Vietnamese Startup Crypto Funding: Navigating the Future

Introduction

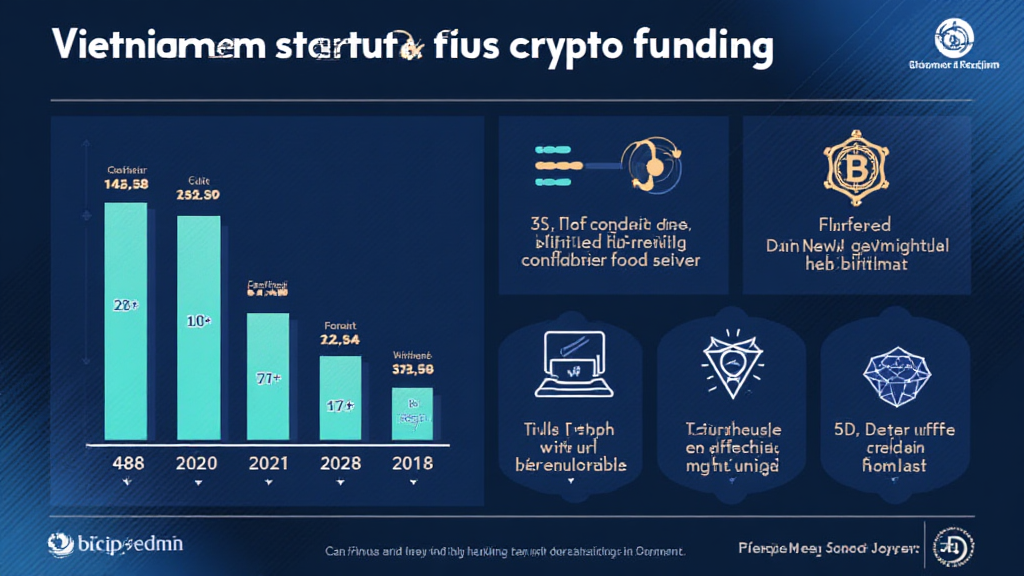

With recent reports showing that the global blockchain industry is projected to grow at a compound annual growth rate (CAGR) of 82.4%, it is no surprise that Vietnam has emerged as a significant player in the crypto funding space. As of 2023, over 2.4 million Vietnamese people are actively involved in cryptocurrency transactions, marking a staggering 500% increase in just two years. The question on everyone’s mind is: how can startups in Vietnam tap into this growing market? In this article, we will explore funding opportunities specifically tailored to Vietnamese startups focusing on crypto innovations.

The Landscape of Crypto Funding in Vietnam

Vietnam’s rapidly evolving crypto ecosystem presents both challenges and opportunities for startups. With local success stories like Sky Mavis, the creator of Axie Infinity, gaining international acclaim, the Vietnamese startup scene is becoming an attractive destination for investors. The government’s stance on cryptocurrency and blockchain technology has also witnessed a shift; regulatory clarity is slowly coming into play, which bodes well for future funding.

The Role of Government Regulation

- The first regulations for cryptocurrencies were proposed in mid-2022.

- According to a recent policy analysis, clearer frameworks are expected by the end of 2023.

- This regulatory development is crucial for enhancing investor confidence.

Types of Funding Available

There are several funding avenues available for Vietnamese crypto startups:

- Venture Capital: There is an increasing interest from global and local venture capital firms keen on funding innovative blockchain projects.

- Initial Coin Offerings (ICOs): Startups can launch ICOs to raise funds directly from the market.

- Grants and Competitions: Various local and international contests, such as the Vietnam Blockchain Hackathon, are aimed at identifying promising projects.

Focus on Blockchain Security Standards

With the rapid growth of the Vietnamese crypto market, ensuring compliance with tiêu chuẩn an ninh blockchain (blockchain security standards) is crucial for startups looking to attract funding. This includes adhering to best practices in blockchain technology and demonstrating a commitment to security.

As highlighted by recent reports, approximately 60% of startups fail due to security breaches and lack of regulatory compliance. Implementing robust security frameworks can mitigate these risks significantly.

How to Audit Smart Contracts

One of the key practices for ensuring security in blockchain projects is smart contract auditing.

- Engage Third-party Auditors: Collaborating with reputable firms can provide insightful evaluations of your code.

- Automated Tools: Utilizing platforms that automatically test your contracts can save both time and resources.

Consumer Trends Impacting Crypto Adoption

Understanding the factors driving crypto adoption in Vietnam can help startups channel their funding strategies effectively. The surge in demand for decentralized finance (DeFi) services is a notable trend.

- Increased Financial Literacy: As more Vietnamese become aware of blockchain technology, the appetite for related products is likely to grow.

- Mobile Usage: With over 80% of the population on smartphones, mobile-friendly crypto solutions are gaining traction.

The Future Outlook for Vietnamese Startups

What lies ahead for the startup ecosystem in Vietnam is an exciting mix of opportunities and potential challenges. Local entrepreneurs must stay adaptable and responsive to both tech advancements and regulatory changes.

- Expect enhanced collaboration between government, academia, and startups to further legitimize the sector.

- Monitoring international trends in crypto adoption can inspire innovative solutions in Vietnam.

Conclusion

As we have explored throughout this article, the landscape of Vietnamese startup crypto funding is rich with potential. With the right combination of regulatory compliance, technological innovation, and understanding of market demand, Vietnamese startups can position themselves for success in the growing crypto market. As the market matures, investors will be looking for projects that not only show promise but are also committed to best practices in blockchain development.

To summarize, navigating the future of startup funding in the Vietnamese crypto landscape requires a deep understanding of both local and global market trends. By focusing on security standards and harnessing consumer interest, startups can secure the funding they need to thrive.

Cryptosalaryincubator is dedicated to supporting Vietnamese startups in their journey toward securing funding and achieving lasting success.