Introduction

With the financial landscape rapidly evolving, central bank digital currencies (CBDCs) have become a focal point of discussion among economists, investors, and policymakers alike. Vietnam, particularly Ho Chi Minh City, is at the forefront with its innovative CBDC bond pilot projects. These initiatives aim to integrate digital currency into mainstream finance, enhancing efficiency and security in transactions. In 2024 alone, the global market for CBDCs is expected to surpass $10 billion, underscoring the urgency for countries like Vietnam to adapt and innovate.

What Are CBDC Bond Pilot Projects?

To understand the significance of Ho Chi Minh City’s CBDC bond initiatives, it’s essential to grasp what these pilot projects entail. CBDCs are digital currencies issued by central banks that represent a digital form of a country’s fiat currency. These digital currencies aim to streamline transactions, improve financial inclusion, and bolster monetary policy implementation.

In the context of Ho Chi Minh City, the CBDC bond pilot projects serve as a testing ground for integrating these digital currencies into the financial system. They are designed to explore how CBDCs can facilitate greater efficiency in bond issuance, trading, and settlement processes. This could lead to significant reductions in transaction costs, time, and risks, akin to a bank vault designed for digital assets.

The Importance of Security in CBDC Projects

Security is paramount when implementing CBDCs. Concerns about hacking and fraud are prevalent, especially in a landscape where $4.1 billion was lost to DeFi hacks in 2024. To mitigate these risks, Ho Chi Minh City’s CBDC bond pilot projects adhere to rigorous tiêu chuẩn an ninh blockchain (blockchain security standards).

- Robust Encryption: High-level encryption methods ensure data integrity and confidentiality.

- Multi-Signature Wallets: These wallets require multiple keys to authorize transactions, reducing the risk of unauthorized access.

- Regular Audits: Frequent security audits and assessments help identify vulnerabilities early.

According to a recent report by hibt.com, more than 70% of financial institutions are enhancing their security protocols to prevent hacks. This trend reflects the urgency that accompanies the launch of CBDC projects globally.

The Impact on Vietnam’s Economy

Vietnam is experiencing a rapid digital transformation, with a growth rate of 35% in the digital economy expected by 2025. The implementation of CBDC bond pilot projects in Ho Chi Minh City is anticipated to catalyze economic growth by:

– Enhancing Financial Inclusion

- Providing access to investment options for unbanked populations.

- Facilitating easier cross-border transactions.

– Boosting Efficiency

- Streamlining bond issuance processes.

- Reducing transaction costs and time.

– Encouraging Innovation

- Fostering an environment for fintech startups and blockchain initiatives.

- Promoting research and development in digital finance.

As a result, these projects not only signal Vietnam’s commitment to embracing technology but also position the country as a leader in the Southeast Asian digital finance landscape.

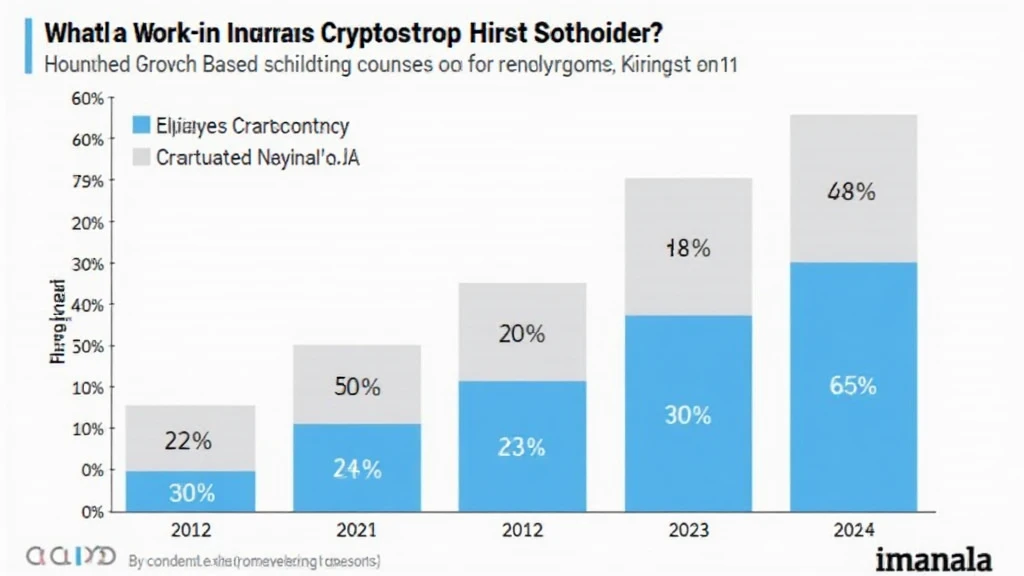

Local Market Dynamics: User Growth in Vietnam

Vietnam’s user growth in the cryptocurrency sector has been remarkable. According to data from recent studies, the number of cryptocurrency users in Vietnam surged to 6.2 million in late 2023, up from 3.5 million in 2021. This rapid increase underscores the growing interest in digital assets and the potential acceptance of CBDCs among the population.

The Vietnamese government’s focus on digital payment systems complements this growth, highlighting the overarching commitment to a cashless economy. Integrating CBDCs and innovative bond structures could further accelerate this transformation.

Benefits and Challenges of Implementing CBDC Bond Projects

While the prospects of CBDC bond pilot initiatives are promising, several challenges remain:

Benefits:

- Increased Transparency: All transactions are recorded on the blockchain, promoting accountability.

- Reduced Counterparty Risk: Smart contracts can automate and enforce agreements without intermediary risk.

Challenges:

- Regulatory Concerns: Clear regulations must be established to govern the use of CBDCs.

- Public Perception: Gaining public trust in digital currencies remains a challenge.

Strategies for overcoming these challenges include conducting public awareness campaigns about CBDCs and establishing strong regulatory frameworks that adapt to technological advancements.

Conclusion: The Future of CBDC Bond Projects in Ho Chi Minh City

The CBDC bond pilot projects in Ho Chi Minh City represent a significant step forward in Vietnam’s financial evolution. By emphasizing security, compliance, and innovation, these initiatives are poised to unleash new opportunities for economic growth. As the landscape continues to change, it is vital for stakeholders to remain adaptable and informed about emerging technologies and regulations. Ultimately, Ho Chi Minh City could very well lead the charge towards a more digital and inclusive financial future, serving as a model for other nations looking to embrace the potential of CBDCs.

As Vietnam moves closer to realizing the full impact of CBDCs, staying informed and engaged with these developments will be crucial for all interested parties. Engaging with platforms like cryptosalaryincubator can provide invaluable insights and updates on the rapidly evolving landscape.

Author: Dr. Nguyen Pham, a leading expert in blockchain technology and digital finance, has published over 30 papers on the subject and has led audits for prominent fintech projects worldwide.