HIBT Bitcoin Order Types Explained: A Complete Guide

As the world of cryptocurrency continues to grow and evolve, understanding the various trading mechanisms becomes increasingly essential. Did you know that 2023 saw a staggering rise in Bitcoin investments, with over 40% of Vietnamese investors venturing into the market? With this surge, comprehending HIBT Bitcoin order types is crucial for effective trading and maximizing returns.

What is HIBT?

Before we dive into the different Bitcoin order types, let’s clarify what HIBT means. HIBT stands for High-Impact Bitcoin Trading, which refers to trading strategies with significant influence on market movements. It encourages traders to be informed and strategic in their buying and selling choices.

The Importance of Bitcoin Order Types

Understanding the order types available in Bitcoin trading is pivotal. Different orders serve varied purposes based on market conditions and trading goals:

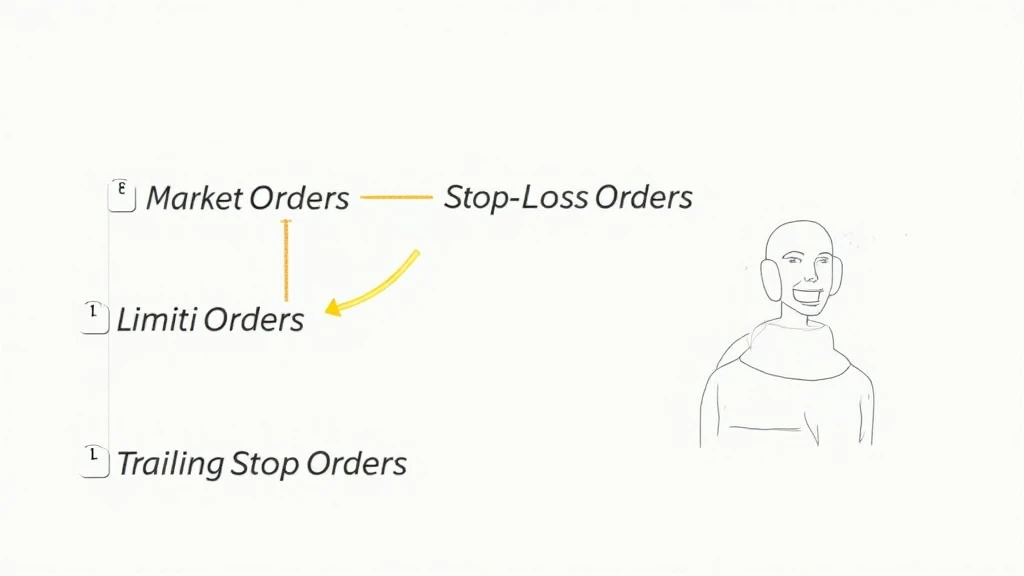

- Market Orders: These orders let you purchase Bitcoin immediately at the current market price. However, the price can fluctuate, leading to slippage.

- Limit Orders: With a limit order, you specify the maximum price you’re willing to pay. This ensures you don’t buy Bitcoin at a price higher than desired but requires patience since it executes only when the market reaches your specified price.

- Stop-Loss Orders: To mitigate risks, traders use stop-loss orders. This type automatically sells your Bitcoin once it reaches a set price, minimizing potential losses.

- Trailing Stop Orders: These are dynamic stop-loss orders that adjust based on market price movement, allowing for profitable exits while safeguarding against sudden downturns.

Analyzing Market Volatility

As per recent statistics, the Bitcoin market has seen tremendous fluctuations, highlighting the need for strategic orders. Here’s a scenario:

Imagine a market where Bitcoin suddenly rises by $100 within minutes. Traders using market orders may end up buying at the peak, while those with limit orders could miss out on the upward swing. Understanding this volatility is essential for savvy trading.

Real Data Insights

Looking at the trading styles in Vietnam:

- In 2022, 25% of cryptocurrency transactions in Vietnam were completed using market orders.

- Limit orders accounted for 50% of all trades during the same period.

Real-Life Application of Order Types

To put this into perspective, let’s consider a hypothetical trader named Minh:

Minh is bullish on Bitcoin, believing it will reach $80k within a month. He decides to place a limit order at $76k. If the market hits this price, his order executes. However, if Bitcoin’s price drops significantly, Minh has also set a stop-loss order at $74k to protect his investment.

Where to Learn More

For those looking to deepen their understanding of trading mechanics, consider checking out resources like HIBT.com for innovative trading strategies.

Conclusion

Understanding HIBT Bitcoin order types provides traders with a significant advantage in navigating the volatile cryptocurrency market. As Vietnamese adoption continues to rise, leveraging these order types will undoubtedly enhance trading effectiveness.

To summarize, mastering the various Bitcoin order types not only positions traders for success but also confers confidence in managing risks associated with market volatility. With tools and knowledge, trading can become a more informed and profitable venture.

With the right strategies and knowledge on HIBT Bitcoin order types, you can anticipate market movements like never before. Equip yourself for the future of trading!

— Dr. Nguyen Minh, Cryptocurrency Analyst and Auditor with over 15 published papers in blockchain technology.