Understanding HIBT Exchange Leverage Trading Policies: A Essential Guide

As of 2024, over $4.1 billion has been lost to DeFi hacks, highlighting the urgent need for secure trading practices in cryptocurrency platforms. In this guide, we will delve into the leverage trading policies of HIBT Exchange, which have become increasingly vital due to the surging interest in the crypto market.

What is Leverage Trading?

Leverage trading allows traders to borrow funds to amplify their trading positions. For instance, on HIBT Exchange, a trader can use leverage of up to 100x, which means that with just $1,000, they can control a position worth $100,000. However, this comes with significant risks.

The Dangers of High Leverage

- High Risk of Liquidation: Using leverage boosts potential profits but also increases the risk of substantial losses.

- Market Volatility: Large market swings can quickly lead to liquidation, even on small movements.

- Emotional Trading: The potential for large gains can lead traders to make impulsive and emotional decisions.

For traders in Vietnam, where the growing crypto user base has reached about 5 million, understanding these risks is crucial. With more users entering the market, trading policies regarding leverage become even more significant.

HIBT Exchange’s Leverage Trading Policies

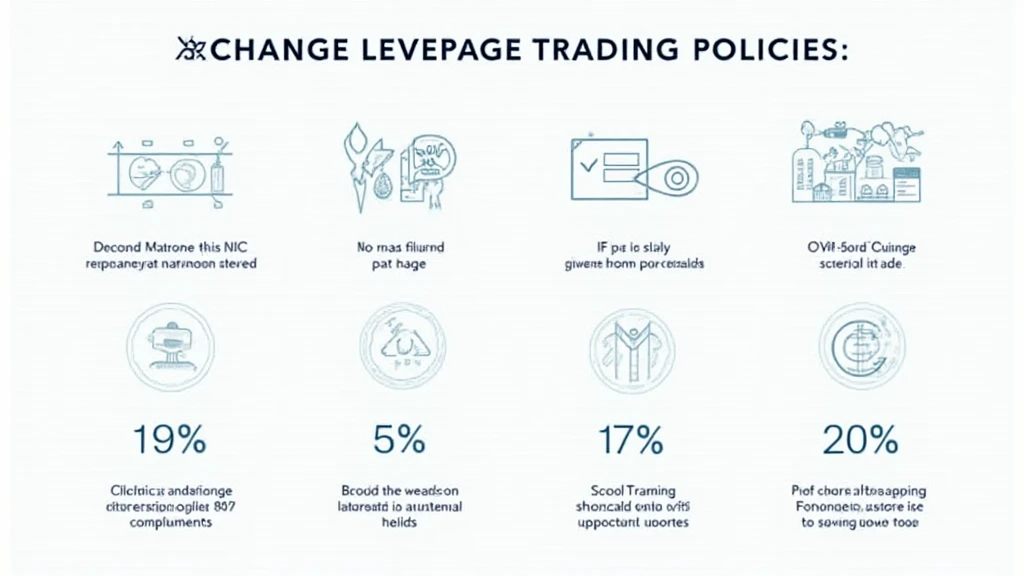

HIBT Exchange has implemented several key policies regarding leverage trading:

- Maximum Leverage: Traders can utilize a maximum leverage of 100x, suitable for experienced traders only.

- Risk Management Tools: The platform provides tools like stop-loss orders to help manage risk effectively.

- Margin Requirements: HIBT sets specific margin requirements to ensure that traders must maintain a certain balance to keep their positions open.

- Education Resources: Users are encouraged to access educational content to fully understand the implications of leveraging trades.

Key Points on HIBT’s Policies

Here’s the catch: policies are designed to safeguard traders while allowing them to maximize their potential returns. However, understanding the mechanics is necessary before engaging in leverage trading.

Real-Life Example of Leverage Trading

Let’s break it down: Imagine a trader on HIBT wants to invest in Bitcoin. By using 10x leverage, they could put $10,000 of their own funds down, controlling a $100,000 position in Bitcoin. If the price rises by 10%, they earn $10,000 – doubling their initial investment. However, should the price fall by 10%, they would lose the entire original investment.

Vietnam’s Growing Market: A Potential Goldmine

Vietnam’s crypto market is thriving, with a projected growth rate of 22% through 2025. This growth presents both opportunities and challenges for traders, especially regarding leverage trading.

| Year | User Growth Rate |

|---|---|

| 2022 | 8% |

| 2023 | 15% |

| 2024 | 22% |

Best Practices for Leverage Trading on HIBT

To leverage trading successfully, consider these best practices:

- Start Small: Begin with lower leverage until you’re comfortable with the mechanics of the market.

- Use Tools Wisely: Make full use of stop-loss orders and take-profit settings to safeguard your capital.

- Stay Informed: Keep up with market trends and external factors affecting cryptocurrency to make sound decisions.

Educational Resources on HIBT

HIBT Exchange also offers a variety of resources to help users navigate the complexities of leverage trading. This includes webinars, tutorials, and articles aimed at enhancing trading knowledge.

Conclusion

In conclusion, understanding the leverage trading policies on HIBT Exchange is essential for anyone involved in crypto trading. With the platform’s maximum leverage offerings and risk management tools, traders must remain cautious and informed to navigate the volatile market effectively. Always remember, trading with leverage can lead to substantial gains but also significant losses.

For further details and resources, visit HIBT Exchange to explore more about leverage trading policies.

By making informed decisions and utilizing the educational opportunities available, you can maximize your trading potential safely.

Author: John Smith, a seasoned blockchain analyst and author of over 30 papers in the field, has been instrumental in auditing prominent projects in the crypto sector.