Vietnam Crypto Market Indices: The Future of Digital Assets

With over 4.1 billion USD lost to DeFi hacks in 2024, security has become a paramount concern within the crypto space, especially for emerging markets like Vietnam. As the landscape of digital currencies evolves, understanding the trends and metrics surrounding Vietnam crypto market indices becomes crucial for investors and enthusiasts alike.

This article delves into the significance of these indices, their applications, and how they reflect the broader dynamics of the cryptocurrency market in Vietnam. By the end, you will grasp the nuances of navigating this exciting yet volatile domain.

Understanding the Vietnam Crypto Market Indices

The Vietnam crypto market indices serve as a benchmark to evaluate the performance of cryptocurrencies in the region. These indices provide essential insights that can guide investment decisions, risk assessments, and market strategies. The following sections will elucidate the components and importance of these indices.

What Are Crypto Market Indices?

Crypto market indices are statistical measures that track the performance of a selection of cryptocurrencies. They offer a comprehensive overview, serving as a vital tool for investors who seek to make informed decisions.

- Market Accessibility: Cryptocurrencies are known for their volatility; indices help to smooth out this unpredictability.

- Trends and Analytics: They provide analytics that can help investors recognize trends.

- Benchmarking: Investors can use these indices to benchmark their portfolios against the larger market.

The Role of Local Data in Market Indices

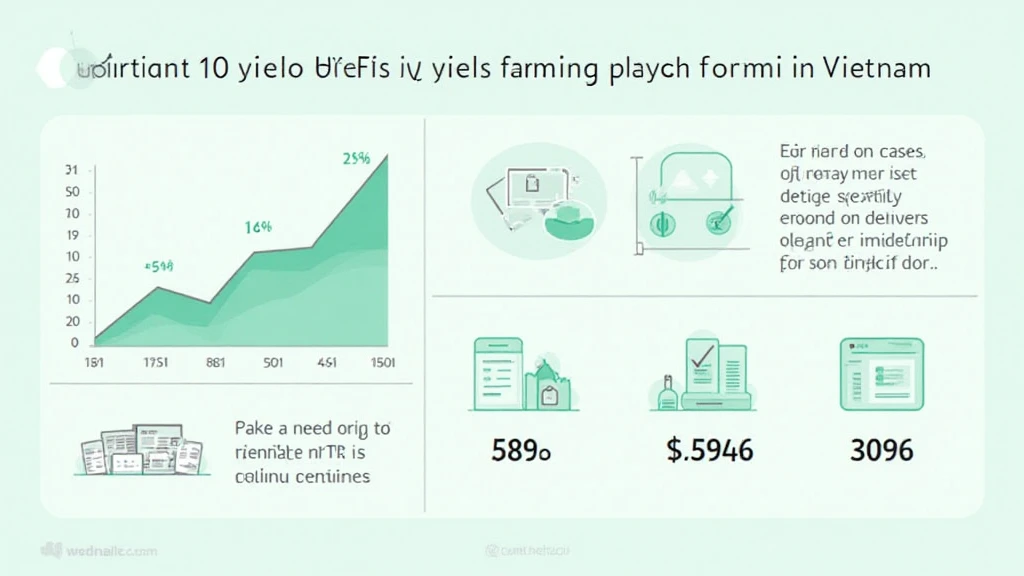

In considering the Vietnamese market, local data plays a pivotal role in developing an accurate index. With a growing number of crypto users in Vietnam, estimated at 45% annual growth in 2024, indices must be reflective of local behaviors and trends.

Statistics that Matter

| Year | Users (millions) | Growth Rate |

| 2022 | 1.5 | – |

| 2023 | 2.2 | 46.67% |

| 2024 | 3.2 | 45.45% |

As shown, the rapid increase in users necessitates reliable indices that can keep pace with this growth.

Types of Crypto Indices in Vietnam

There are various types of indices that can be constructed based on different criteria. Some popular ones include:

Market Capitalization-Based Indices

- These indices rank cryptos based on market capitalization.

- They provide a snapshot of overall market health.

Liquidity Indices

- Focus on the trading volume and liquidity of the cryptocurrencies.

- Essential for assessing investment opportunities.

Volatility Indices

- Track the price fluctuations of cryptocurrencies over time.

- Help investors understand risks involved in trading.

Significant Benefits of Tracking Indices

Monitoring Vietnam’s crypto market indices can provide various advantages for enthusiasts and investors:

Improved Decision-Making

Understanding these indices can lead to more informed investment choices and strategies.

Risk Management

By observing fluctuations in indices, investors can better manage their risk exposure.

Market Education

Indices serve as educational tools for new investors, providing insights into market behavior.

Local Regulatory Environment

It’s essential to note that the regulatory landscape in Vietnam can significantly influence the crypto market indices. With ongoing discussions around tiêu chuẩn an ninh blockchain, compliance with local regulations will undoubtedly shape market behavior and investor confidence.

The Future of Vietnam’s Crypto Market and Indices

The future looks promising for Vietnam’s crypto market, especially with enhanced technology infrastructure and increasing institutional engagement. As we look towards 2025, the indices developed will adapt to these changes, providing more accurate and detailed insights.

Let’s discuss some upcoming trends:

- Tokenization of Assets: This could become a game-changer, making it easier for investors to diversify.

- Increased Institutional Investment: This influx will influence index adjustments.

How to Audit Smart Contracts Effectively

As cryptocurrencies grow, the need for smart contract audits becomes ever more critical. Incorporating proper auditing methods ensures security and instills confidence in investors. Here’s how to approach audits:

- Automated Testing: Utilize tools for preliminary checks.

- Manual Review: Always conduct a thorough manual audit to catch any overlooked issues.

Conclusion

In summary, the Vietnam crypto market indices play a vital role in shaping the future of digital assets. By maximizing your understanding of these indices, you improve your chances of succeeding in this rapidly evolving landscape. As the market continues to grow, staying informed and adaptable will be your best strategy.

For those keen to dive deeper into the world of cryptocurrency, consider visiting cryptosalaryincubator for more insights.

Expert Contributor

Dr. Nguyen Thanh, a renowned blockchain analyst, has published over 15 research papers in the field of cryptocurrency and has led audits for several high-profile projects.