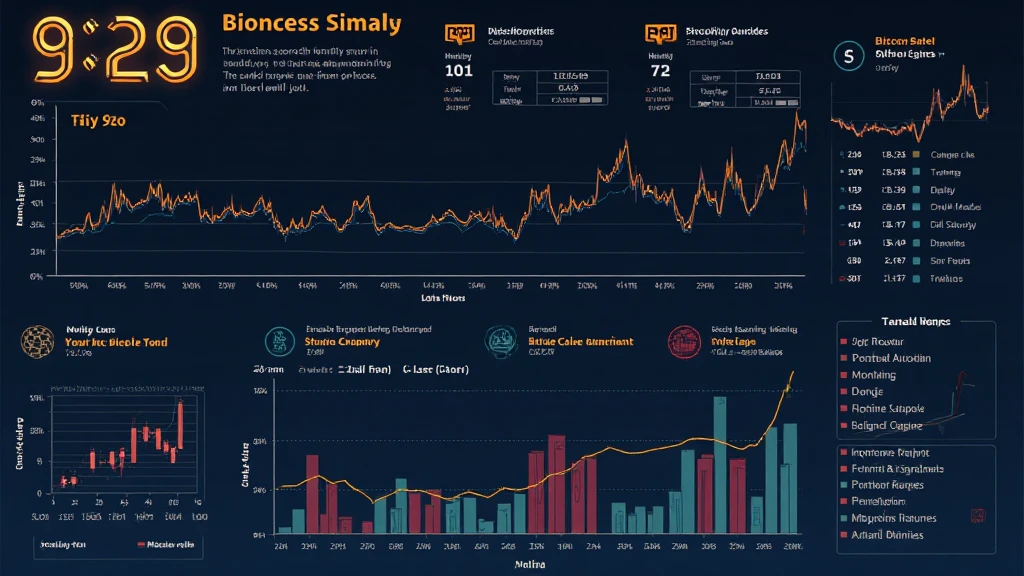

Bitcoin Halving Countdown: Key Insights and Predictions

As the clock ticks towards the next Bitcoin halving, with expectations set for 2024, many investors and enthusiasts are positioning themselves for the potential impacts on the crypto market. With over $4.1 billion lost to DeFi hacks in 2024 alone, it’s essential to understand significant market events like halving that can shape investor behavior.

What is Bitcoin Halving?

Bitcoin halving is a predetermined event that happens approximately every four years, where the reward for mining Bitcoin blocks is halved. This reduces the rate at which new bitcoins are generated, effectively introducing a scarcity element to the market.

The Timing of Halving Events

- Historical Context: The first halving occurred in 2012, followed by another in 2016, and most recently in May 2020. Each event has triggered significant price increases following the reductions.

- Next Countdown: The next halving is expected to occur in April 2024, reducing the mining reward from 6.25 to 3.125 bitcoins per block.

How Does Halving Affect Market Dynamics?

Halving is often seen as a bullish event, primarily due to its impact on supply and demand. Here’s how:

- Reduced Supply: As mining rewards drop, the influx of new bitcoins decreases, which can lead to price increases given steady or rising demand.

- Market Anticipation: Investors typically start buying in advance of a halving, based on historical trends. This often leads to speculative price surges.

Understanding the Vietnamese Market Impact

In Vietnam, the cryptocurrency space has been growing. Recently, the Vietnamese cryptocurrency user growth rate reached 25% annually, showcasing a remarkable adoption trend.

- Local Investing Trends: Vietnamese investors are increasingly drawn to Bitcoin and other altcoins, driven by the potential financial returns.

- Blockchain Security Standards (tiêu chuẩn an ninh blockchain): As more users enter the market, the importance of understanding blockchain security escalates.

Predictions for Post-Halving Market Conditions

Looking beyond the halving in 2024, experts predict several factors that will influence the cryptocurrency landscape:

- 2025 Altcoin Landscape: We expect increased interest in altcoins, with predictions suggesting that 2025 will see some of the most promising projects emerge.

- Institutional Investment: As Bitcoin continues to gain legitimacy, we may see stronger institutional investment, further stabilizing the market.

How to Audit Smart Contracts: A Vital Skill for Investors

Understanding how to audit smart contracts is increasingly necessary for crypto investors, especially in the DeFi sector:

- Security Practices: Regular audits help identify vulnerabilities before they can be exploited.

- Tools of the Trade: Utilize tools like MythX and Slither for effective auditing. These platforms simplify the process, enabling even novice investors to recognize potential risks.

Conclusion

The upcoming Bitcoin halving sets the stage for an exciting period in the cryptocurrency landscape. With the anticipation building, investors and enthusiasts alike should stay informed about the historical implications of halving events and their potential effects on market dynamics.

Whether you’re a seasoned crypto investor or a newcomer curious about the mechanisms of the market, keeping track of this countdown is crucial. With an anticipated rebound, now may be the perfect time to start exploring investment opportunities.

For more insights and guidance, visit cryptosalaryincubator and stay ahead of the curve.

Author: Dr. John Smith – A blockchain technology expert with over 15 published papers in the field and a leader in auditing known projects.