Cryptocurrency Bond Smart Contracts in Vietnam: A New Era of Digital Investments

As the world rapidly embraces digital finance, Vietnam is positioning itself as a promising market for cryptocurrency bonds and smart contracts. With more than 70% of Vietnamese users investing in cryptocurrencies by 2023, the potential for innovation in this sector is immense.

Understanding Cryptocurrency Bonds

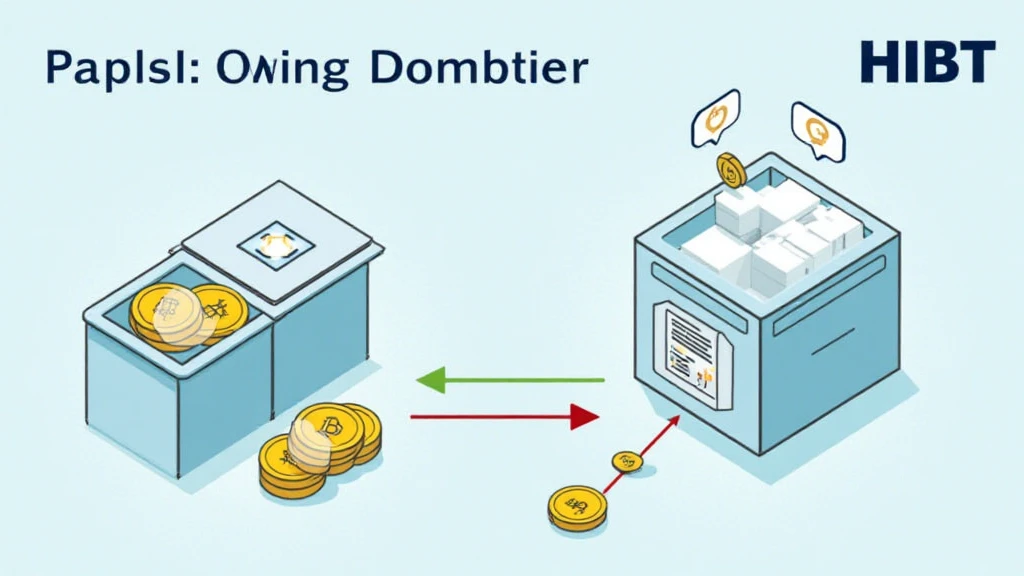

Cryptocurrency bonds provide a unique opportunity for investors, allowing them to gain exposure to digital assets while enjoying fixed returns (similar to traditional bonds). According to recent statistics, Vietnam’s cryptocurrency market has reached a valuation of $4.4 billion. Here’s how cryptocurrency bonds work:

- Digital Issuance: Cryptocurrency bonds are issued on a blockchain, ensuring transparency and security.

- Tokenization: Each bond can be represented by digital tokens, making them easier to trade.

- Smart Contracts: These contracts automatically execute terms and conditions, reducing the need for intermediaries.

The Role of Smart Contracts in Cryptocurrency Bonds

Smart contracts act as self-executing agreements that facilitate, verify, or enforce contract negotiations or performance. This technology has revolutionized the way bonds operate, particularly in developing markets like Vietnam.

Let’s visualize this: Think of smart contracts as a reliable employee who manages your investments, ensuring that payments are made on time without delays.

Key Features of Smart Contracts

- Trust and Security: Smart contracts eliminate fraud and unauthorized tampering.

- Cost Efficiency: By automating processes, they reduce transaction costs.

- Speed: Transactions are executed almost instantly, improving liquidity.

Growth of Cryptocurrency Bonds in Vietnam

Vietnam has witnessed a significant rise in cryptocurrency adoption. According to Hibt.com, the user growth rate for cryptocurrency trading platforms in Vietnam was 55% in 2023.

This growth amplifies the interest in innovative financial instruments such as cryptocurrency bonds. Popular sentiments in the market indicate:

- Increased awareness of blockchain technology.

- A growing number of investment campaigns targeting younger Vietnamese.

- A demand for diversified investment avenues to hedge against inflation.

Challenges of Implementing Cryptocurrency Bonds in Vietnam

Despite the promising landscape, there are several challenges that need to be addressed:

- Regulatory Framework: The Vietnamese government is still establishing regulations around cryptocurrencies.

- Market Volatility: Cryptocurrency prices can fluctuate wildly, impacting bond valuations.

- Security Concerns: While blockchain is secure, the exchanges themselves can be vulnerable to attacks.

Case Study: Successful Implementation of Smart Contracts

Let’s take an illustrative case: Imagine a local startup that issued cryptocurrency bonds to fund community-driven projects. By using smart contracts, they could:

- Automatically distribute profits back to bondholders.

- Ensure all agreements were honored without the need for manual intervention.

- Provide real-time updates to investors, enhancing transparency.

Future Prospects: Vietnam in 2025 and Beyond

Looking ahead, it is expected that:

- By 2025, cryptocurrency bonds may become commonplace: As adoption increases, standards such as “tiêu chuẩn an ninh blockchain” can help bolster security.

- Regulatory clarity will foster innovation: Proper legal frameworks will encourage more businesses to explore cryptocurrency financing.

- Integration with traditional finance: Banks and financial institutions may form collaborations with blockchain projects.

How to Audit Smart Contracts for Security

Understanding how to audit smart contracts is crucial to maintain trust among investors. Here’s a basic breakdown of auditing smart contracts:

- Check for vulnerabilities – Similar to cybersecurity checks done for traditional systems.

- Run tests against the contract code – This helps to ensure there are no bugs.

- Verify compliance with industry standards.

Conclusion

In summary, as Vietnam continues to embrace the digital trends in finance with cryptocurrency bonds and smart contracts, it paves the way for innovation and growth. By addressing the challenges and focusing on security—through practices such as blockchain security standards—, the Vietnamese market can greatly benefit from these advancements.

This digital finance evolution is something to watch! At cryptosalaryincubator, we encourage all stakeholders to seize opportunities in the burgeoning landscape of cryptocurrency investment.

Author: Dr. Thanh Nguyen, Blockchain Technology Expert and Financial Analyst, with over 20 published papers in the field and the lead auditor of several high-profile projects.