Introduction

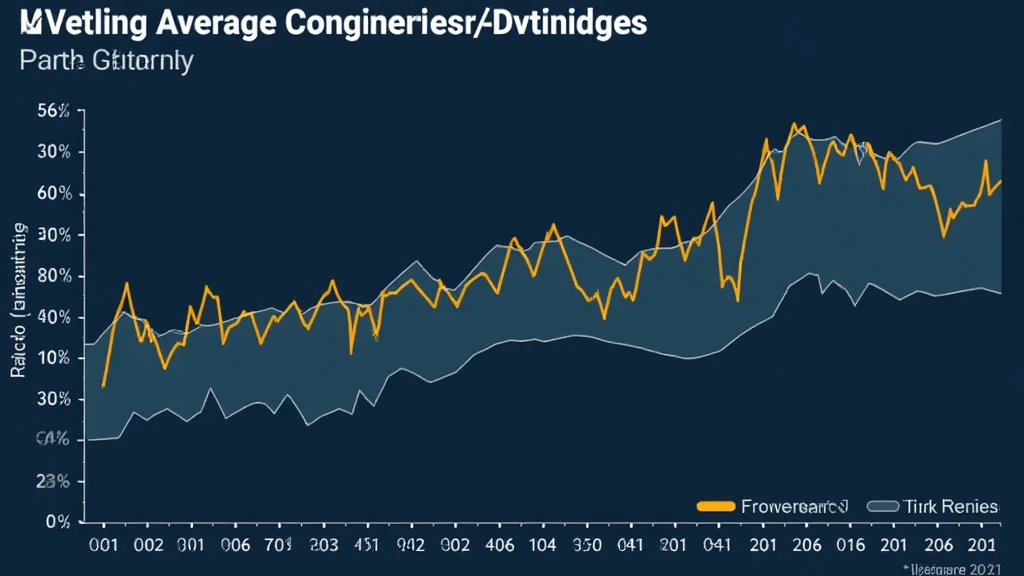

In 2024, the cryptocurrency market witnessed dramatic fluctuations, with losses reaching up to $4.1 billion due to various factors, including DeFi hacks. Understanding market signals is crucial for navigating these turbulent waters. Among various tools, the Moving Average Convergence Divergence (MACD) has emerged as a vital instrument for investors looking into bonds and cryptos in Vietnam.

So, what exactly is MACD, and how does it work with HIBT Vietnam bond moving average convergence/divergence signals? This article aims to dissect this term, offering insights into its significance and how it can be leveraged for better investment decisions.

What is MACD?

The Moving Average Convergence Divergence (MACD) is a trading tool that helps identify trends in stock prices and cryptocurrencies. Developed by Gerald Appel in the late 1970s, MACD combines both trend-following and momentum strategies.

- Components of MACD: The MACD line, signal line, and histogram.

- How it works: MACD measures the difference between two exponential moving averages (EMAs) and generates buy/sell signals.

The Importance of HIBT in Vietnam

The HIBT (Hanoi Investment Bond Trust) is a pivotal term in the Vietnamese financial landscape. As the Vietnamese crypto market grows—reporting a 25% annual user growth rate—the significance of understanding HIBT and its signals, specifically regarding bonds, becomes increasingly vital for local investors.

Analyzing HIBT Bond Signals

Utilizing the MACD with HIBT bond signals can provide tremendous insights into potential entry and exit points for investors. The ability for investors to identify convergence or divergence in price movements can lead to more informed trading decisions.

Practical Examples of MACD in Action

To illustrate the use of HIBT Vietnam bond moving average convergence/divergence signals, let’s consider the following:

- Buy Signals: A bullish crossover occurs when the MACD line crosses above the signal line, indicating a potential upward trend.

- Sell Signals: Conversely, a bearish crossover suggests potential downward trends.

Benefits and Drawbacks of MACD

Like all trading indicators, MACD comes with its benefits and drawbacks. Understanding these can help traders avoid pitfalls and optimize their strategies.

Benefits

- Effective for identifying trends and momentum.

- Useful in various asset classes, including HIBT bonds.

Drawbacks

- Can give false signals during market consolidation.

- Lagging indicator—often reacts after price moves are already underway.

Market Trends and Data

As we delve deeper into the technicalities of MACD signals, it’s essential to cite reliable data. According to Chainalysis in 2025, the adoption of cryptocurrency in Vietnam is expected to surge by 50%.

Future Perspectives

As we pace ourselves into 2025, we must look ahead. Investment strategies leveraging HIBT Vietnam bond moving average convergence/divergence signals are bound to become sophisticated with the increasing adoption of blockchain technology in financial markets.

Conclusion

The use of HIBT Vietnam bond moving average convergence/divergence signals is essential for anyone aiming to make informed decisions in the rapidly evolving crypto landscape. By mastering MACD interpretations, investors can gain a better understanding of market trends, ultimately improving their financial performance.

For a more comprehensive resource on cryptocurrency investments and trading signals, visit hibt.com.