Ordinals vs Runes: A Deep Dive into Bitcoin Protocols

With the explosive growth of the cryptocurrency market in Vietnam, evident from a significant 45% increase in users over the past year, understanding the nuances of Bitcoin protocols is crucial. Two noteworthy concepts emerging in this space are Ordinals and Runes. But what exactly are they, and how do they differ in terms of functionality and application?

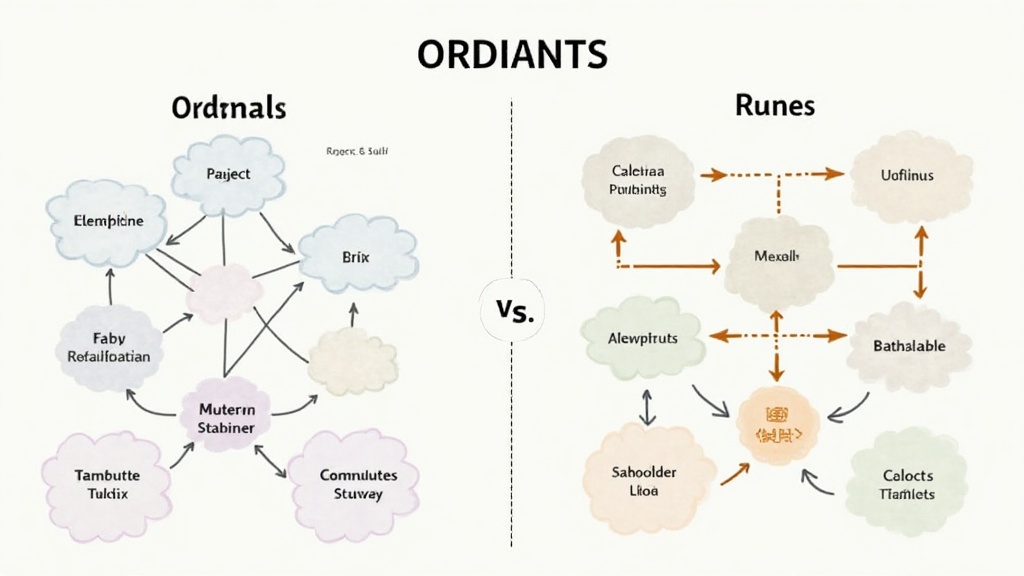

What are Ordinals?

Ordinals are a method used to assign unique identifiers to Bitcoin transactions, allowing users and developers to track their digital assets more effectively. This system creates a framework for individual satoshis (the smallest unit of Bitcoin) to be treated uniquely. In essence, each satoshi can carry data such as ownership history, enhancing its value. Consider it similar to how collectable trading cards can have unique identifiers; each card might hold different values based on its rarity and history.

The Functionality of Runes

Runes, on the other hand, provide a different layer of operability within the Bitcoin network. Designed to simplify the process of executing smart contracts and decentralized applications (dApps), Runes enhance application programmability in Bitcoin. Imagine it as the architecture of a building; while Ordinals give each brick its identity, Runes construct the very framework that holds everything together.

Comparison of Ordinals and Runes

Here’s a quick comparison of the two:

- Purpose: Ordinals are about identity verification, while Runes focus on facilitating application development.

- Data Handling: Ordinals deal with unique data assignments, and Runes handle the execution of complex functions.

- Use Cases: Collectibles and asset tracking for Ordinals, and smart contracts for Runes.

Real-World Applications

In practical terms, the implementation of Ordinals has seen a growing interest from artists and collectors alike. For instance, consider the Bored Ape Yacht Club NFT series; using Ordinals, each NFT can be mapped back to its original satoshi, cementing its authenticity and ownership history. Conversely, Runes have implications in decentralized finance (DeFi) protocols, enabling users to create all kinds of smart contracts seamlessly.

The Future Landscape of Bitcoin Protocols

As Vietnam’s crypto landscape is on the rise, with expectations that over 20 million individuals might be involved by 2025, innovations like Ordinals and Runes will likely pave the way for more robust use cases in the crypto economy. Notably, the integration of these protocols can lead to better security and transparency – aspects that every user prioritizes when engaging in cryptocurrency transactions.

Challenges and Technology Integration

Despite their advantages, both Ordinals and Runes face challenges. Security remains a top concern, especially considering that $4.1 billion lost to DeFi hacks in 2024 highlights the vulnerabilities inherent in the digital asset space. To counter these risks, adopting security standards, like tiêu chuẩn an ninh blockchain (blockchain security standards), becomes vital, ensuring that users can safely explore the benefits of Ordinals and Runes.

Conclusion

As we delve into the world of Ordinals and Runes, it’s important to note that understanding these protocols is vital for anyone interested in Bitcoin’s evolution. They not only reshape how we perceive transactions but also how we engage with digital assets. In a landscape rapidly advancing, with predictions showing potential for even greater user engagement in Vietnam’s market, staying informed on such developments is critical.

Ultimately, incorporating both Ordinals and Runes into your digital asset strategy could offer valuable insights and tools. They stand at the forefront of Bitcoin’s operational enhancements and are essential for navigating the future of decentralized finance.

This article was brought to you by the team at cryptosalaryincubator. Stay ahead in your crypto journey!