Ethereum 2.0 Upgrade Impact: What to Expect

In late 2022, Ethereum underwent one of the most significant upgrades in its history, transitioning from a proof-of-work (PoW) to a proof-of-stake (PoS) consensus mechanism. This monumental shift was not just a technical makeover but a pivotal moment for the blockchain ecosystem as whole. With an astounding $4.1 billion reportedly lost due to DeFi hacks in 2024, Ethereum 2.0 aimed to significantly bolster security and efficiency. But what does this really mean for developers, investors, and everyday users alike? Let’s dive deeper into the various impacts of the Ethereum 2.0 upgrade.

The Transition from PoW to PoS

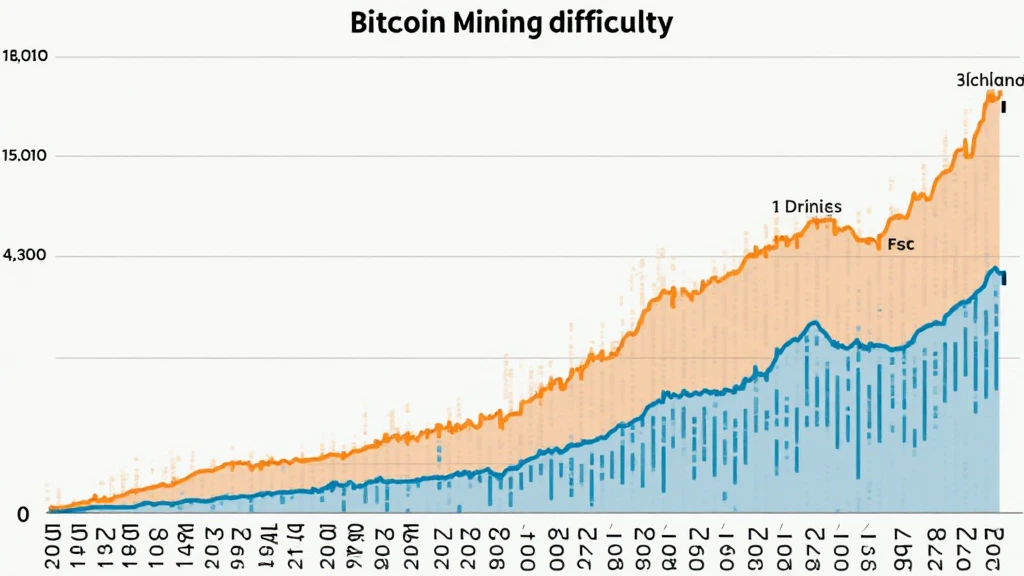

Ethereum’s shift to a proof-of-stake algorithm transforms how transactions are validated. In PoW, miners use computational power to solve complex algorithms. This method is energy-intensive and is one of the reasons Ethereum sought to make a change. PoS, however, relies on validators who stake their assets to secure the network, leading to a reduction in energy consumption. Imagine a bank wherein rather than every account needing to prove their identity through multiple cumbersome processes, they only need to put down a deposit. This is not just more efficient but also significantly more environmental-friendly.

Benefits for Developers

- Reduced Barriers: With Ethereum 2.0, developers can create decentralized applications (dApps) using a significantly improved network. This lowers the costs associated with deploying smart contracts.

- Scalability: The upgrade introduces sharding, a process that divides the database into smaller, more manageable pieces. This means faster transactions.

Security Enhancements

One of the focal points of Ethereum 2.0 is the enhancement of security protocols. As seen from the rising number of hacks in DeFi, security has never been more crucial. Ethereum’s new PoS model makes it prohibitively expensive for attackers to carry out malicious actions. Instead of merely acquiring 51% of the computational power, potential attackers would need to acquire a significant amount of Ether, making attacks financially impractical.

Impacts on Users and Investors

Transitioning to a PoS model and its anticipated benefits also extend to users and investors. For the first time, holders of Ether can participate in network security through staking. This allows everyday users not only to hold their investment but also earn a yield, reminiscent of how traditional savings accounts offer interest.

Economic Implications

Ethereum 2.0 brings the prospect of lower fees—considering scalability—coupled with potentially increased Ether value due to reduced supply inflation. As more investors hop onto staking, the availability of Ether in circulation could decrease, bolstering value over time. The financial landscape in Vietnam reflects increasing interest in staking cryptocurrencies, with a growth rate of users reaching an astounding 75% annually within the last two years.

Integration and Accessibility

- User-Friendly Wallets: The Ethereum 2.0 upgrade enables wallet providers to offer staking facilities, making it simpler for users to participate.

- Education Materials: With the rise of online content about Ethereum, users are increasingly gaining knowledge about how to leverage the technology.

Long-Term Implications for the Blockchain Ecosystem

The broader impacts of Ethereum 2.0 extend beyond just its own network. As the largest smart contract platform, changes made within Ethereum have ripple effects across the entire blockchain ecosystem. The move towards PoS and the launch of sharding technology set a new standard for blockchain scalability and security protocols.

Market Competition

With Ethereum taking strategic steps towards improved security and efficiency, other blockchain networks are likely to either follow suit or evolve further. This competitive pressure could spur innovations and improvements across the board. For example, projects like Cardano and Solana may need to pivot or innovate further to retain their user bases.

DeFi and NFT Impacts

DeFi and NFTs have pulled the attention of millions, with Ethereum holding the majority of market share in both sectors. The upgraded Ethereum network is expected to bolster the security of DeFi protocols significantly, which have been historically vulnerable.

DeFi Protocol Adaptations

In light of Ethereum 2.0, many DeFi projects are undergoing significant changes to adapt to the new security and yield characteristics. This means users can potentially look forward to safer yields and more reliable platforms.

NFT Market Evolution

- Market Growth: Enhanced transaction speeds and lower fees could lead to a surge in NFT transactions, further solidifying the space.

- More Creative Opportunities: Artists may find it easier to mint and sell NFT artworks.

Conclusion: Navigating the Future of Ethereum

Overall, the Ethereum 2.0 upgrade not only transforms the Ethereum network itself but also sets a new precedent for blockchain technology’s future trajectory. As complexities in the digital asset world increase, having a robust, secure, and efficient framework becomes crucial. For developers, users, and investors alike, understanding these changes is essential for navigating future opportunities.

As we brace ourselves for what lies ahead in 2025, the Ethereum network is poised to remain at the forefront of blockchain innovation.

Remember to explore resources like hibt.com to stay updated on the latest market dynamics and strategies.

For more insights on crypto, check out our guide on Vietnam crypto tax policies and stay informed!

Note: The information provided herein is not financial advice. Always consult with your local regulatory authorities.

Written by Dr. John Smith, a blockchain technology researcher and author of over 25 papers in cryptography. He has led multiple renowned project audits and provides insights into effective blockchain strategies.