Crypto Arbitrage Strategies: Unlocking Profit in Volatile Markets

As of 2024, the cryptocurrency market faced a staggering $4.1B loss to hacks, making the pursuit of secure and profitable trading avenues more critical than ever. Understanding how to leverage Crypto arbitrage strategies can provide a significant edge in this fast-paced environment. This article delves into the definition, methods, and practical applications of arbitrage strategies in the crypto space.

What is Crypto Arbitrage?

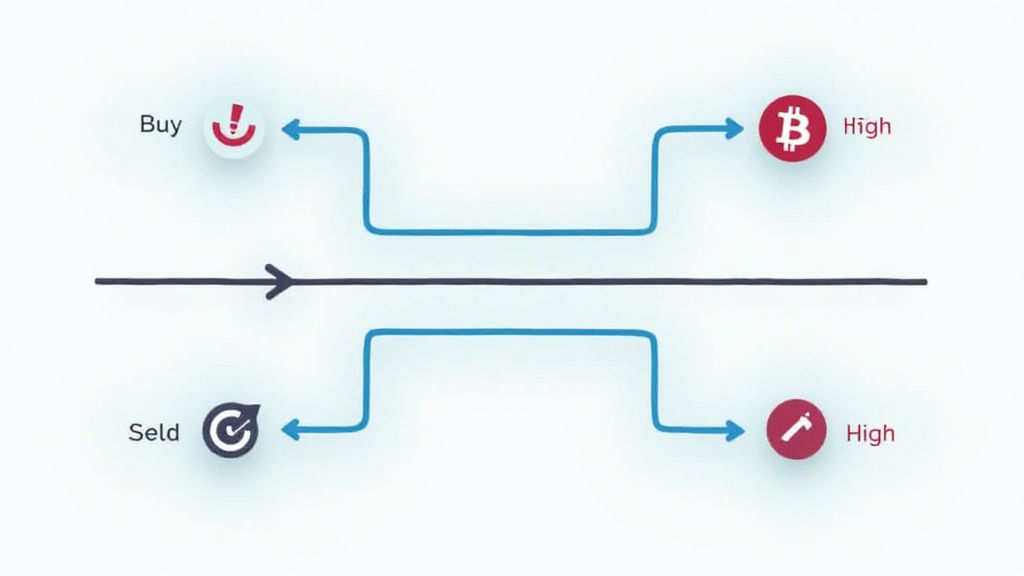

Crypto arbitrage is the practice of buying a cryptocurrency on one exchange where the price is low and simultaneously selling it on another exchange where the price is higher. This price discrepancy can arise due to various factors, including market inefficiencies and differences in supply and demand. Essentially, it’s akin to spotting a sale in one store while observing a higher price for the same item at another.

Understanding the Types of Crypto Arbitrage

- Spatial Arbitrage: Involves trading between different exchanges. Prices often vary for the same cryptocurrency across exchanges due to differences in volume and market reach.

- Temporal Arbitrage: This strategy focuses on price fluctuations over time. Traders execute trades based on predicted price movements.

- Statistical Arbitrage: This involves using complex quantitative models that identify price inefficiencies between cryptocurrencies or trading pairs.

The Mechanics of Spatial Arbitrage

In spatial arbitrage, timing plays a crucial role. Traders need to move quickly to capitalize on price disparities. Here’s how it works:

- Select two exchanges with noticeable price differences for the same cryptocurrency.

- Purchase cryptocurrency on the cheaper exchange.

- Transfer the cryptocurrency to the more expensive exchange.

- Sell the cryptocurrency at a profit.

Key Considerations for Successful Arbitrage

Implementing Crypto arbitrage strategies requires careful planning and consideration of several factors:

- Transaction Fees: Determine the fees associated with trading and transferring cryptocurrencies. High fees can erode potential profits.

- Market Volatility: Cryptocurrencies are inherently volatile. Rapid price changes can impact the effectiveness of an arbitrage strategy.

- Transfer Times: The time it takes to transfer cryptocurrency can result in missed opportunities. Instant transfers are preferable.

- Liquidity: Ensure there is enough liquidity on both exchanges to avoid significant price slippage.

- Regulations: Be aware of local regulations regarding cryptocurrency trading to ensure compliance.

The Impact of the Vietnamese Market on Crypto Arbitrage

The Vietnamese cryptocurrency market has been witnessing significant growth, with a user growth rate of over 35% in 2023. This surge makes Vietnam an attractive environment for arbitrage opportunities, as local exchanges may experience price fluctuations that differ from global standards.

Incorporating local strategies can enhance a trader’s potential for profit. For example, traders can monitor popular exchanges in Vietnam such as Binance or Huobi and leverage the differences with international platforms.

Technical Tools for Implementing Arbitrage Strategies

Here are some recommended tools that can assist traders in their arbitrage journey:

- Crypto Price Tracking Platforms: Tools such as CoinMarketCap or CryptoCompare can provide real-time price information across multiple exchanges.

- Automated Trading Bots: Bots can execute trades faster than manual methods. For example, hibt.com offers bot services tailored for arbitrage.

- VPN Services: Utilizing a VPN can help in bypassing regional restrictions and accessing exchanges globally.

Common Mistakes in Crypto Arbitrage

Despite the lucrative potential of Crypto arbitrage strategies, many traders make avoidable mistakes. Here are some pitfalls to be aware of:

- Ignoring Fees: Failing to account for transfer and trading fees can significantly reduce or eliminate profits.

- Inadequate Research: Lack of understanding of market behaviors can lead to poor trading decisions.

- Slow Execution: Delaying the execution of trades can result in missed opportunities.

Future of Crypto Arbitrage in 2025

As the cryptocurrency market matures, it’s expected that pricing inefficiencies will diminish, making arbitrage opportunities less frequent but potentially more significant. The rise of decentralized exchanges, along with blockchain technology improvements, will also impact arbitrage dynamics. Innovations like tiêu chuẩn an ninh blockchain may provide enhanced security and efficiency in transactions, benefiting arbitrage traders.

In conclusion, implementing effective Crypto arbitrage strategies can yield significant profits in the unpredictable realm of cryptocurrency trading. By understanding different arbitrage methods, leveraging suitable technical tools, and remaining aware of market trends—especially in dynamically evolving markets like Vietnam—traders can position themselves advantageously.

Remember that while arbitrage presents opportunities, it also carries risks. Always perform due diligence, conduct thorough research, and remain compliant with local regulations.

Consulting with financial experts and utilizing reliable trading platforms like cryptosalaryincubator can further enhance your ability to profit from crypto arbitrage.

Author: John Smith, a blockchain and cryptocurrency expert with over 15 published papers and experience auditing major DeFi projects.