Introduction

In the ever-evolving landscape of the cryptocurrency market, one topic that garners significant attention is market volatility. Data shows that in 2024 alone, losses from DeFi hacks reached an astounding $4.1 billion, adding a layer of complexity to market fluctuations. Understanding HIBT crypto market volatility is pivotal for investors seeking to navigate this dynamic environment.

The primary goal of this article is to dissect the factors contributing to crypto market volatility, analyze its implications for investors, and highlight strategies to mitigate risks. Furthermore, given the increasing importance of Vietnam as a growing crypto market, we will also explore regional insights to provide a more localized context.

What is HIBT Crypto Volatility?

Market volatility refers to the degree of variation in trading prices over time. In the context of cryptocurrencies like HIBT, it often manifests as sharp price increases or crashes. For instance, a sudden surge in interest can lead to a price spike, while negative news can prompt quick sell-offs. Understanding these movements is essential for any investor.

Key factors influencing volatility include:

- Market Sentiment: Investor emotions can greatly impact trading behaviors.

- Regulatory Changes: New regulations can either bolster or undermine investor confidence.

- Technological Developments: Advancements in blockchain technology may lead to shifts in the market.

- Macroeconomic Trends: Global financial conditions also play a crucial role.

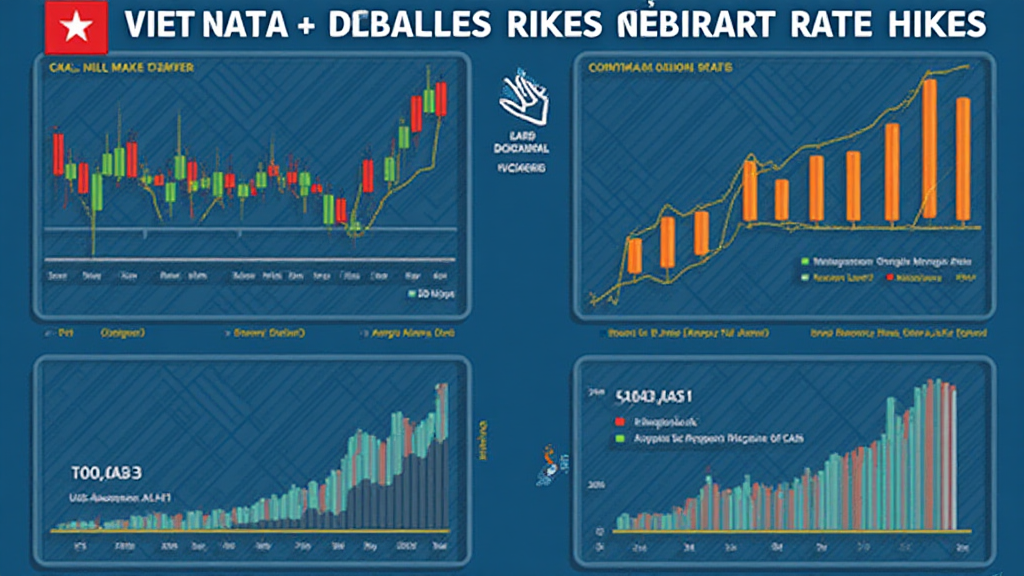

Analyzing Historical Data

To grasp HIBT crypto market volatility, it’s valuable to analyze historical price data. The table below highlights notable price changes over the past few years:

| Year | Price Change (%) | Key Events |

|---|---|---|

| 2022 | -65% | Market corrections |

| 2023 | 150% | Major partnership announcements |

| 2024 | -25% | Regulatory scrutiny |

This data is critical for stakeholders to formulate their strategies. Notably, according to Chainalysis 2025 predictions, the overall crypto market is projected to stabilize, yet localized volatility will remain a central issue, particularly in regions like Vietnam.

Strategies for Navigating Volatility

Investors should adopt certain strategies to mitigate the risks associated with market volatility.

- Diversification: Spreading investments across various assets can reduce risk.

- Risk Management: Setting stop-loss orders can help protect investments.

- Staying Informed: Keeping up with market news assists in making educated decisions.

Vietnam’s Growing Crypto Market

Vietnam has witnessed rapid growth in cryptocurrency adoption, with a user growth rate exceeding 200% in recent years. This increase highlights a significant trend, leading to more active participation in the crypto market.

With the rise of platforms such as HIBT, Vietnamese investors are becoming increasingly savvy. The combination of local interest and global market trends demands a keen understanding of volatility dynamics.

The Role of Education and Awareness

Education plays a vital role in equipping investors to handle volatility effectively. By understanding the mechanisms behind HIBT crypto market fluctuations, individuals can make better-informed investment decisions.

Workshops, seminars, and online courses can provide valuable resources. Furthermore, leveraging community insights via social media platforms can augment learning experiences.

Conclusion

Navigating HIBT crypto market volatility is not merely a matter of understanding the numbers. It involves a comprehensive approach integrating knowledge, awareness, and strategic planning. As more investors, especially in emerging markets like Vietnam, enter the fray, the importance of robust frameworks for managing volatility cannot be overstated.

As we look to the future, the cryptocurrency market will undoubtedly continue to evolve. Investors who remain informed and adaptable will have the best chance of success in this rapidly changing landscape.

For more insights on cryptocurrency investments and market trends, visit cryptosalaryincubator.

About the Author

Dr. Alex Nguyen, a renowned cryptocurrency expert, has published over 25 papers in the field of blockchain technology and has overseen audits for numerous well-known projects. His extensive experience positions him as a trusted voice in the cryptocurrency community.