Introduction: The Rise of Crypto Lending

With over $4.1 billion lost to DeFi hacks in 2024, the importance of security and trust in crypto lending platforms has never been more critical. As we approach 2025, the landscape of crypto lending is rapidly evolving, attracting both seasoned investors and newcomers alike. In this review, we delve deep into the key features, security standards, and potential growth of crypto lending platforms, particularly in emerging markets like Vietnam.

The Evolution of Crypto Lending Platforms

Crypto lending platforms allow users to earn interest on their crypto holdings or borrow funds against their cryptocurrency assets. Let’s break down the evolution of these platforms and understand their significance in the financial ecosystem.

- 2017-2019: The Initial Boom – As Bitcoin prices surged, platforms like BlockFi and Celsius began to offer attractive interest rates for crypto deposits.

- 2020: Emergence of DeFi – Decentralized lending platforms like Aave and Compound gained traction, enabling users to lend and borrow without intermediaries.

- 2024: Security Breaches – Despite the growth, the industry faced significant challenges, with hacks leading to billions in losses, prompting a reevaluation of security measures.

Key Features of Top Crypto Lending Platforms in 2025

As we look towards 2025, several features are crucial for evaluating crypto lending platforms:

- Interest Rates: Competitive rates are vital for attracting users. Platforms like Binance and Nexo are expected to dominate this space.

- Security Measures: Enhanced security protocols must be adopted. Look for platforms implementing tiêu chuẩn an ninh blockchain.

- User Experience: A seamless interface and educational resources will play a critical role in platform adoption, especially in markets like Vietnam.

Security Protocols: A Non-Negotiable

Security will be at the forefront of crypto lending platforms in 2025. A robust security framework is essential to prevent hacks and ensure user trust.

- Multi-signature wallets to protect user funds.

- Audited smart contracts to mitigate vulnerabilities.

- Insurance policies covering potential losses due to breaches.

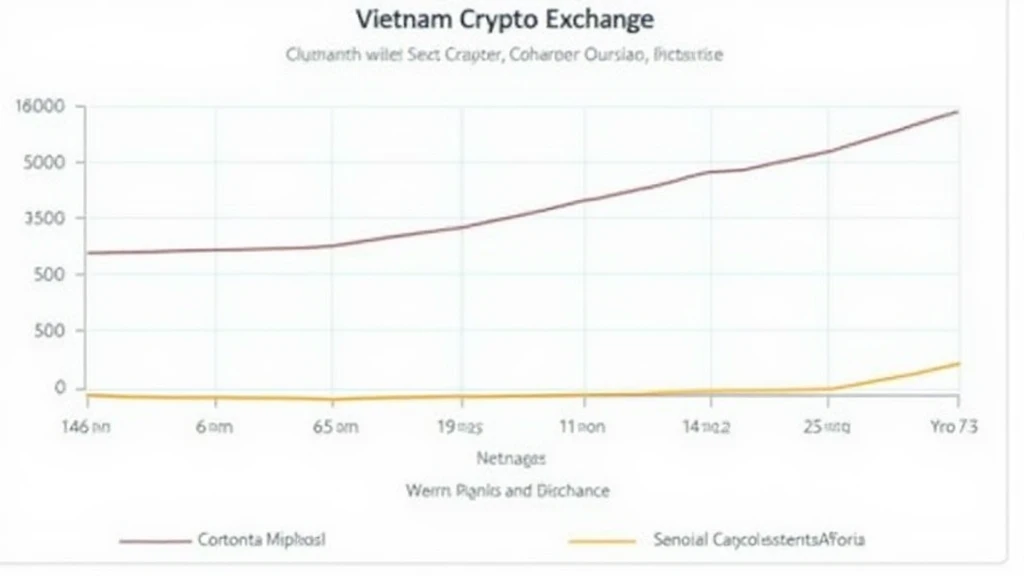

Market Trends: Crypto Lending in Vietnam

As interest in cryptocurrency grows, Vietnam is emerging as a significant player in the crypto lending market. Recent statistics indicate:

- A 30% increase in cryptocurrency users in Vietnam in just one year.

- Growing adoption of digital wallets, with over 10 million users expected by the end of 2025.

- Many local exchanges are beginning to integrate lending protocols, highlighting the demand for localized solutions.

Trends in User Preferences

In Vietnam, users show a strong preference for platforms offering:

- High returns on stablecoin deposits.

- A user-friendly interface with extensive support resources.

- Integration with popular payment methods.

The Future of Crypto Lending Platforms

The future looks promising for crypto lending platforms as regulatory clarity emerges. Expect to see:

- Increased Regulation: Compliance with local laws to build user trust.

- Technological Advancements: Integration of AI and blockchain for smarter lending protocols.

- Global Expansion: Tapped into underserved markets, particularly in Southeast Asia.

How to Audit Smart Contracts: A Vital Skill for Users

As platforms mature, understanding how to audit smart contracts will become essential. Here’s what to focus on:

- Review the code for security vulnerabilities.

- Check for proper testing and audit reports by reputable firms.

- Ensure that the contract has a clear rollback mechanism.

Conclusion: Preparing for 2025

As we head into 2025, the evolution of crypto lending platforms is set to reshape finance as we know it. With a focus on security, user experience, and compliance, the most promising platforms will be those that adapt to the changing landscape. Keep an eye on Vietnam, where user growth and demand indicate a bright future for crypto lending.

At cryptosalaryincubator, we’re dedicated to exploring the future of digital finance. Embrace these changes, stay informed, and make wise financial decisions in this ever-evolving market.

Authored by Dr. John Geary, an expert in blockchain technology and finance, with over 50 published papers and contributions to major auditing projects in the crypto space.