embrace digital bonds may require substantial outreach.

The Role of Blockchain in Vietnam’s Financial Future

Blockchain’s integration in Vietnam’s financial sector—from CBDBs to other applications—is likely to reshape how financial services operate in the region. This transformative technology has the potential to:

- Improve efficiency in the settling of financial transactions.

- Provide businesses with innovative fundraising options.

Moreover, thị trường blockchain (blockchain market) in Vietnam is seeing exponential growth, with user rates increasing rapidly. As blockchain technology matures, the adoption of CBDBs may serve as a focal point for the evolution of financial services.

Conclusion: A Bright Future for Digital Bonds in Vietnam

As Vietnam places itself on the global stage with its central bank digital bond initiatives, financial institutions, investors, and consumers alike can expect a more dynamic, secure, and transparent financial environment. The successful execution of these initiatives, coupled with the advancement of blockchain technology, promises to usher in a new era for Vietnam’s financial landscape. The synthesis of traditional financial practices with blockchain innovation marks a revolutionary step in enhancing fiscal credibility and operational efficiency.

In summary, witnessing the development of Vietnam’s CBDBs will not just be significant for local investors but also for the global financial community. Digital bonds in Vietnam may become a benchmark in the intersection of modern finance and technological innovation, setting standards that resonate well beyond its borders.

For those keen to explore the cryptocurrency landscape and its implications, cryptosalaryincubator provides insightful resources and guidance.

Author: Dr. Nguyen Minh Tan – A leading economist specializing in digital currencies, with over 15 publications in blockchain finance and projects auditing globally renowned fintech solutions.