Introduction to Crypto Insurance in Vietnam

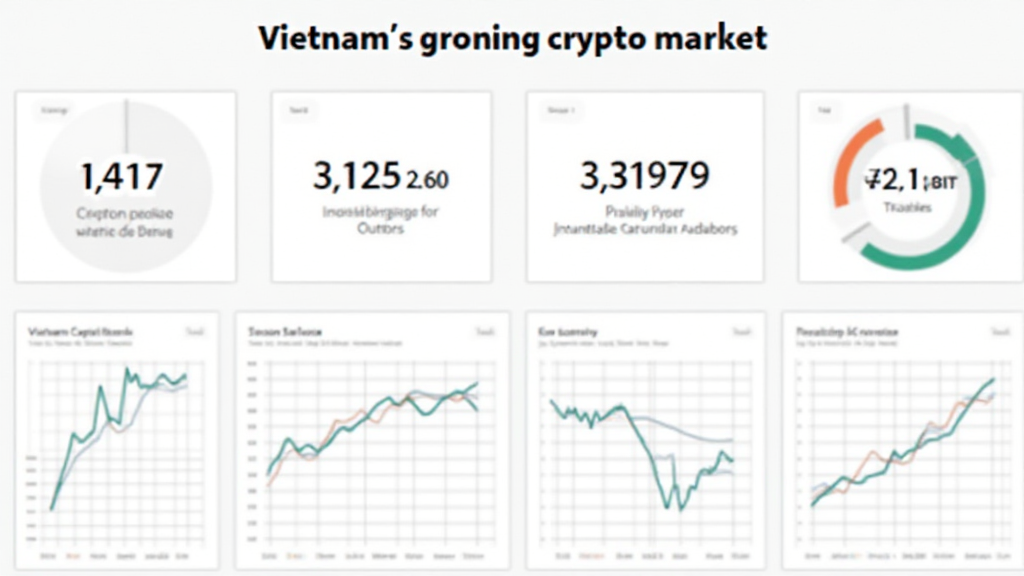

According to recent statistics, the cryptocurrency market in Vietnam has witnessed exponential growth, with an increase of 200% in user adoption year-over-year. However, this rapid expansion brings significant risks; in 2024 alone, $4.1 billion was lost to DeFi hacks globally. As a result, understanding Vietnam crypto insurance becomes crucial for investors to safeguard their digital assets.

The Importance of Crypto Insurance

Like a bank vault for traditional assets, crypto insurance serves as a safety net for digital investments. This insurance can cover various risks, including hacks, fraud, and smart contract vulnerabilities. In a country where over 1.6 million people are actively trading cryptocurrencies, the need for robust insurance solutions is more pressing than ever.

Understanding Blockchain Security Standards (tiêu chuẩn an ninh blockchain)

The foundation of crypto insurance lies in understanding the security standards associated with blockchain technology. These standards are essential for protecting assets against potential vulnerabilities:

- Consensus Mechanism Vulnerabilities: Different blockchains utilize various consensus mechanisms, each with its potential weaknesses.

- Smart Contract Weaknesses: Audit practices such as how to audit smart contracts play a critical role in identifying vulnerabilities before they can be exploited.

Varieties of Crypto Insurance Products

In Vietnam, several emerging products offer diverse coverage options tailored to individual investor needs. Each type provides varying degrees of protection:

- Custodial Insurance: Coverage for assets held in custodial wallets against breaches or theft.

- Non-Custodial Insurance: Protects individual wallets against unauthorized access and hacks.

Localized Solutions in Vietnam

Vietnam’s unique crypto landscape calls for localized insurance solutions. With the country witnessing accelerated user growth of 35% in 2024, insurance firms are responding by developing tailored products that resonate with local investors.

Choosing the Right Insurance Provider

When selecting an insurance provider, consider the following factors to ensure a reliable and trustworthy experience:

- Company Reputation: Look for providers with a solid track record in both the crypto and traditional insurance markets.

- Policy Coverage: Assess the comprehensiveness of coverage options available for different asset types.

- Claim Process: Research the provider’s claim handling process to gauge efficiency and customer satisfaction.

Leveraging Technology in Crypto Insurance

As the digital landscape evolves, so does the technology used in crypto insurance. Solutions like AI-driven risk assessment are becoming instrumental in identifying potential threats:

- Advanced algorithms can analyze past transactions to predict future vulnerabilities.

- Blockchain technology ensures transparency in policy management and claim processes.

Investing in Focused Educational Initiatives

Educating investors about risks and insurance options is fundamental. Organizing workshops, webinars, and community meetups can empower users by:

- Enhancing understanding of the crypto insurance landscape.

- Encouraging best practices in digital asset management.

The Regulatory Environment in Vietnam

Vietnam’s regulatory landscape plays a pivotal role in shaping the crypto insurance market. Investors should keep abreast of government policies regarding digital currencies to ensure compliance. Key regulatory highlights include:

- Ongoing discussions on legal frameworks surrounding cryptocurrencies.

- Efforts to enhance investor protection and risk management practices.

Final Thoughts on Vietnam Crypto Insurance

In an increasingly digital world, safeguarding your assets through Vietnam crypto insurance is not just prudent; it’s essential for peace of mind. As the cryptocurrency market continues to mature, staying informed about your options and understanding the landscape will empower you to make sound investment decisions.

With specialists like cryptosalaryincubator, you can access valuable resources and insights that are vital for navigating the complexities of crypto investments. Remember, investing in crypto insurance is an investment in your future security.