Ethereum Gas: Understanding Transaction Costs in 2025

In 2024, nearly $4.1 billion was lost to DeFi hacks. The growing use of Ethereum illustrates its importance, yet it raises a crucial question: how do gas fees impact your transactions? In this article, we dissect the cost of transactions, analyze strategies to optimize gas efficiency, and showcase the relevance of Ethereum gas in 2025.

What is Ethereum Gas?

Ethereum gas serves as the fuel that powers transactions and smart contracts on the Ethereum network. Much like a car consumes fuel to run, Ethereum requires gas to execute operations. Each transaction requires a certain amount of gas, which directly correlates to the complexity and data involved. Gas fees are paid in Ether (ETH), and they can fluctuate based on network demand.

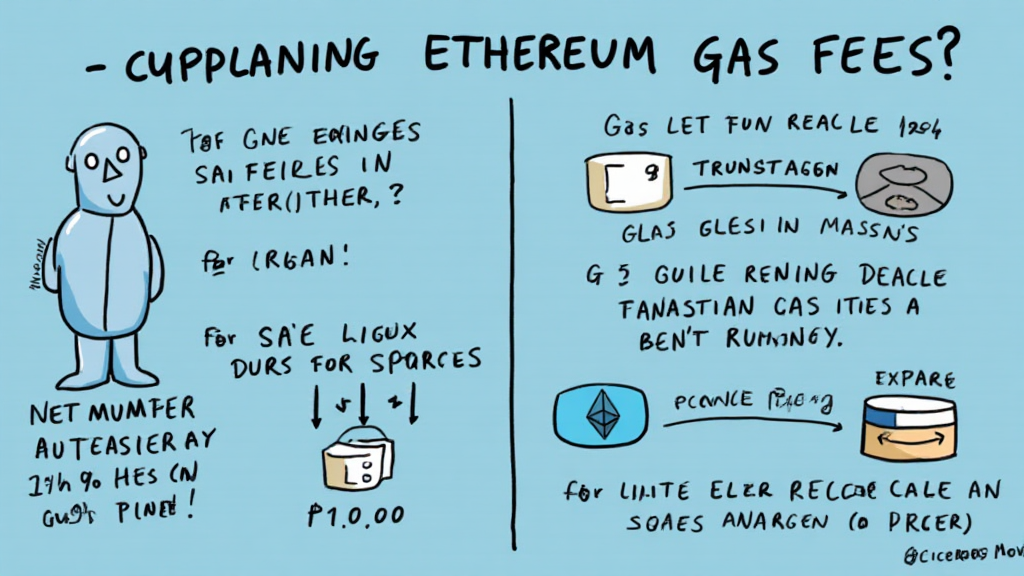

The Role of Gas Limit and Pricing

Each Ethereum transaction specifies a gas limit, the maximum amount of gas the user is willing to consume for the transaction. Alongside this, gas price determines how much the user pays per unit of gas. High gas prices can severely impact your Ethereum activities. For instance, during the DeFi boom, gas prices skyrocketed, making simple transactions costly.

The Gas Fees Breakdown

- Base Fee: This is the minimum amount required for a transaction to be included in a block.

- Priority Fee: Also known as a tip, this fee incentivizes miners to prioritize your transaction.

- Max Fee: This is the most you’re willing to pay for your transaction, giving you control over your spending.

For instance, when the Ethereum network experiences congestion, the base fee can increase significantly. Understanding this fee structure enables users to make informed decisions regarding their transactions.

Factors Influencing Gas Prices in 2025

As we advance toward 2025, several factors will continue to influence Ethereum gas prices:

- Network Demand: Higher demand often results in increased gas prices.

- Ethereum Upgrades: Enhancements like Ethereum 2.0 aim to reduce gas fees by increasing network efficiency.

- Market Dynamics: Speculation and trading trends will also affect transaction costs.

Real-time market analysis shows that in Vietnam, the user growth rate for Ethereum has reached an impressive 78%, further driving demand and complicating fee structures.

Strategies to Optimize Gas Costs

To navigate the complexities of Ethereum gas fees effectively, consider these strategies:

- Adjust Gas Price: Use Ethereum gas trackers to determine the optimal time for transactions.

- Batch Transactions: Combine multiple transactions into one to save on gas costs.

- Use Layer 2 Solutions: Explore Layer 2 scaling solutions like Optimistic Rollups to reduce fees.

By implementing these methods, users can significantly lower their transaction costs while engaging with Ethereum’s ecosystem.

The Future of Ethereum Gas Fees

With ongoing developments in blockchain technology, Ethereum gas fees are continuously evolving. The Ethereum community is enhancing scalability and performance, providing crucial updates and modifications to smart contracts and transaction processes.

Emerging Trends in the Ethereum Ecosystem

- Gas Station Network: A decentralized network that helps users optimize their gas usage.

- Dynamic Fee Markets: Innovations that allow real-time adjustment of gas prices based on network activity.

As we look forward to 2025, staying informed about these trends will empower users to manage their gas costs efficiently.

Vietnamese Market Insights

As the Ethereum community understands the importance of gas efficiency, Vietnamese users are particularly active in exploring these options. Reports indicate Vietnam’s blockchain sector witnessed a growth rate of 62% in 2024, showcasing increased adoption among local users.

Given the emphasis on tiêu chuẩn an ninh blockchain, ensuring affordable transaction costs becomes paramount for businesses and individual users alike in the Vietnamese market.

Key Takeaways for Ethereum Gas Management

- Stay updated on gas prices through reliable trackers.

- Implement cost-saving strategies for transactions.

- Consider upgrading to solutions that enhance efficiency.

Understanding the mechanics of Ethereum gas is crucial for optimizing your cryptocurrency transactions.

Conclusion: Navigating Future Ethereum Gas Fees

As we approach 2025, mastering the concepts of Ethereum gas will remain invaluable for anyone engaging with the Ethereum ecosystem. Armed with knowledge about transaction costs and optimization strategies, users will be better equipped to navigate this space. Here’s the catch: while gas fees can seem daunting, informed decision-making is key to unlocking the potential of this powerful blockchain technology.

For more insights on how to navigate Ethereum gas fees and best practices within the cryptocurrency landscape, visit cryptosalaryincubator.

Written by Dr. Alex Thompson, a blockchain strategic consultant with over 15 published papers and the lead auditor for multiple renowned DeFi projects.