Navigating Vietnam Crypto Real Estate Tax Compliance

With the rapid growth of cryptocurrency transactions, particularly in the real estate sector of Vietnam, compliance with tax regulations has never been more crucial. As of 2025, Vietnam has seen a significant uptick in crypto investments, promoting the need for clear tax guidelines. In this article, we will delve into the intricacies of Vietnam crypto real estate tax compliance, providing insights and practical strategies for investors and developers alike.

The Rise of Crypto in Vietnam’s Real Estate Market

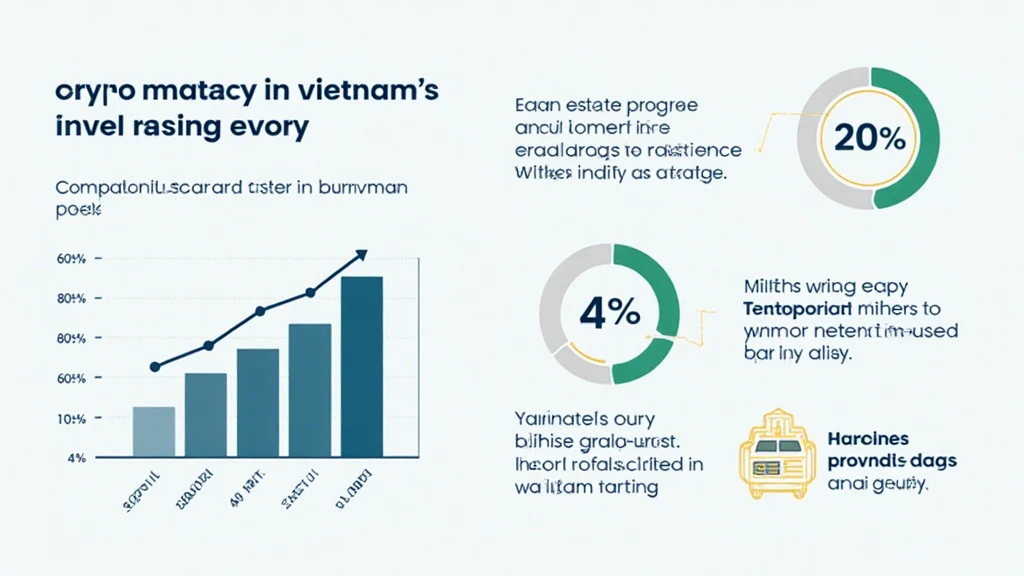

In recent years, Vietnam has embraced cryptocurrencies, with an estimated market growth rate of 35% annually, according to a report by Hibt.com. This surge in popularity has led to a dynamic shift in the real estate market, where crypto is increasingly used as a payment method. However, the lack of clear regulations presents challenges for compliance, necessitating a thorough understanding of the tax implications and reporting requirements for crypto transactions.

Understanding Tax Obligations

- Corporate Income Tax (CIT): Businesses must report income generated from crypto transactions as part of their operable revenue.

- Value-Added Tax (VAT): Crypto transactions may be subject to VAT, depending on the nature of the transaction (e.g., buying or selling property).

- Personal Income Tax (PIT): Individuals profiting from crypto trades must also comply with PIT regulations.

It is essential to highlight that taxes are calculated based on the market value of the crypto at the time of the transaction, requiring accurate valuation and reporting practices.

Tax Compliance Strategies for Crypto Investors

To ensure compliance with Vietnamese tax laws while navigating the intricacies of Vietnam crypto real estate tax compliance, consider the following strategies:

1. Keep Accurate Records

Record-keeping is paramount. Maintain detailed logs of all crypto transactions, including dates, amounts, involved parties, and the market value at the time of each transaction. A simple excel sheet or dedicated accounting software can help streamline this process.

2. Consult with Tax Professionals

Due to the complexities involved, seeking advice from tax professionals who specialize in cryptocurrency can significantly mitigate risks. They provide insights on optimizing tax obligations and navigating ambiguities.

3. Stay Informed About Regulatory Changes

The regulatory landscape in Vietnam is evolving. Keeping up with the latest developments will help ensure that you remain compliant with any new laws that may be enacted.

The Role of Blockchain Security in Real Estate Transactions

As cryptocurrency gains traction in real estate transactions, security becomes a focal point. Leveraging technologies such as tiêu chuẩn an ninh blockchain (blockchain security standards) helps safeguard assets and boost investor confidence. Here are the key components:

- Decentralization ensures no single point of failure.

- Smart contracts automate transactions and reduce fraud.

- Transparency allows for real-time tracking of all transactions.

Potential Challenges Facing Crypto Real Estate Investors

Not everything is straightforward. Investors may face several challenges in dealing with Vietnam crypto real estate tax compliance:

1. Regulatory Uncertainty

With regulations still developing, many investors feel uncertain about their compliance status. This can lead to hesitance in performing transactions.

2. Valuation Issues

Fluctuating cryptocurrency values can complicate tax reporting and compliance. Transactions may require determining fair market value, which can be challenging in a volatile market.

Conclusion: The Future of Crypto and Real Estate in Vietnam

As Vietnam continues to embrace cryptocurrency and its integration into real estate, staying compliant with tax regulations becomes increasingly essential. Investors who proactively establish sound Vietnam crypto real estate tax compliance practices now will be better positioned to leverage future market opportunities.

For further insights, explore our extensive resources at cryptosalaryincubator. Keeping abreast of compliance strategies will not only safeguard investments but also foster a healthier market environment for all stakeholders.

Author: Dr. Nguyen Minh Chau, a blockchain technology expert and tax compliance consultant with over 20 publications in cryptocurrency regulations, has led multiple audits for high-profile projects across Southeast Asia.