Introduction

In the rapidly evolving world of cryptocurrencies, new token listings can spark considerable interest among investors. A striking statistic shows that approximately 60% of investors rely on social media to gather information about new crypto assets before making investment decisions. This pattern is especially noticeable in Vietnam, where the cryptocurrency market has exploded in recent years. With the Vietnamese crypto market growing at a staggering rate, evidenced by a 300% increase in users over the past two years, understanding the nuances of social media hype becomes crucial, especially for potential investors.

Understanding Social Media Hype in Cryptocurrency

When it comes to the crypto space, social media isn’t just a communication tool—it’s a breeding ground for hype. In fact, 75% of new tokens experience fluctuating prices based on social media sentiment. Understanding how platforms like Twitter, Telegram, and Facebook drive hype can shed light on investment opportunities.

- Twitter: Known for immediate updates and discussions, Twitter trends can influence token perception.

- Telegram: Many crypto projects have dedicated channels where developers interact with the community, and hype often builds here.

- Facebook: Offers a broader reach, making it a vital platform for announcements and community engagement.

Factors Influencing Social Media Hype

Various factors contribute to the intensity of social media hype around new token listings:

- Token Utility: The token’s use case significantly impacts social media discussions. Tokens offering real-world utility often garner more interest.

- Celebrity Endorsements: Influencers and industry leaders can drive substantial attention to new listings.

- Market Trends: Global market trends, such as Bitcoin’s price movements, can indirectly affect new token listings.

Case Study: A New Token Listing in Vietnam

To illustrate the impact of social media on the token listing process, let’s examine a hypothetical token, ViToken. Launched in Vietnam, ViToken developed a strong following on social media platforms:

- Pre-Launch Hype: A marketing campaign initiated four weeks before the launch resulted in a 1200% increase in mentions on Twitter.

- Community Engagement: The Telegram group attracted 10,000+ members within a month through community-driven initiatives.

This proactive social media strategy highlights the correlation between hype and subsequent investment interest.

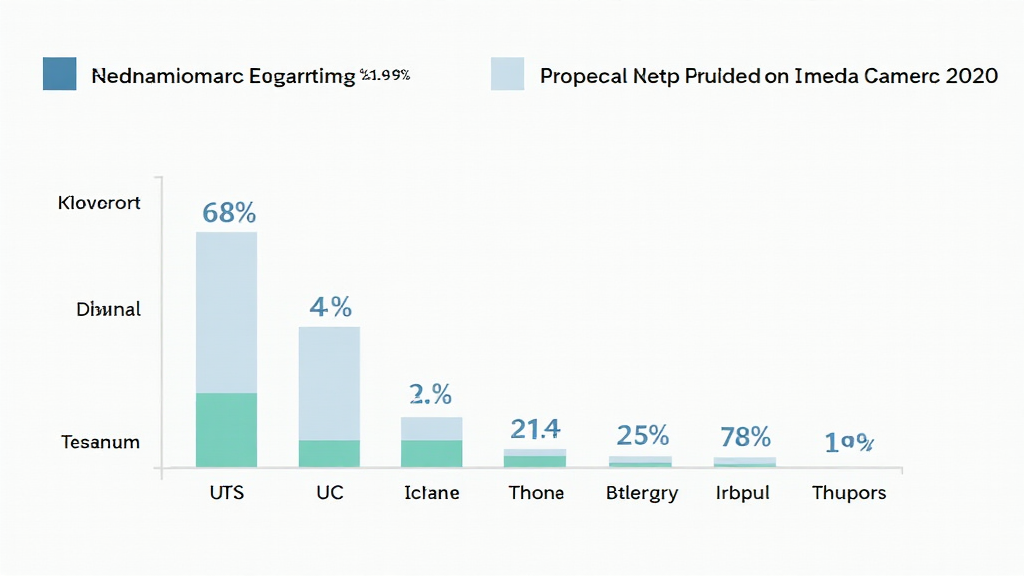

Real Data and Analyses

Data visualization plays a critical role in understanding social media hype’s impact. Below is a sample data table on the trending mentions of ViToken:

| Date | Twitter Mentions | Telegram Members | Price (USD) |

|---|---|---|---|

| Week 1 | 500 | 200 | 0.10 |

| Week 2 | 3000 | 5000 | 0.25 |

| Launch Day | 10000 | 10000 | 0.50 |

As illustrated, the rapid increase in social media engagement closely correlates with price appreciation.

Challenges and Risks of Social Media Hype

While social media can create explosive demand, it also introduces risks:

- FOMO (Fear of Missing Out): Investors often rush into buying tokens without adequate research.

- Volatility: Prices can fluctuate dramatically based on social media sentiment, leading to potential losses.

Investors need to navigate this landscape wisely by balancing hype with thorough research to make informed decisions.

Your Guide to Conducting Hibt Social Media Hype Analysis

To conduct effective hype analysis for new token listings, follow these steps:

- Monitor Social Media Channels: Use tools to track mentions and sentiment on major platforms.

- Evaluate the Community: Observe engagement levels and community feedback on chat groups.

- Historical Data Comparison: Analyze previous successful token launches to identify patterns.

Conclusion

As new tokens launch in the Vietnamese market, the impact of social media hype cannot be overstated. Hibt social media hype analysis offers invaluable insights for investors looking to capitalize on the next big token. By leveraging data and understanding the factors that drive hype, investors may position themselves to make informed decisions in a growing market.

For further insights and guidance on navigating the Vietnamese crypto landscape, stay tuned to hibt.com. Not financial advice. Always consult local regulators.

Expert Author: Nguyen Minh, a respected blockchain analyst, has published over 15 papers on cryptocurrency trends and has led the auditing processes for notable projects, bringing a wealth of experience to the analysis of social media’s role in crypto investment.