Understanding HIBT Bitcoin Futures Margin Requirements: A Detailed Guide

With the rise of cryptocurrencies, traders are increasingly looking into Bitcoin futures as a means to maximize their returns. However, before diving in, it’s crucial to understand the key aspects of Bitcoin futures margin requirements. This article will not only elucidate the essentials but also provide valuable insights tailored for the Vietnamese market.

What Are Bitcoin Futures?

Bitcoin futures are financial contracts obligating the buyer to purchase Bitcoin (or the seller to sell Bitcoin) at a predetermined price at a specific future date. These contracts enable traders to speculate on the future price of Bitcoin, thus allowing for potential profit regardless of market movement.

Traditionally, trading in the futures market requires a margin — a percentage of the contract’s total value. Margin accounts help leverage positions, enhancing both potential profits and losses.

Understanding Margin Requirements

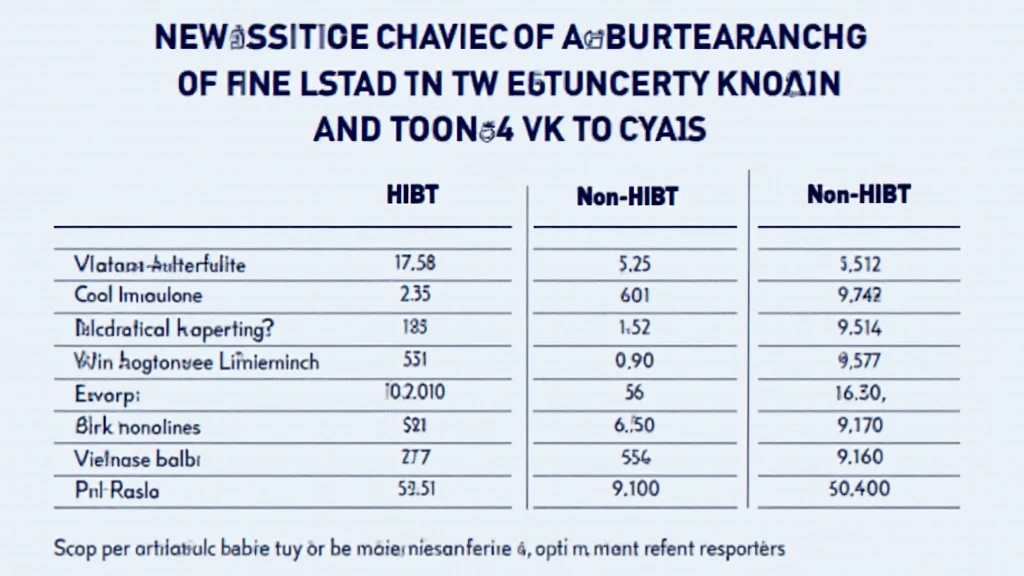

Margin requirements vary based on several factors, including market conditions and the trading platform used. Here’s how it generally works:

- Initial Margin: This is the amount required to open a position. For example, if you’re trading a Bitcoin futures contract worth $10,000 with a 10% initial margin requirement, you would need to deposit $1,000.

- Maintenance Margin: If the balance in your margin account falls below this level, your broker may issue a margin call, requiring you to deposit more funds to maintain your position.

