Hibt Exchange Dividend Token vs Staking Yield: A Comparative Insight

In the ever-evolving landscape of cryptocurrency investment, understanding the subtle distinctions between various earning mechanisms is vital for investors. With nearly 200 million users globally and a notable increase in interest from Vietnamese investors, the question arises: What is the best way to amplify your digital assets? Today, we’re diving deep into the comparison of Hibt exchange dividend tokens and staking yields.

The Growth of Cryptocurrency in Vietnam

Vietnam has seen a significant increase in cryptocurrency adoption, with approximately 29% of its population engaging in crypto trading as of 2023. This uptick contributes substantially to our discourse on investment strategies. But why focus on Hibt exchange dividend tokens and staking yields?

Understanding Hibt Exchange Dividend Tokens

Hibt exchange dividend tokens serve as a method for users to earn rewards based on their trading activity within the exchange. Simply put, users receive tokens proportional to the trading volumes they generate. Here’s a breakdown:

- Passive income: Users earn tokens without actively trading.

- Dividend distributions: Typically, dividend tokens pay out periodically, boosting liquidity.

- Token utility: These tokens often prove valuable in other aspects of the exchange ecosystem.

What are Staking Yields?

Staking yields, on the other hand, involve locking up your cryptocurrency in a wallet to support the operations of a blockchain network. This process generally provides higher rewards compared to holding tokens in a wallet. Here are the key features:

- Direct support: By staking, you help secure the network.

- Higher returns: Staking often promises yield that can surpass dividend tokens.

- Long-term commitment: Staking usually requires less liquidity since it locks up assets for a period.

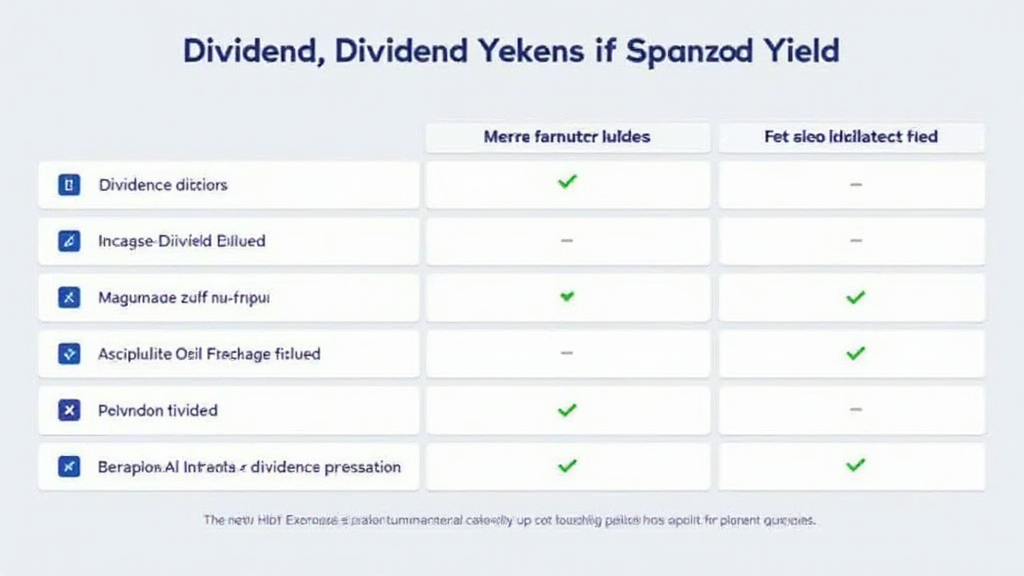

Comparing Returns: Hibt Exchange Dividend Tokens vs Staking Yields

When deciding where to allocate your investments, the potential return on investment (ROI) is a major factor. According to various analyses, the average staking yield stands at approximately 8-12% annually, while dividend tokens generally yield around 3-6%.

Analyzing Risk Factors

Every investment comes with its own set of risks. For dividend tokens, market volatility can impact the stability of token values. Staking often involves network risks, such as slashing, where a portion of the staked tokens can be lost due to network misbehavior. Here’s how to mitigate these risks:

- Choose platforms with robust security measures, i.e., using wallets with tiêu chuẩn an ninh blockchain.

- Conduct thorough research into the project’s fundamentals before investing.

Case Studies and Real-World Examples

Examining real-world scenarios can provide insight into Hibt exchange tokens and staking yields:

- Example A: An investor holds $1,000 in Hibt tokens and receives a dividend of $60 over a year, yielding a 6% return.

- Example B: A different investor stakes $1,000 on a blockchain with an annual yield of 10%, generating $100 over the same period.

These examples reflect how investors might prefer one method over another based on their financial goals and risk tolerance.

Overall Conclusion: Making an Informed Choice

Ultimately, choosing between Hibt exchange dividend tokens and staking yields boils down to individual investment strategies, risk tolerance, and market conditions. Vietnamese investors continue to grow their portfolios by identifying high-potential opportunities.

Let’s not forget about the importance of continuous education. Staying informed about trends, compliance, and new token developments will enhance not only your understanding but your investment performance.

In summary, whether you lean towards Hibt exchange dividend tokens for their consistent passive income or prefer staking for potentially higher yields, a blended approach could diversify your assets, fortifying your investment strategy in the booming Vietnamese crypto market.

For more insights, refer to our detailed articles on crypto investment strategies at hibt.com.

Meet Our Expert: Dr. Nguyen Van Hai

Dr. Nguyen Van Hai is a renowned expert in blockchain technology with over 15 published papers and has led audits for notable projects in the crypto space.