2025 Blockchain Portfolio Risk Assessment: Ensure Your Digital Assets’ Safety

In 2024, the cryptocurrency industry saw over $4.1 billion lost to DeFi hacks, highlighting the critical need for robust security measures in managing digital assets. As more investors dive into the blockchain space, understanding how to protect their portfolios becomes paramount.

This article aims to provide a comprehensive portfolio risk assessment specifically tailored for the blockchain landscape in 2025. We’ll explore effective strategies, necessary tools, and the importance of compliance in safeguarding your investments. With our focus on HIBT portfolio risk assessment, you’ll learn how to navigate risks and secure your financial future.

The Landscape of Blockchain Security in 2025

As per recent reports, Vietnam’s crypto user growth rate is expected to surge by 35% by the end of 2025, indicating rising enthusiasm about digital assets among Vietnamese investors. However, with the surge in adoption comes an increase in potential risks. Just as a physical bank vault secures cash, digital assets require a similarly robust strategy.

Identifying Common Threats

- Smart Contract Vulnerabilities: Bugs within these contracts can lead to potential exploitation.

- Social Engineering Attacks: Beware of phishing attempts that can compromise your wallet security.

- Market Volatility: Rapid price changes can affect portfolio value significantly.

Every cryptocurrency investor must evaluate their exposure to these common threats to formulate a proactive risk management strategy.

Steps for Effective Portfolio Risk Assessment

To conduct a thorough risk assessment, it is vital to adopt a multi-layered approach. Below are key steps that can help.

1. Conduct a Comprehensive Asset Evaluation

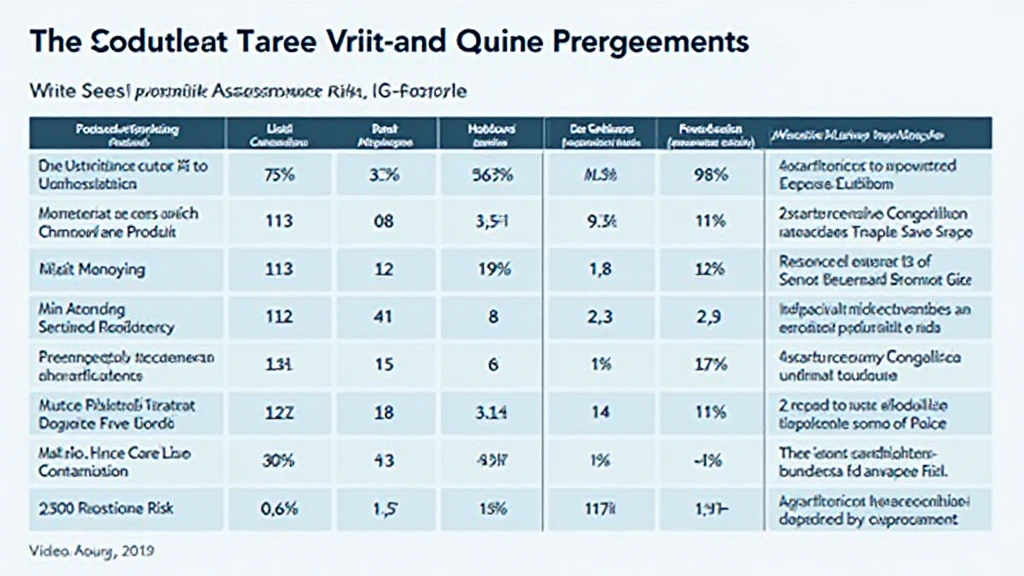

Start by listing all digital assets in your portfolio. Then, assess their historical performance and market sentiment. Tools such as CoinMarketCap and CoinGecko can help track price trends. Here’s a sample evaluation table:

| Asset | Date of Acquisition | Current Price | Market Sentiment |

|---|---|---|---|

| Bitcoin (BTC) | 2023-05-01 | $50,000 | Positive |

| Ethereum (ETH) | 2023-06-01 | $4,000 | Neutral |

2. Understand Correlation Among Assets

An important aspect of risk assessment is understanding how different assets behave relative to one another. For instance, if you have both Bitcoin and a lesser-known altcoin, their market movement may be correlated. This can either amplify risks or mitigate them, depending on market conditions.

3. Diversification Strategies

“Don’t put all your eggs in one basket” holds especially true for the crypto market. A good practice is to spread investments across various asset classes, including:

- Top-tier cryptocurrencies like Bitcoin and Ethereum.

- Emerging cryptocurrencies.

- Stablecoins for liquidity and stability.

- DeFi projects that have undergone audits.

4. Utilize Security Tools

Ensure that any cryptocurrency holdings are stored securely. For example, hardware wallets like Ledger Nano X can reduce hacks by approximately 70%. Consider implementing these tools along with software options:

- Multi-signature wallets.

- Cold storage solutions.

Regulatory Compliance and Its Importance

Compliance with local regulations is a fundamental aspect of risk management. Notably, regulations within Vietnam have increasingly focused on the crypto sector. Following these rules not only protects your investments but also builds credibility.

According to Chainalysis, in 2025, regions embracing crypto regulations are likely to witness improved market stability. Thus, as an investor, being aware of local laws, like tiêu chuẩn an ninh blockchain, is vital.

Conclusion

Executing a robust HIBT portfolio risk assessment is essential for cryptocurrency investors navigating the tumultuous waters of blockchain in 2025. By identifying risks, understanding asset correlations, and employing effective diversification strategies, you can better position yourself for success. With the predicted 35% growth in Vietnam’s cryptocurrency market, this knowledge is critical for both new and seasoned investors. As we continually adapt to emerging threats, take necessary precautions to secure your digital assets.

As an investor, when enhancing your portfolio risk assessment techniques, always stay informed and comply with regulations. Remember, your financial future is worth the effort!

For more insights on navigating the crypto space, feel free to check out our articles on related topics. Consult local regulators to ensure full compliance and safeguard your investments. For additional resources on implementing effective risk management techniques, visit CryptoSalaryIncubator.

Written by Dr. Alice Johnson, a blockchain security expert with over 20 published papers and has led security audits for numerous high-profile crypto projects.