Vietnam Crypto Tax Planning: Essential Strategies for 2025

With the rapid rise of cryptocurrency investments and over 5 million crypto users in Vietnam as of 2024, navigating the complexities of Vietnam crypto tax planning has never been more critical. In 2025, as the Vietnamese government looks to regulate the crypto market more extensively, understanding the tax implications is paramount for investors and businesses alike. This article will dive into essential strategies, challenges, and future outlooks for crypto tax planning in Vietnam.

Understanding the Crypto Tax Landscape in Vietnam

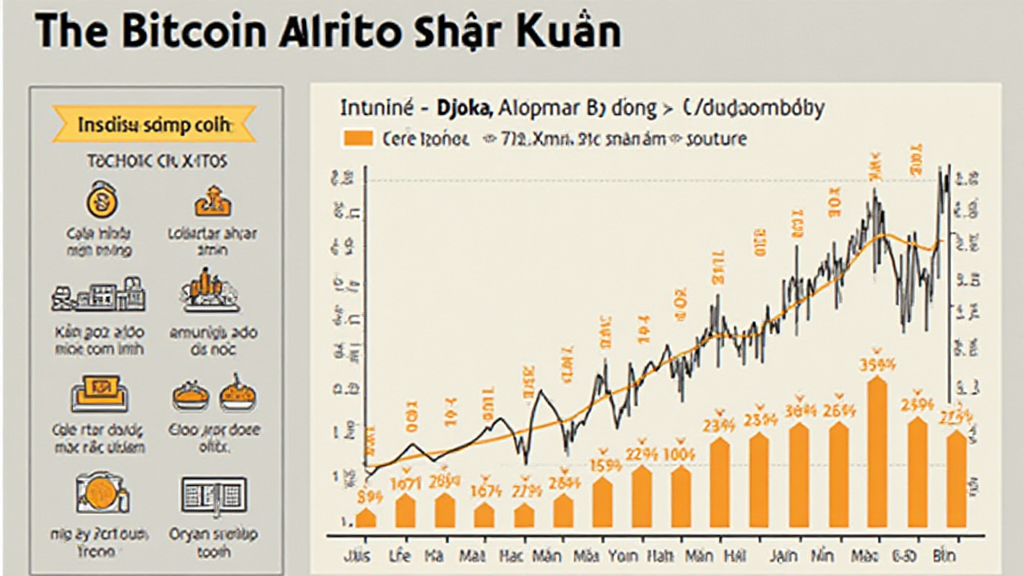

The Vietnamese government has recently taken steps to establish clearer regulations surrounding cryptocurrencies. As of early 2024, Vietnam is witnessing a surge in crypto adoption, with a user growth rate of 300% year-over-year. The absence of a comprehensive tax framework, however, leaves many wondering about their obligations and rights.

Current Regulatory Framework

Vietnam’s current stance on crypto taxation is evolving. While virtual assets are not officially recognized as currencies, they are subject to personal income tax (PIT) and value-added tax (VAT) under certain conditions. Investors must consider:

- Profits from trading or transacting are usually taxable.

- Cryptocurrency mining activities may also incur tax liabilities.

- Exchanges may have different tax obligations based on their operating structures.

Capital Gains Tax and Reporting Requirements

When it comes to trading digital currencies like Bitcoin or Ethereum, any profit made is often considered capital gains. In Vietnam, the tax rate could be as high as 20% for these gains. Hence, sufficient records of all transactions should be maintained. Here’s what you need to keep track of:

- Date of acquisition and sale.

- Amount and type of cryptocurrencies exchanged.

- Market values at the time of transactions.

Strategies for Tax Optimization

Efficiently planning your tax obligations can lead to significant savings. Here are strategies tailored for Vietnam crypto tax planning:

Utilizing Tax Deductions

Many crypto transactions may qualify for deductions. This includes:

- Transaction fees paid to exchanges.

- Losses incurred during trades can offset gains.

Timing the Sale of Assets

Another effective strategy is to be mindful of when you sell your assets. Holding period implications can affect the capital gains tax rate significantly. If investors hold for longer than one year, they might find favorable tax outcomes.

Challenges in Compliance

Despite the advantages, several challenges exist in adhering to tax obligations:

Intangible Nature of Cryptocurrencies

The decentralized nature of cryptocurrencies makes tracking transactions challenging. Unlike traditional assets, crypto does not have a central authority to provide transaction histories. This highlights the importance of reliable accounting tools and software.

Lack of Guidance from Tax Authorities

Many investors report confusion regarding interpretations of tax laws. As regulations continue to evolve, seeking professional advice becomes crucial to avoid penalties.

Future Outlook: What to Expect in 2025

Looking forward, it’s essential to stay informed about potential regulatory changes. According to a report from the Vietnam Ministry of Finance, guidelines for digital asset taxation are expected to be finalized by the end of 2025. Key trends to watch include:

- Increased clarity and structure around tax obligations.

- Potential introduction of incentives for compliant crypto businesses.

To stay ahead, consider maintaining continuous education about the market and its regulatory environment.

Conclusion

As cryptocurrency continues to rise in popularity in Vietnam, the need for effective Vietnam crypto tax planning strategies is more important than ever. By understanding the existing landscape, optimizing tax strategies, and staying informed on future regulations, investors can navigate the complexities with skill.

For those looking for assistance and resources in this field, cryptosalaryincubator offers tools and guidance to help you manage your crypto assets efficiently and remain compliant with local regulations.

Author: Dr. Nguyễn Văn An, a specialist in blockchain law with over 10 published articles in the field and a leader in auditing several prominent projects in Vietnam.