Bitcoin Halving Market Forecasts: What to Expect

With over $4.1 billion lost due to DeFi hacks in 2024, the crypto market remains an intriguing yet volatile environment. As we approach the next Bitcoin halving event, scheduled for 2024, investors and enthusiasts alike are keen to understand what this monumental event means for future prices and market forecasts. In this article, we will explore the implications of Bitcoin halving on market movements, investment strategies, and the overall landscape of cryptocurrencies.

Understanding Bitcoin Halving: A Brief Overview

Bitcoin halving refers to the process by which the Bitcoin mining reward is cut in half, effectively reducing the rate at which new bitcoins are created. Historically, this event has led to significant price changes in the years that follow. Let’s illustrate this with an analogy: think of Bitcoin like a limited resource, similar to gold. As we tap into our gold reserves, they become scarcer, which generally pushes prices up. Each time Bitcoin halves, we lower the rate of new supply, which has led to past price surges.

The Historical Impact of Bitcoin Halving

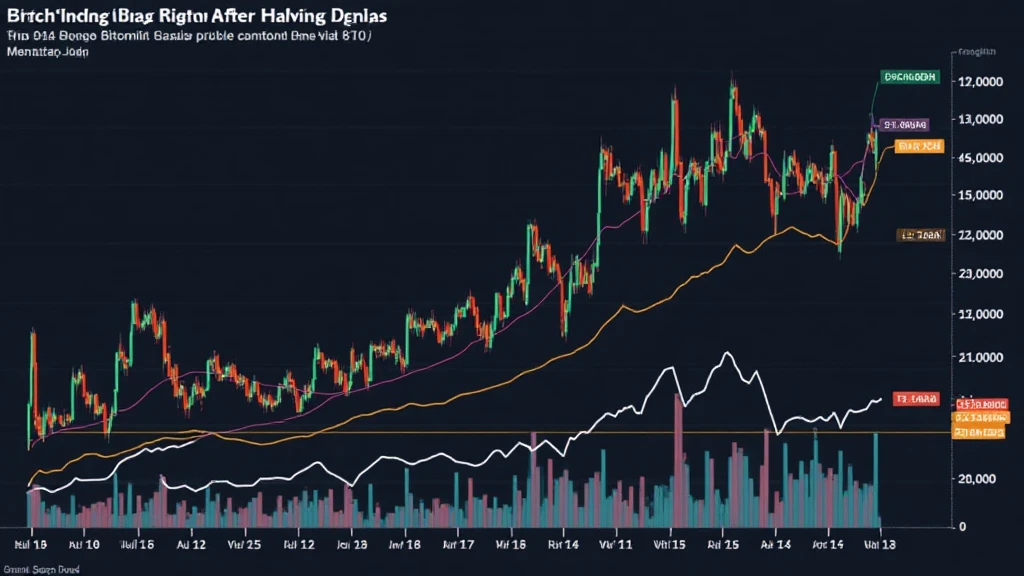

Bitcoin halving has occurred three times since its inception in 2009. Here’s a quick rundown:

- 2012: The first halving reduced blocks from 50 BTC to 25 BTC. Price rose from $11 to over $1,200 in the following year.

- 2016: The second halving cut the reward from 25 BTC to 12.5 BTC. Price jumped from $400 to over $20,000 by the end of 2017.

- 2020: The third halving brought rewards down to 6.25 BTC. Prices surged from around $8,000 to nearly $60,000 by 2021.

Given this historical data, many analysts are speculating on what the next halving will bring.

Analyzing Bitcoin Market Trends Post-Halving

So, what should investors look out for following the next halving? Here are some key trends currently observed:

- Euphoria and Speculation: As the halving approaches, speculation tends to drive prices upwards. Many traders jump in, hoping to ride the wave, which can lead to volatility.

- Increased Interest in Bitcoin: Halvings tend to attract more media attention. Since Bitcoin remains the most well-known cryptocurrency, increased interest can lead to more buyers entering the market.

- The Role of Miners: With reduced rewards, miners will start focusing on transaction fees instead of block rewards, which can influence Bitcoin’s transaction dynamics.

These trends often set the stage for potential price movements.

Why Bitcoin Halving Matters for Investors

The mechanics of Bitcoin halving translate into a refined value proposition for potential investors. Let’s break it down:

- As the supply decreases, demand outstrips availability, typically resulting in price increases.

- Strategic long-term investments can place savvy investors in advantageous positions as new market dynamics take shape.

- Understanding the halving cycle offers insights into timing investments more strategically.

It is important for prospective Bitcoin investors to remain vigilant and perform thorough research, especially in the face of market fluctuations.

Market Forecasts: What Analysts are Saying

Many analysts are making predictions based on historical patterns influenced by Bitcoin halvings. For example, analysts project Bitcoin could reach a price range of $100,000 to $300,000 within 2025. Furthermore, a recent report from Chainalysis forecasted a significant uptick in demand due to increased institutional investments in cryptocurrencies.

Local Insights: The Vietnam Crypto Market

The growth of cryptocurrency adoption in Vietnam has been exponential, with a reported 500% increase in Bitcoin users in 2023 alone. Furthermore, learn how local events and regulations are shaping the market by visiting hibt.com for ongoing updates.

Conclusion: The Future of Bitcoin Post-Halving

As we anticipate the forthcoming Bitcoin halving in 2024, investors must carefully consider the historical context, market dynamics, and forecasts. While many factors can influence Bitcoin’s trajectory, the historical pattern suggests potential for significant price increases in the years following each halving event. As you build your investment strategies, consider keeping an eye on the Vietnamese market and how it can impact global trends.

In short, Bitcoin halving is more than a technical event; it signifies a shift in market sentiment, investment strategies, and ultimately pricing. Being prepared and informed is crucial.

For more insights, make sure to visit cryptosalaryincubator and stay updated on the latest trends and forecasts in the crypto market.