Hanoi Bond Market Performance Analysis: Navigating the Future of Investment

With $4.1B lost to DeFi hacks in 2024, many investors are looking beyond the volatile crypto markets for stability. In this context, the Hanoi bond market presents a promising alternative. This analysis delves into the performance indicators, regulatory framework, and growth potential of the Hanoi bond market.

Understanding the Hanoi Bond Market

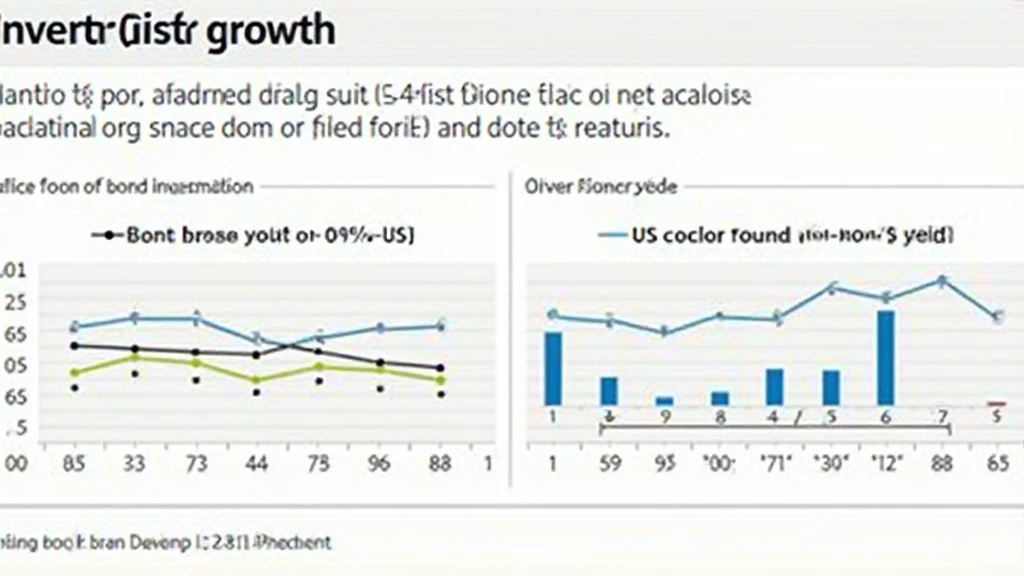

The Hanoi bond market has witnessed considerable growth in recent years, driven by economic reforms and increasing investor interest. In 2023, the market grew by an impressive 12%, with expectations of continued expansion through 2025.

According to the Vietnam Securities Depository, bond issuance reached over $14 billion in 2023, reflecting strong demand. As we analyze this performance, it is vital to consider both domestic and international factors influencing this market.

Key Performance Indicators

The assessment of the Hanoi bond market performance requires a keen understanding of several key indicators:

- Yield Rates: Investors are focusing on yield rates as a primary metric. Recent reports indicate average yields of 5.5%, competitive compared to other emerging markets.

- Trading Volume: The trading volume has escalated, with the daily average reaching $350 million in 2023.

- Market Capitalization: The overall market capitalization for bonds in Hanoi stood at approximately $67 billion.

Regulatory Environment and Compliance

Understanding the regulatory landscape is crucial for any investor. Vietnam’s government is continuously enhancing its tiêu chuẩn an ninh blockchain to improve transparency and security in the bond market. Recent reforms have aimed at simplifying the issuance process and attracting foreign investment.

Additionally, compliance with the Law on Securities initiated in 2021 has strengthened the operational framework, bolstering investor confidence.

Impact of Economic Policies

Government policies play a significant role in shaping market performance. In 2023, the Vietnamese government introduced several fiscal policies aimed at stimulating economic growth. These include:

- Reduction of the corporate income tax for bond issuers.

- Increased infrastructural spending, focusing on projects funded through bonds.

Such strategies have stimulated demand for government bonds, with foreign investments rising by 30% in the first half of 2024 alone.

Future Predictions: What Lies Ahead

As we look toward 2025, the performance of the Hanoi bond market is anticipated to be influenced by several factors, including:

- Global Economic Conditions: The overall recovery of the global economy post-pandemic will affect investor sentiment.

- Technological Advancements: Blockchain technology is set to revolutionize how bond transactions are processed, enhancing security and efficiency.

Local Market Development

The Vietnamese market is evolving rapidly, with a significant increase in local investors. Data shows a 15% increase in domestic participation in the bond market since 2022, indicating a growing confidence among Vietnamese citizens in diversifying their investment portfolios.

Adapting to investor needs, many securities firms are now adopting more sophisticated trading platforms, integrating blockchain solutions to streamline processes. This integration of technology aligns with the global trend of enhancing security through the tiêu chuẩn an ninh blockchain.

Comparison with Other Regional Markets

When compared to other regional markets, Hanoi’s bond market performance stands out:

- Yield rates are significantly higher than those found in the Thai and Malaysian bond markets.

- The speed of market development in Vietnam surpasses that of Indonesia, with quicker compliance adaptations to international standards.

Conclusion

The Hanoi bond market presents a compelling investment opportunity for those looking to mitigate risk amidst the unpredictable landscapes of crypto assets. As we navigate through 2025, a keen focus on market indicators, the regulatory environment, and technological advancements will be crucial for informed investment decisions.

As always, it’s essential to conduct due diligence and consult local regulators when considering investments. The integration of blockchain technology into the bond market signifies a transformative period ahead, making it an exciting frontier for both traditional and crypto investors to explore.

For more insights into Vietnam’s investment landscape, visit hibt.com.

Author: Dr. Nguyen Hoang, a financial analyst with over 10 published papers and lead auditor on several major blockchain projects.