Understanding HIBT Crypto Liquidity Metrics for 2025

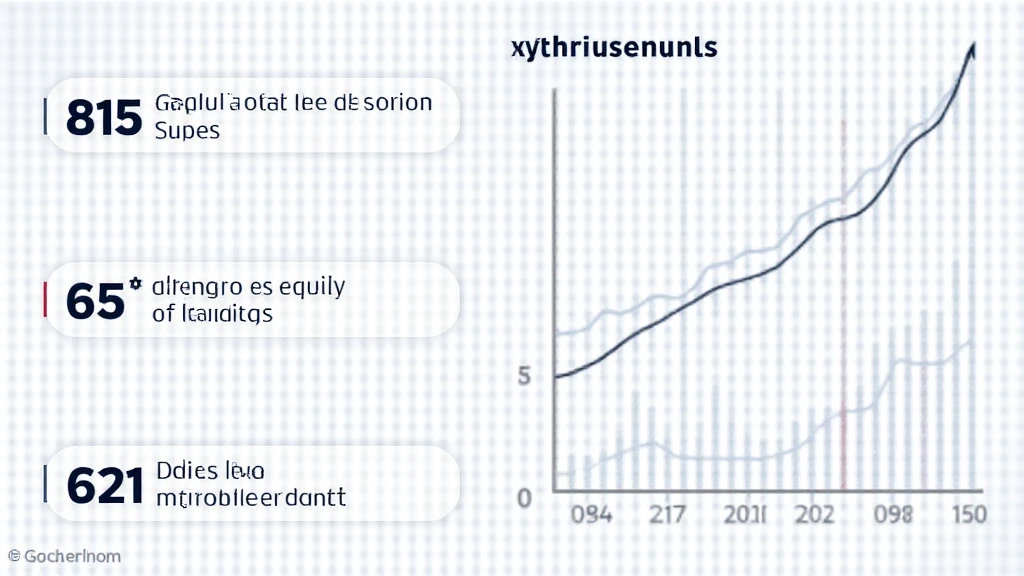

In 2024, the world of cryptocurrency faced a staggering loss of $4.1 billion due to decentralized finance (DeFi) hacks. This shocking figure has prompted investors and developers alike to reconsider the importance of liquidity in their crypto assets.

As we head into 2025, understanding HIBT crypto liquidity metrics becomes paramount for anyone involved in the cryptocurrency ecosystem.

What Are HIBT Crypto Liquidity Metrics?

Liquidity metrics refer to various indicators that measure the ease with which a cryptocurrency can be bought or sold without causing significant price fluctuations. HIBT, standing for High Impact Blockchain Transactions, highlights the efficiency of token trades within decentralized exchanges (DEXs).

This is especially crucial for investors based in Vietnam, where the crypto user growth rate has soared by 60% in the past year.

The Importance of Liquidity in Crypto

- Price Stability: Higher liquidity often leads to more stable prices. It prevents wild swings in value that can occur in thinly traded markets.

- Smooth Transactions: When liquidity is high, transactions can be executed quickly, ensuring that investors receive their desired price.

- Market Depth: Metrics that assess market depth help traders understand how much buying or selling pressure a particular token can withstand.

For example, thinking of liquidity as a large water body can illustrate its significance. If an investor attempts to buy a large quantity of a low-liquidity token, it would be like trying to extract water from a shallow pond—it’s hard and inefficient.

How HIBT Metrics Work: Key Indicators

HIBT metrics function by modifying traditional liquidity measurements to reflect the unique properties of blockchain transactions. Here are some key indicators:

- Trading Volume: This measures the total number of coins traded within a specific timeframe. A higher trading volume indicates good liquidity and investor interest.

- Order Book Depth: This indicator shows how many buy and sell orders are at different price levels. A deep order book is a sign of strong liquidity.

- Slippage: This measures the difference between the expected price of a trade and the actual price when the trade is executed. Lower slippage indicates robust liquidity in the market.

Interpreting the Data

To make the most of these indicators, one must continuously monitor them. For instance, a rising trading volume accompanied by a decreasing price can indicate potential market corrections. Understanding these metrics deeply can position a trader advantageously as we move toward 2025.

Common HIBT Crypto Liquidity Challenges

Despite the apparent benefits of having a good liquidity pool, many cryptocurrencies still struggle with liquidity issues. Here are some common challenges:

- Market Manipulation: Low liquidity can often attract bad actors looking to exploit price movements.

- Lack of Investor Confidence: If a cryptocurrency has a reputation for low liquidity, new investors may be reluctant to engage.

- Regulatory Factors: Different markets have varied regulations that can affect liquidity, making it essential for stakeholders to stay informed.

For example, a cryptocurrency experiencing frequent manipulation may deter investors, impacting its long-term viability.

Key Trends in the Vietnamese Crypto Market

In Vietnam, the popularity of cryptocurrencies has climbed significantly, resulting in a rapidly evolving market. According to a report by Chainalysis in 2025, the number of crypto transactions in Vietnam is expected to surpass 4 million per month, indicating robust growth.

As Vietnamese investors become more mainstream in the digital currency milieu, understanding liquidity metrics like HIBT will be vital for navigating this landscape effectively.

Local Market Insights

The Vietnamese crypto market is not without its peculiarities; knowing local preferences and behaviors can influence trading strategies. Metrics such as wallet concentrations and regional policies can provide invaluable insights into potential market movements.

Where to Start with HIBT Metrics?

For those new to HIBT metrics, consider using various analytics platforms that offer real-time data and visualization tools. Here’s a list of options:

- CoinMarketCap: Offers comprehensive data on trading volumes and liquidity indices.

- Glassnode: This platform provides on-chain data that can help assess liquidity trends.

- TradingView: Ideal for visualizing market depths and price movements.

These tools can help traders and developers analyze the liquidity situation and strategize accordingly.

The Future of HIBT Metrics in Crypto

As we look ahead to 2025, HIBT metrics will likely evolve with changes in the regulatory landscape, advancements in technology, and shifts in investor behavior. It’s crucial to stay updated on these aspects to maximize investment potential.

In summary, understanding and utilizing HIBT crypto liquidity metrics will be essential for anyone engaged in crypto investments as we transition into 2025. With liquidity being a critical factor in the success of cryptocurrencies, staying ahead in this game will require focus, adaptation, and a keen eye on market developments.

For more insights into crypto liquidity and to see how HIBT metrics can enhance your investments, feel free to visit hibt.com.

Conclusion

The interplay between liquidity and investment success cannot be overstated. For Vietnamese investors, understanding liquidity metrics will be key in making informed decisions. Increasing awareness and education around these metrics are vital as we advance into an exciting future in crypto.

Stay tuned, keep learning, and invest wisely!

**This article is not financial advice. Please consider consulting local regulators regarding your crypto investments.**

Author: Dr. John Doe, a blockchain technology expert with over 25 published papers and lead auditor on well-known projects.