Introduction

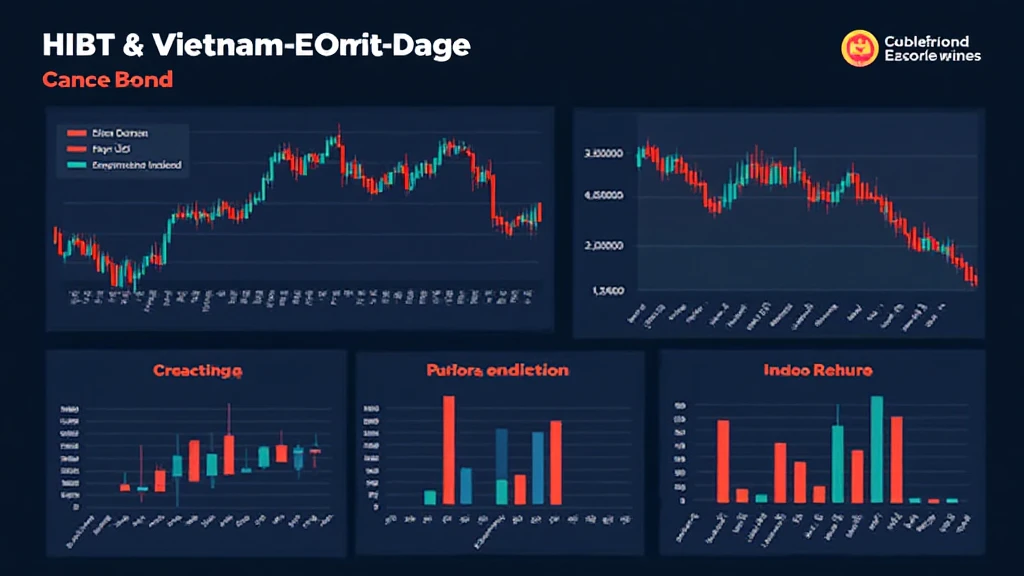

In the rapidly evolving world of cryptocurrency and blockchain technology, the importance of accurate market sentiment analysis cannot be overstated. As of 2023, approximately $6.9 billion has been invested in the Vietnamese crypto market, reflecting its burgeoning potential. However, this expansion comes with significant risks, including a reported loss of $4.1 billion to DeFi hacks in 2024. With this backdrop, the development of tools to gauge market sentiment, such as the HIBT Vietnam bond sentiment bot, offers critical insights for investors navigating the volatile landscape.

This article aims to evaluate the accuracy metrics of the HIBT Vietnam bond sentiment bot, explore its relevance within the cryptosalaryincubator platform, and discuss the implications of these insights on investment strategies in Vietnam’s crypto market.

Understanding Sentiment Analysis

Sentiment analysis, or the process of extracting and measuring attitudes and emotions from text and speech, plays a crucial role in financial markets. Like a weather forecast for investments, it helps investors get a clearer picture of market trends. In Vietnam, where the user growth rate in crypto adoption has spiked by 30% in the last year, effective sentiment analysis is paramount.

- Market Impact: A positive sentiment can indicate potential price rallies, while negative sentiment often predicts downward trends.

- Data Collection: Data sources include social media platforms, news articles, and user forums, which all contribute to a comprehensive sentiment score.

- Relevance to Investors: Understanding how the public perceives specific bonds can assist investors in making informed decisions about their portfolios.

Metrics for Measuring Sentiment Bot Accuracy

The accuracy of a sentiment bot, such as HIBT, can be gauged through various metrics, including:

1. Precision and Recall

Precision measures the number of true positive predictions divided by the total number of positive predictions made by the bot, whereas recall assesses the true positive predictions against the actual number of positive cases.

2. F1 Score

The F1 score is a harmonic mean of precision and recall, giving a balanced view of the bot’s performance across various scenarios.

3. Sentiment Score Distribution

Examining the distribution of sentiment scores for bonds can reveal potential biases in the bot’s algorithms, vital for continuous improvement.

4. EMA (Exponential Moving Average)

By utilizing the EMA of sentiment scores over time, investors can discern trends and shifts in user sentiment.

5. Backtesting Data

Conducting backtests using historical data allows the evaluation of the bot’s predictive power, ensuring it can adapt to changing market dynamics.

The Role of HIBT in Vietnam’s Crypto Landscape

The HIBT Vietnam bond sentiment bot stands as a critical player in determining market trends and influencing investor decisions. By providing real-time sentiment analysis, it enables investors to leverage data in their decision-making processes. The bot’s insights into public perceptions can impact the valuation of bonds tied to cryptocurrencies.

- Effectiveness: The bot’s analysis is underpinned by machine learning algorithms that refine its predictions over time.

- User Engagement: Increasing interaction from the growing population of crypto users in Vietnam emphasizes the need for such tools.

Implications of Bond Sentiment in Investment Strategies

Understanding bond sentiments can significantly influence investment strategies among crypto traders and traditional investors alike. For example, as bond sentiments shift, traders can anticipate price fluctuations and adjust their portfolios accordingly.

- Risk Management: Investors can use sentiment data for better risk management practices, particularly in volatile markets.

- Market Timing: By analyzing sentiment trends, investors can make more informed decisions regarding entry and exit points.

Conclusion

In summary, the HIBT Vietnam bond sentiment bot provides essential accuracy metrics that are invaluable for investors in the crypto sector. By focusing on precision, recall, and F1 score among other metrics, investors can better navigate the complexities of Vietnam’s growing crypto market. As we move toward 2025 and beyond, tools like these will leverage the growth of the crypto community by providing insights that illuminate investment paths.

For detailed insights and updates on market trends, visit cryptosalaryincubator.

Author: Dr. Jonathan Lee, a financial analyst with over 10 published works in cryptocurrency and blockchain strategies, and a lead auditor for prominent projects in the industry.