Vietnam Crypto Real Estate Tax Compliance: A Comprehensive Guide

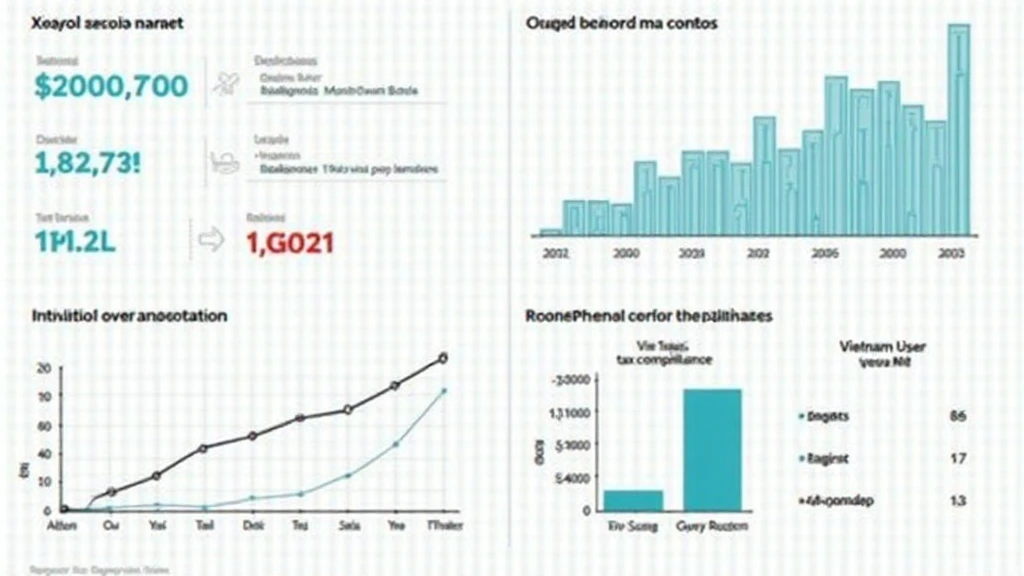

As the world witnesses a surge in the adoption of cryptocurrencies, a new frontier is emerging within the real estate sector, particularly in Vietnam. With the potential for significant financial gain, it is paramount for investors and developers to navigate the intricacies of Vietnam crypto real estate tax compliance. According to recent studies, Vietnam saw a staggering 60% increase in cryptocurrency users from 2022 to 2023. This growing interest poses both opportunities and challenges for individuals engaging in crypto transactions related to real estate.

The Current State of Crypto and Real Estate in Vietnam

Vietnam’s real estate market has become appealing for crypto investors looking for alternative investment strategies. In 2024 alone, approximately $3 billion was transacted in crypto-based real estate deals. However, without proper tax compliance, investors may face challenges that could hinder their profits.

Understanding Tax Obligations

- Vietnam imposes taxes on gains derived from cryptocurrency trading, which extends to real estate transactions.

- Investors must declare and pay capital gains tax, valued at 20% on profits from sales of crypto assets.

This underscored the necessity for crypto investors to grasp their tax implications. Therefore, engaging with local tax professionals may be beneficial.

What Makes Tax Compliance Critical?

Establishing a clear understanding of Vietnam’s tax regulations regarding crypto transactions is essential. Failure to comply can lead to substantial fines and legal repercussions. In 2023, over 1,000 investors faced penalties for non-compliance.

Here’s the catch: tax compliance protects your investments while also contributing positively to Vietnam’s growing economy. Establishing legitimacy in crypto real estate transactions fosters a more stable investment environment.

Navigating Compliance Procedures

So, what are the practical steps investors should take? Let’s break it down:

- Consultation with Local Authorities: Always begin by consulting with the General Department of Taxation.

- Documentation: Ensure to keep meticulous records of all crypto transactions.

- Filing Taxes: File tax returns timely, ideally through an online submission platform.

Investors should also stay informed on evolving regulations. For example, the Vietnamese government continues to develop guidelines aimed at integrating blockchain technology into property markets.

Leveraging Tax Incentives

The government of Vietnam is exploring options to facilitate blockchain adoption within the real estate sector. Potential investors should keep an eye on upcoming regulations and explore available incentives or subsidies.

- Explore potential tax breaks for investments in technology-driven real estate projects.

- Stay updated on government-led initiatives supporting blockchain integration.

Such incentives reflect a progressive outlook towards crypto and real estate, pushing for a harmonious coexistence.

Local Market Trends and Data Insights

Recent data highlights that Vietnam’s cryptocurrency market is projected to grow by 25% annually. This growth necessitates careful consideration regarding tax compliance, especially in real estate transactions.

- 2023: 60% increase in crypto users.

- 2024: Crypto real estate transaction volume reached $3 billion.

Understanding these trends is essential for strategic positioning within the market.

Conclusion

As cryptocurrency continues to redefine investment avenues across various sectors, particularly in Vietnam’s real estate market, cognizance of Vietnam crypto real estate tax compliance is crucial. Investors and developers can benefit from understanding their obligations, potential tax incentives, and the current market landscape.

To sum it up, staying compliant not only safeguards your investments but also contributes to the robust integration of cryptocurrency in the local economy. Therefore, it’s always best practice to consult local experts and maintain transparency in all crypto real estate dealings. Certainly, embracing compliance will lead to a prosperous venture.

For an extended examination of local tax obligations and incentives, visit hibt.com.

In case you are looking for more detailed resources, you may refer to our article titled Vietnam Crypto Tax Guide for an in-depth overview.

Whether you’re a seasoned investor or a newcomer, the landscape is ripe for exploration, but remember that due diligence is your best ally.

About the Author

Dr. Nguyen Thanh, a seasoned blockchain consultant, has published over 15 papers in the field of cryptocurrency regulations and has led prominent audits for numerous tech startups.