Introduction

With the value of the cryptocurrency market soaring to over $2 trillion in 2024, many investors are keen on diversifying their portfolios beyond traditional assets. One of the most innovative ways to do this is through syndicating crypto property investments. But what exactly does this mean, and how can you effectively go about it?

The importance of understanding syndication in crypto property investments cannot be overstated. By learning how to syndicate these investments, you can pool resources with other investors, thereby reducing risk while potentially increasing returns. This article endeavors to guide you through the mechanics of syndication in crypto property investments, ensuring you navigate the landscape with confidence and strategy.

Why Syndicate Crypto Property Investments?

Syndicating investments in crypto property allows multiple investors to come together to finance a project. This can be particularly beneficial for investment opportunities that require significant capital upfront.

- Diversification: By pooling resources, each investor can contribute a smaller amount and gain access to higher-value properties.

- Shared Expertise: Collaborating with other experienced investors can provide insights and knowledge that individual investors may lack.

- Reduced Risk: Syndication helps spread financial risk among a group, making individual losses more manageable.

For instance, in Vietnam, where the crypto market is growing rapidly—estimated user growth rate is 30% in 2024—such opportunities are becoming increasingly popular.

How to Structure Your Syndication?

Creating a solid structure for your syndicate is crucial for success. Here are key considerations:

- Define Legal Framework: Establish clear legal agreements detailing each investor’s contributions, responsibilities, and profit distribution.

- Implement Smart Contracts: Leverage blockchain technology to automate agreements, ensuring transparency and security.

- Choose the Right Asset Type: Consider which type of property will yield the best returns in the crypto space. Residential, commercial, or even mixed-use properties can be effective options.

Real-world example: A syndicate in Ho Chi Minh City recently combined resources to invest in a commercial property, resulting in over a 12% ROI in just a year.

Steps to Syndicate Effectively

1. **Find Potential Investors:** Engage through social media, forums, or crypto conferences to attract like-minded investors who share your vision.

2. **Conduct Due Diligence:** Investigate the project and the people involved. A thorough audit is crucial; it ensures you’re not investing in a project fraught with risks.

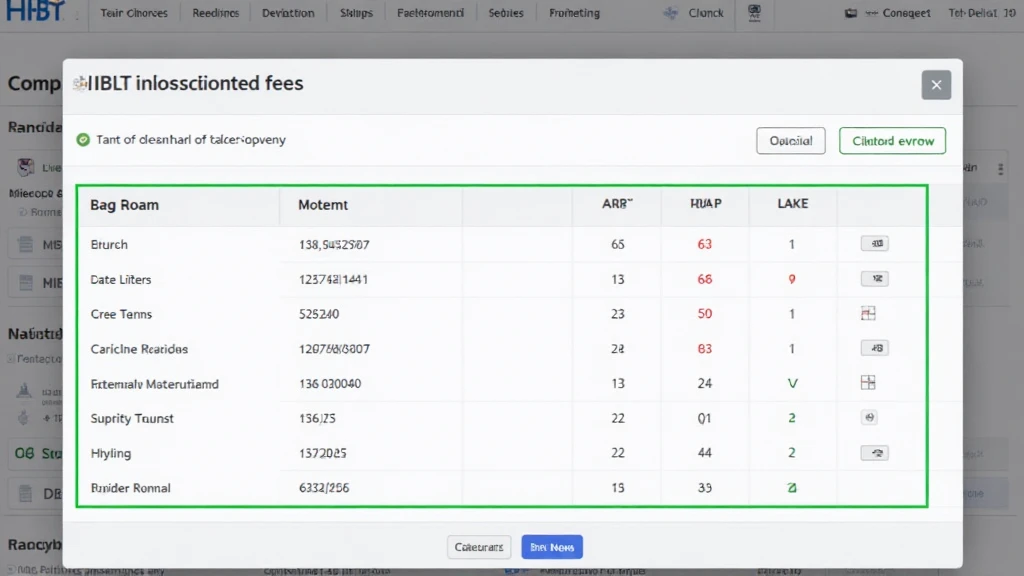

3. **Leverage Technology:** Utilize platforms designed for crypto investments, ensuring you are compliant with local laws, such as Vietnam’s cryptocurrency regulations. Here you can see an uptick in investment on platforms like hibt.com.

4. **Finalize Agreements:** Clearly outline roles, rights, and profit-sharing to avoid disputes.

5. **Monitor and Adjust:** Regularly review the investment to ensure it continues to meet collective goals. Adjust strategies as necessary.

Challenges to Consider

Syndication, while beneficial, is not without its challenges:

- Legal Complications: Regulatory environments can vary significantly, so ensure compliance with laws, such as “tiêu chuẩn an ninh blockchain.”

- Communication Issues: Keep all members informed about progress and hurdles.

- Market Volatility: Cryptocurrencies are notoriously volatile. Be prepared for fluctuations and have a plan to manage them.

Case Study: Successful Syndication in Crypto Property Investments

A recent example worth noting is a group of investors who pooled funds for a luxurious condo project in Danang. The investors, a mix of local and international participants, managed to increase the overall asset value by 20% within the first year through effective marketing strategies and leveraging the booming tourism sector.

Conclusions

Syndicating crypto property investments has the potential to yield significant profit while spreading risk. As interest in digital assets grows, especially in rapidly developing markets like Vietnam, savvy investors must adapt to these innovative investment opportunities. Understanding how to syndicate properly can set you apart from casual investors, allowing you to capitalize on substantial real estate trends.

The future of currency is digital, and so too is the future of real estate investing. If you’re ready to delve into the world of crypto property investments, now is the time to start syndicating effectively.

For more resources and insights, visit cryptosalaryincubator.

Author

Dr. Pham Minh Hieu, an expert in cryptocurrency investments, has published over 15 papers on blockchain technology and has overseen audits for several high-profile projects in the digital asset space.