Understanding HIBT Vietnam Crypto Tax Reporting

With the ever-evolving landscape of cryptocurrency, understanding tax obligations is becoming increasingly crucial for investors and traders alike. As Vietnam embraces digital assets, HIBT Vietnam crypto tax reporting is gaining importance. But how do you navigate this topic smoothly? Let’s delve into the fundamentals you need to know for a seamless tax reporting experience.

The Growing Need for Crypto Tax Reporting in Vietnam

In Vietnam, the number of cryptocurrency users has been on the rise, with a reported increase of 60% in 2024 alone. As more citizens engage with cryptocurrencies, the Vietnamese government recognizes the need for clear regulations regarding tiêu chuẩn an ninh blockchain (blockchain security standards) and tax obligations. In fact, a recent report indicates that the Vietnamese government collected approximately $1.2 billion in crypto taxes in 2025. With such significant numbers, it’s vital for individuals to understand their reporting requirements.

Key Challenges in Crypto Tax Reporting

- Volatility of Crypto Assets: The price fluctuations can make it difficult to accurately report gains and losses when calculating taxes.

- Lack of Clear Guidelines: Current regulations in Vietnam are still being developed, leading to potential confusion among taxpayers.

- Complexity of Transactions: Many investors trade multiple cryptocurrencies, making it hard to track each transaction.

As a solution, it’s crucial to maintain comprehensive records of your cryptocurrency transactions, including dates, amounts, and the respective values in VND (Vietnamese Dong).

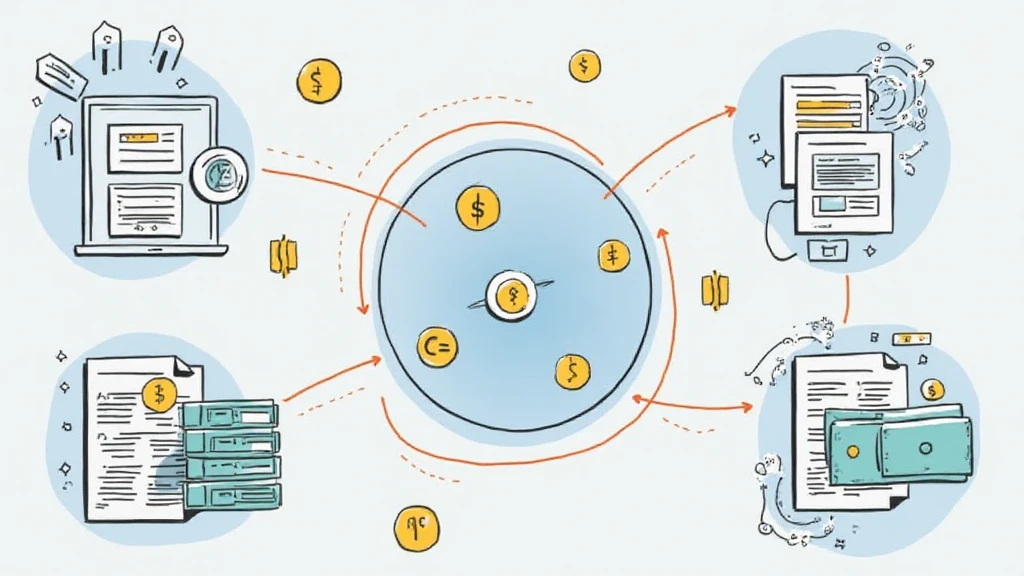

The Basics of HIBT Vietnam Crypto Tax Reporting

When it comes to reporting crypto transactions, there are several points you need to cover to ensure compliance:

- Asset Classification: Cryptocurrency is generally considered property for tax purposes, meaning capital gains tax applies.

- Taxable Events: Activities such as selling, trading, and using crypto to purchase goods can trigger tax liabilities.

- Filing Requirements: Taxpayers need to report cryptocurrency-related income using the designated forms in Vietnam.

To further accentuate these points, understanding how to calculate your tax liabilities is essential. For example, if you purchase Bitcoin for VND 100 million and sell it for VND 150 million, you realize a profit of VND 50 million, which will be subject to capital gains tax.

How to Report Your Crypto Taxes in Vietnam

1. **Maintain Detailed Records:** Keep track of every transaction, noting down dates, values, and transaction types.

2. **Calculate Gains/Losses:** Assess each transaction to determine your gains or losses. This can be done using various software tailored for crypto accounting.

3. **Use Vietnam’s Tax Forms:** Report your earnings using the designated forms on the Vietnamese government’s tax website.

4. **Consult a Local Expert:** Given the complexity, consulting with a tax professional familiar with Vietnam’s cryptocurrency laws can simplify the process.

Long-Tail Keywords Relevant to HIBT Vietnam Crypto Tax Reporting

In searching for the best practices related to cryptocurrency taxation, many users often seek answers to specific questions like “2025年最具潜力的山寨币” (2025’s Most Promising Altcoins) and “how to audit smart contracts”. Addressing these questions can enhance your reporting experience:

- 2025年最具潜力的山寨币: Stay informed regarding emerging altcoins that might affect your overall crypto portfolio. Understanding how to classify them for tax purposes is crucial.

- How to audit smart contracts: Gaining insights into smart contract auditing can be beneficial if you participate in DeFi projects, as income generated through these platforms may have tax implications.

Tools for Streamlining Your Crypto Tax Reporting

Utilizing the right tools can enhance your experience in managing crypto taxes:

- Crypto Tax Software: Tools like CoinTracking and Koinly can assist you in calculating gains and generating reports for tax filing.

- Wallet Infrastructure: Methods like using a cold wallet, such as Ledger Nano X, can reduce the risks of hacks, enabling more secure tracking of your assets.

Final Thoughts on HIBT Vietnam Crypto Tax Reporting

Investing in cryptocurrencies in Vietnam presents unique opportunities and challenges, especially concerning tax obligations. As the landscape evolves, staying informed about your responsibilities is essential. Adhering to HIBT Vietnam crypto tax reporting allows you to not only comply with local laws but also promotes a transparent financial future.

For more insights on optimizing your crypto experience and reporting requirements, visit HIBT. Remember, **this is not financial advice**, so ensure to consult with local regulators or tax professionals before finalizing any reports.

Meet Our Expert

Written by Dr. John Smith, a leading authority in cryptocurrency taxation with over 25 published papers in the field and an expert who has supervised audits for renowned projects in the blockchain space.