Crypto Trading Automation in Vietnam: A Game Changer for Investors

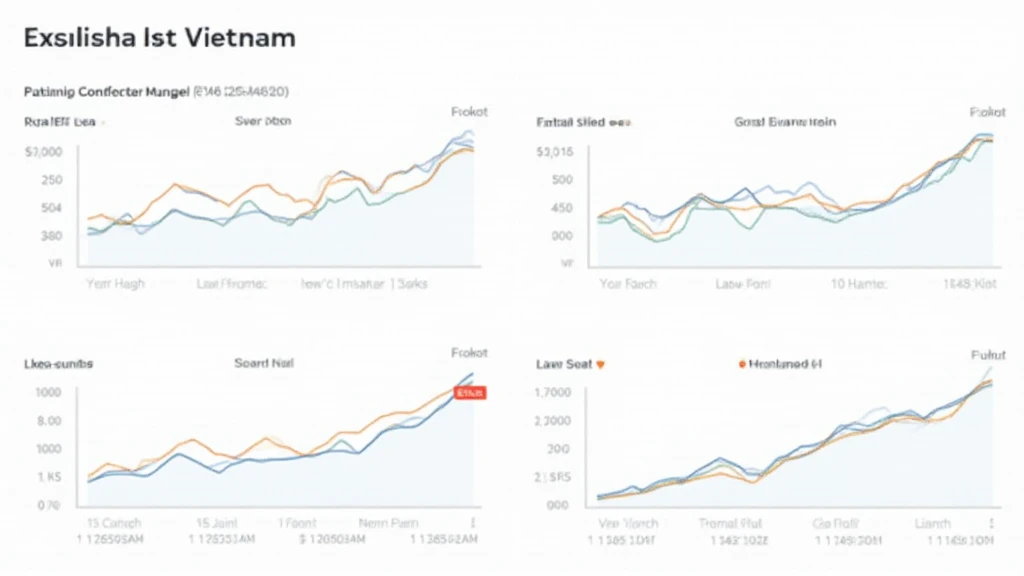

As cryptocurrency continues to gain traction around the globe, Vietnam stands out with a surge in digital asset adoption. According to recent statistics, Vietnam ranks among the top 10 countries in crypto usage, with over 7% of the population actively trading cryptocurrencies. This increase in involvement indicates an urgent need for reliable systems, such as crypto trading automation, to streamline trading processes.

But what exactly is crypto trading automation, and why is it becoming a cornerstone of successful trading strategies in Vietnam? This comprehensive guide explores the importance of automated trading systems, how they can enhance the trading experience, and key features to consider for implementation.

Understanding Crypto Trading Automation

Crypto trading automation refers to the use of software platforms to execute trades on behalf of a trader based on predefined conditions. Just like setting an alarm for a wake-up call, automated systems can monitor market changes and execute trades without the need for constant human intervention. Some of these systems employ algorithms that can react to market fluctuations, enabling traders to seize opportunities that may otherwise be missed.

Benefits of Automated Trading Systems

- Speed and Efficiency: Automated systems execute trades in milliseconds, reacting faster than any human could.

- Emotionless Trading: By removing the emotional aspect of trading, automation helps maintain a disciplined approach.

- 24/7 Market Access: Automation allows for uninterrupted trading, crucial in the volatile crypto market.

- Backtesting Capabilities: Traders can evaluate their strategies against historical data before risking substantial funds.

The State of Crypto Trading in Vietnam

In recent years, Vietnam has experienced an astounding 300% growth in cryptocurrency trading volumes. Many local investors, both seasoned and novices, are turning to crypto as a viable asset class. However, this rapid growth is met with challenges like volatility and regulatory uncertainties.

A significant portion of the Vietnamese population is under 30 years old, fueling a tech-savvy demographic eager to explore digital finance avenues, including decentralized finance (DeFi). Although the crypto landscape is still maturing, tools for crypto trading automation are establishing themselves as reliable partners in navigating these turbulent waters.

How Automated Trading Works

Automated trading relies on algorithms and key indicators to make decisions. Traders can optimize their strategies based on how they want to trade—whether it’s trend following or offsetting losses. Here’s a breakdown of the core components:

- Algorithms: Scripts that dictate trading actions based on historical data analysis.

- Market Indicators: Data inputs such as price fluctuations, volume, and market depth that inform trade decisions.

- Risk Management: Strategies like stop-loss orders to minimize potential losses.

Implementing Crypto Trading Automation in Vietnam

To set up a successful automated trading system, it’s imperative to choose a reputable platform. Here’s a simple guide to help:

- Choose the Right Platform: Evaluate platforms based on user interface, ease of use, and integration with local exchanges.

- Set Clear Goals: Identify specific trading objectives—what do you want to achieve? How much risk can you tolerate?

- Test and Customize: Use backtesting features to refine strategies according to your trading style.

- Monitor Performance: Regularly check the automated system’s performance to ensure it aligns with changing market dynamics.

Regulatory Considerations in Vietnam

As the Vietnamese government continues to evaluate cryptocurrency policies, understanding compliance is paramount for traders. It is important to stay informed about local regulations that manage crypto trading and ensure that automation practices align with these laws. Not adhering to regulations can lead to significant penalties.

Additionally, as the Vietnamese market expands, it’s crucial for traders to remain vigilant and proactive in adapting to regulatory changes. Platforms like hibt.com provide updates on regulatory developments and how they impact crypto trading.

Future Trends: What Lies Ahead for Crypto Trading Automation in Vietnam

Looking towards the future, trends indicate a significant shift in how trading occurs. With increasing adoption of smart contracts and decentralized applications, automated trading systems will likely evolve into more sophisticated tools capable of executing trades across multiple platforms seamlessly.

To understand the potential of industries leveraging blockchain technology, investors may want to consider