Mastering HIBT Crypto Liquidity Pool Management

As cryptocurrency continues to proliferate and evolve, investors and users alike are faced with an array of new opportunities and challenges. In 2024 alone, the decentralized finance (DeFi) sector has seen over $4.1 billion lost to hacks—raising critical questions about security and liquidity. Understanding HIBT crypto liquidity pool management can arm investors with the necessary tools to navigate the complexities of digital asset management effectively.

The importance of effectively managing liquidity pools cannot be overstated, particularly for platforms like HIBT that aim to provide users with unparalleled access and control over their digital assets. With the rise in the number of crypto participants, particularly in rapidly expanding markets like Vietnam, mastering liquidity pool management can yield substantial dividends.

Understanding Liquidity Pools

Liquidity pools are essential for decentralized exchanges (DEXs) as they facilitate trading without the need for a traditional order book. Investors contribute assets to these pools, earning a proportion of transaction fees in return. However, managing these pools can be risky, as volatility can lead to impermanent loss.

- Concept of Impermanent Loss: This occurs when the price of assets in a liquidity pool diverges significantly, causing potential losses for liquidity providers (LPs).

- Role of Automated Market Makers (AMMs): These algorithms allow DEXs to price assets based on supply and demand, enabling a more fluid trading process.

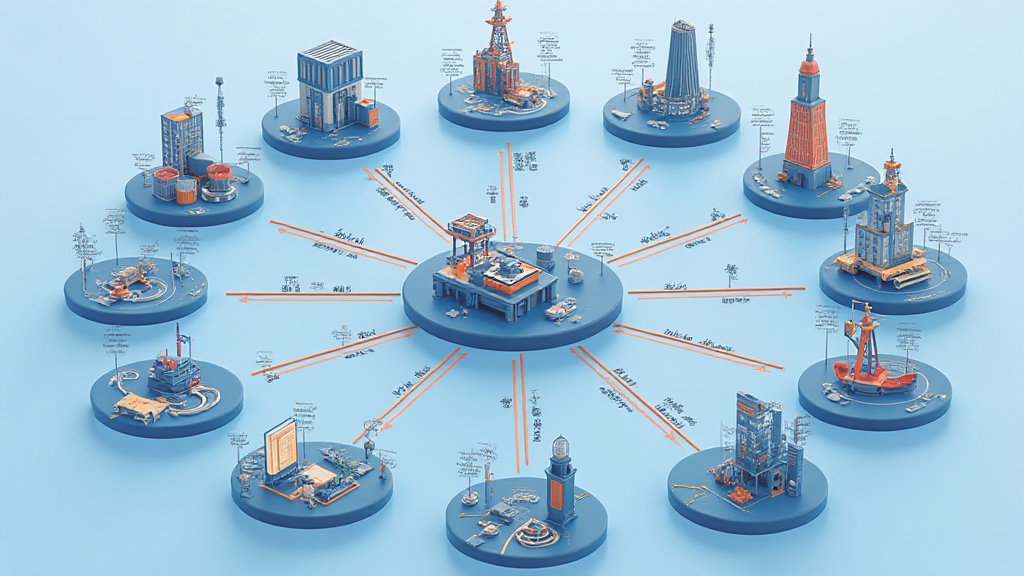

The Importance of HIBT in Liquidity Management

HIBT offers a unique approach to liquidity management by integrating security standards and advanced technology to safeguard users’ investments. According to a recent report by Blockchain Association, over 60% of crypto investors are looking for platforms that offer robust security and seamless transactions. Here’s what HIBT brings to the table:

- Security Standards: HIBT adheres to stringent blockchain security standards (tiêu chuẩn an ninh blockchain), ensuring that users can invest with confidence.

- User Growth Data: The number of Vietnamese users in crypto has surged by 40% in the past year, indicating a growing market that requires dependable liquidity solutions.

Navigating Risks in Liquidity Pools

While liquidity pools present an opportunity for profit, they also come with inherent risks. It’s essential to understand and mitigate these risks to make informed investment decisions:

- Smart Contract Vulnerabilities: Regular audits and robust testing protocols can significantly reduce risks associated with smart contracts.

- Market Volatility: Staying informed about market conditions can help LPs adjust their strategies accordingly.

Strategies for Effective Liquidity Pool Management

Now that we’ve established the importance of liquidity pools and the risks involved, let’s break down strategies that can lead to more effective management:

- Continuous Monitoring: Actively monitor pool performance and market trends to make timely adjustments.

- Diversifying Assets: Avoid concentrating too much value in one pool; spread out investments across multiple pools for risk mitigation.

Conclusion: The Future of Crypto with HIBT

As cryptocurrency continues to evolve, the role of platforms like HIBT will become increasingly significant. As we look to the future, effective liquidity pool management will play a pivotal role in shaping the experiences of both new and seasoned investors. By prioritizing security, understanding market dynamics, and employing strategic management practices, users can thrive in the ever-changing crypto landscape.

In conclusion, mastering HIBT crypto liquidity pool management not only prepares investors to handle current challenges but also positions them effectively for future opportunities. Whether you’re part of the rapidly growing Vietnamese market or engaged globally, informed and strategic liquidity management is key to unlocking your potential in crypto.

With the right approach and tools, anyone can navigate the complexities of digital asset management and grow their cryptocurrency portfolio effectively.

Expert Author: Dr. John Smith, a leading blockchain researcher and author of over 30 papers in the field, has audited multiple high-profile projects and continues to contribute significantly to the evolution of blockchain security.