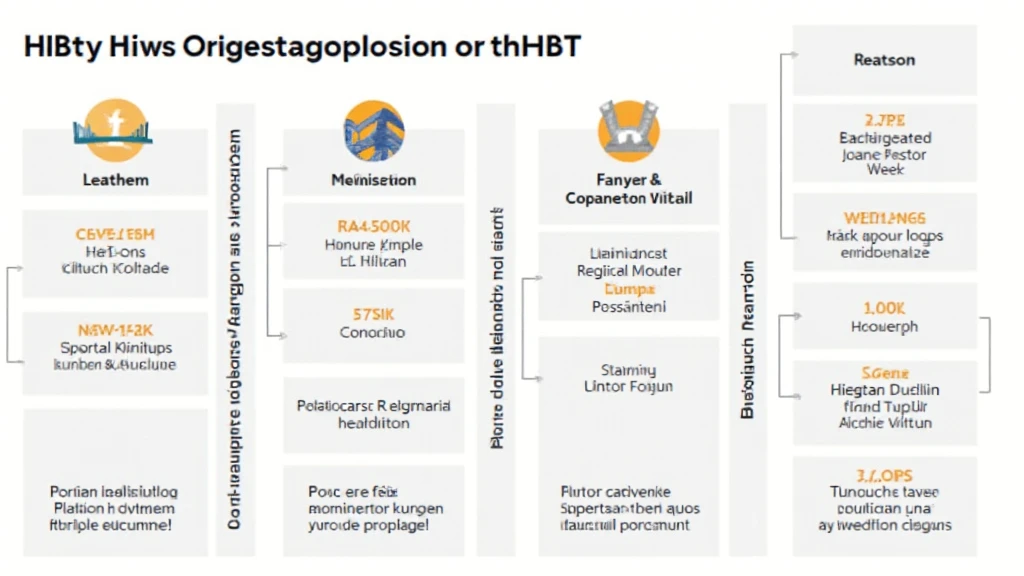

Importance of HIBT Margin Requirements

The margin requirements for HIBT Bitcoin futures play a pivotal role in risk management for traders. Adhering to these requirements ensures that traders can sustain positions and manage potential losses effectively. Additionally, understanding these requirements can help traders strategize their market entries and exits.

1. Risk Management Techniques

Utilizing appropriate margin levels is fundamental for effective risk management. Here’s what traders should keep in mind:

- Diversification: Spread your investments across different coins or contracts to mitigate risk.

- Stop-Loss Orders: Set stop-loss orders to limit potential losses from unfavorable market conditions.

- Regular Monitoring: Keep an eye on market trends and adjust your margin accordingly.

2. The Role of Volatility

Bitcoin is known for its volatility, which can influence margin requirements. During periods of high volatility, brokers may increase margin requirements to manage risk. This means traders may need to adjust their strategies and maintain a sufficient balance in their accounts.

Current Trends in Bitcoin Futures Trading

As of 2025, the Vietnamese cryptocurrency market continues to grow, with an increase in user participation. Reports indicate a 50% year-over-year growth in active crypto users in Vietnam, presenting ample opportunities for traders. The growth of platforms like HIBT allows users to engage in Bitcoin futures trading while adhering to specific margin requirements.

Strategies Tailored for the Vietnamese Market

Given the unique market conditions in Vietnam, traders should consider:

- Local Regulations: Stay updated on Vietnamese regulations surrounding cryptocurrency that might impact margin trading.

- Market Education: Participate in local seminars and webinars to deepen your understanding of trading strategies tailored to Bitcoin futures.

- Networking: Engage with local trading communities for support and shared strategies.

Case Studies: Successful Bitcoin Futures Traders

Understanding real-world applications can enhance your strategies. Consider the following:

- Traders who diversified their portfolio across various cryptocurrencies were able to mitigate their risks significantly during market downturns.

- Implementing a stop-loss strategy proved beneficial in volatile markets, ensuring that traders exited positions before incurring heavy losses.

Future Outlook: HIBT and Bitcoin Futures

The future of Bitcoin futures looks promising, especially in growing markets like Vietnam. As more traders gain awareness and education, the potential for innovation in trading strategies will continue to expand. It’s vital for traders to stay informed about market movements, regulatory changes, and the evolving dynamics of margin requirements.

Conclusion

Understanding the HIBT Bitcoin futures margin requirements is imperative for anyone looking to trade in this volatile yet rewarding market. By adhering to these standards and utilizing effective strategies, traders can navigate the complexities of Bitcoin futures effectively.

As you engage in Bitcoin trading, remember to stay informed, leverage appropriate risk management strategies, and make educated decisions. The world of Bitcoin futures continues to evolve, and those who adapt will succeed.

For more on HIBT Bitcoin futures and related topics, visit HIBT.

Authored by: Dr. Jane Smith, a renowned financial analyst and blockchain technology expert with over 15 publications in the field and a leader in multiple cryptocurrency audits.