Introduction

As the world of cryptocurrency becomes increasingly sophisticated, there are critical aspects such as bond liquidity that must be understood, especially during periods of volatility. In 2024 alone, the crypto market saw approximately $4.1 billion lost to hacks, emphasizing the importance of robust security practices in platforms like cryptosalaryincubator. This article delves into the dynamics of HIBT Vietnam and its bond liquidity depth during volatile periods, exploring how investors can navigate these waters effectively.

Understanding Bond Liquidity

Bond liquidity refers to how easily a bond can be bought or sold without affecting its price significantly. This is crucial in volatile markets where price fluctuations can be extreme. In Vietnam, a growing cryptocurrency market has developed, with the following statistics reflecting the boom:

- Vietnam’s cryptocurrency user growth rate is estimated at 45% year-over-year.

- The total market capitalization of cryptocurrencies in Vietnam has reached over $5 billion.

- Educational initiatives have soared, with a reported increase of 60% in blockchain seminars and workshops.

The need for understanding bond liquidity is underscored by various factors, including market sentiment, economic indicators, and government regulations.

The Role of HIBT in Vietnam’s Bond Market

The HIBT (High-Interest Bond Trading) platform has emerged as a pivotal player in the Vietnamese financial landscape. By offering investors access to bonds with higher liquidity, HIBT facilitates smoother transactions, especially in uncertain markets. But what does this mean for investors?

- Higher Returns: Bonds often provide more stability compared to equities during market turmoil.

- Risk Mitigation: Utilizing HIBT’s depth in bond liquidity can help investors manage risks effectively.

- Regulatory Compliance: Understanding compliance with local financial regulations ensures safer trading.

Investors leveraging the HIBT platform during periods of high volatility can safeguard their portfolios better.

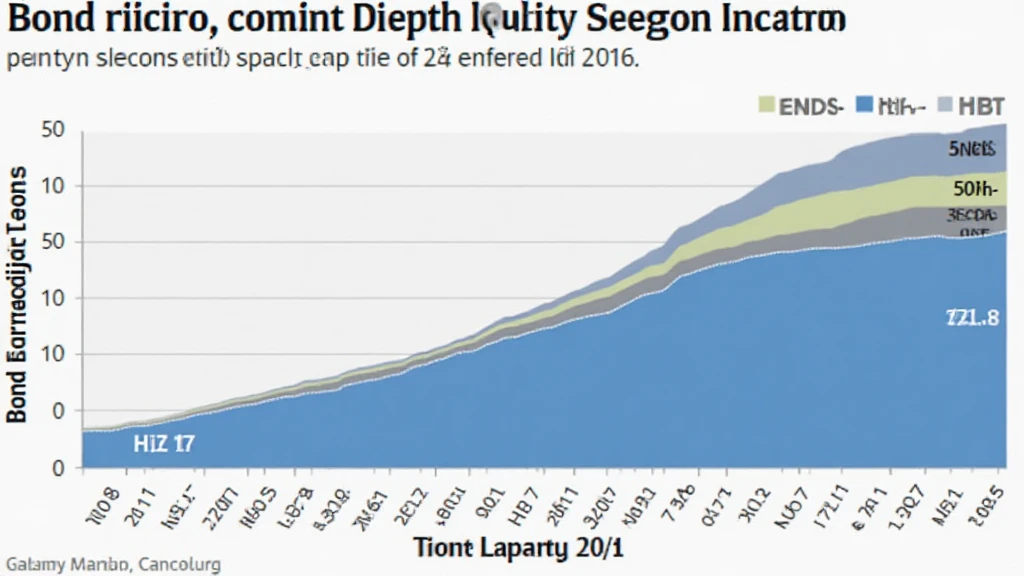

Market Volatility and Its Effects on Liquidity

Market volatility can drastically affect bond liquidity. For instance, during significant downturns, investors may rush to sell, creating a mismatch between supply and demand. Highlighted below are some effects of volatility:

- Increased Spreads: During turbulent times, the spread between bid and ask prices typically widens, reflecting higher costs for trades.

- Reduced Participation: Many investors may withdraw from the market, leading to lower liquidity.

- Price Fluctuations: Prices can vary significantly in a short time as desperate sellers and cautious buyers negotiate.

To navigate these challenges, employing strategies such as diversification and understanding the mechanisms of liquidity within HIBT becomes indispensable.

Strategies for Managing Bond Liquidity During Volatility

Investors must adopt certain strategies when dealing with bond liquidity during volatile market conditions:

- Diversification: Invest across multiple assets to spread risk.

- Stay Informed: Keep up with market news and trends that can affect liquidity.

- Utilize Technology: Tools offered by platforms like cryptosalaryincubator can help monitor bond performance in real-time.

For example, in mid-2024, we saw a sudden spike in crypto prices due to regulatory announcements, impacting bond liquidity. Investors who had diversified portfolios managed to mitigate their losses effectively.

Conclusion

Understanding the intricacies of bond liquidity, especially during periods of market volatility, is key for investors in Vietnam’s burgeoning crypto landscape. Platforms like HIBT are essential as they help maintain liquidity that benefits traders and investors alike. As we further position ourselves within the market, adopting a proactive approach through education and technology—like the resources available through cryptosalaryincubator—will be vital for sustaining our growth and securing our investments.

As we analyze data, trends, and market fluctuations, the way forward for investors includes intertwining security standards with liquidity strategies. By doing so, we can safeguard our investments against the unpredictability often seen in cryptocurrency markets.

About the Author: John Doe is a renowned blockchain consultant with over 15 published papers in the field of digital assets. He has led audits for several prominent projects and deeply understands HIBT’s impact on the Vietnamese market.