Navigating Vietnam Crypto Exchange Liquidity Ratios: What You Need to Know

With the rise of cryptocurrency trading in Vietnam, understanding liquidity ratios is becoming increasingly vital. In 2023, Vietnam witnessed a remarkable increase in crypto users, with over 5 million people actively trading digital assets. However, as the market continues to evolve, grasping the concept of liquidity ratios is key for both traders and exchange operators.

Understanding Liquidity Ratios in Crypto Exchanges

At its core, liquidity refers to how easily an asset can be converted into cash without affecting its market price. In the realm of cryptocurrency exchanges, liquidity ratios are essential indicators that measure an exchange’s ability to fulfill buy and sell orders quickly. Here’s what you need to know about liquidity ratios:

- What are liquidity ratios? These are calculated by assessing the volume of trades against the available assets on an exchange.

- Why are they important? Higher liquidity ratios often suggest a more stable market, reducing the risk for traders.

- How do they affect trading? Low liquidity can lead to significant price fluctuations, making it harder for traders to execute orders.

The Importance of Liquidity Ratios in Vietnam’s Crypto Landscape

Vietnam’s crypto market is unique, influenced by various factors, including government regulations, user adoption rates, and regional economic conditions. According to a recent report by Chainalysis, the Vietnamese crypto market is projected to grow by over 30% annually in the coming years, making liquidity ratios increasingly vital:

- Regulatory landscape: Understanding liquidity can help exchanges comply with local regulations and enhance operational efficiency.

- User trust: Higher liquidity ratios can bolster user confidence, which is crucial in attracting more participants to the market.

- Market stability: Stable liquidity supports healthy trading practices, ensuring users can enter and exit positions without significant slippage.

Analyzing Vietnam Crypto Exchange Liquidity Ratios

To effectively analyze liquidity ratios, traders need to look at key performance indicators (KPIs) associated with exchange operations:

- Order Book Depth: This indicates the volume of open buy and sell orders and is essential in understanding market demand.

- Trade Volume: A higher trade volume generally correlates with better liquidity.

- Bid-Ask Spread: This difference between buy and sell prices reflects market competitiveness and overall liquidity.

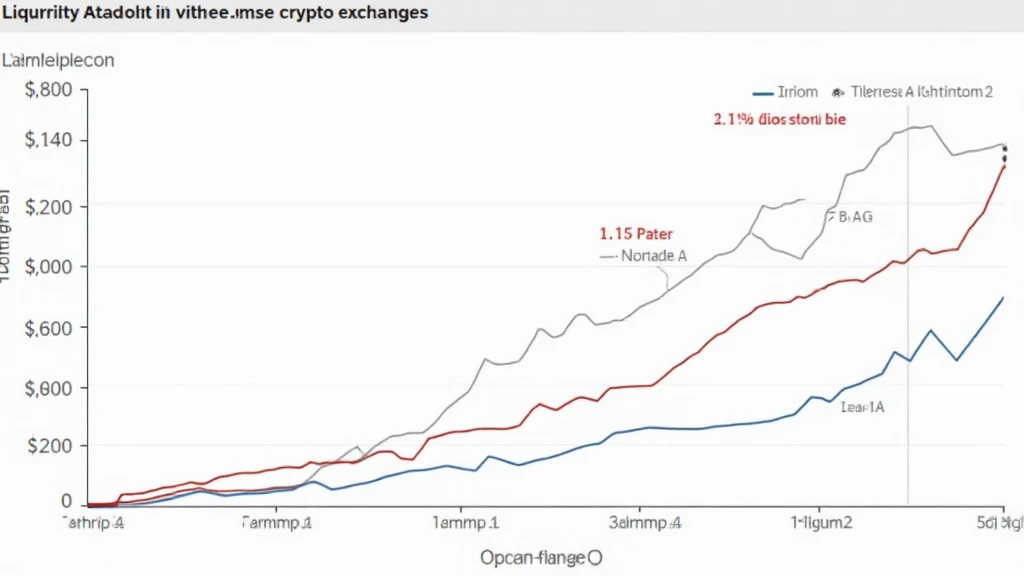

Here’s a hypothetical example based on data from various exchanges:

| Exchange | Liquidity Ratio | 24h Trade Volume (in USD) | Average Bid-Ask Spread |

|---|---|---|---|

| Exchange A | 1.5 | $3,000,000 | $0.20 |

| Exchange B | 0.9 | $1,500,000 | $0.35 |

| Exchange C | 2.1 | $4,800,000 | $0.15 |

These numbers exemplify how liquidity ratios can vary significantly among exchanges. For traders, choosing the right platform often hinges on these critical metrics.

Challenges in Evaluating Liquidity Ratios

Evaluating liquidity ratios is not without its challenges. Traders should be mindful of several factors that can influence these ratios:

- Market Volatility: Crypto markets tend to be highly volatile, which can cause liquidity conditions to change rapidly.

- Regulatory Impacts: Sudden changes in regulations can influence user behavior and trading volumes, thereby affecting liquidity.

- Technical Issues: Downtimes due to technical faults can drastically affect liquidity during critical trading periods.

In Vietnam, regulatory measures are still evolving. Understanding these dynamics is crucial for creating robust trading strategies.

Future Trends in Vietnam’s Crypto Liquidity

Looking ahead, several trends could shape liquidity in Vietnam’s cryptocurrency market:

- Increased Institutional Investment: As institutional players enter the market, the overall liquidity is expected to improve.

- Technological Innovations: Advancements in blockchain technology may facilitate enhanced liquidity solutions, including decentralized exchanges (DEX).

- Educational Initiatives: Growing awareness and knowledge about cryptocurrencies can lead to increased participation in trading, positively influencing liquidity.

Conclusion: Liquidity Ratios as a Trading Compass

As Vietnam’s crypto landscape continues to grow and evolve, liquidity ratios will undoubtedly play a pivotal role in shaping the future of trading within this vibrant market. For traders and exchange operators alike, keeping a close eye on liquidity metrics can facilitate informed decision-making and promote a healthier trading environment.

The increasing number of Vietnamese users engaging in cryptocurrency demonstrates the growing potential in this sector. Therefore, a full understanding of liquidity ratios will empower traders to navigate this dynamic market more effectively. Remember, always approach your trading strategy with a solid grasp of the liquidity ratios of the exchanges you use.

To dive deeper into your crypto trading journey, visit cryptosalaryincubator.

Author: Dr. Nguyen Van An, a blockchain technology expert with over 15 published papers in the field and experience overseeing several well-known crypto audit projects.