Navigating HIBT Vietnam’s Crypto Market Volatility

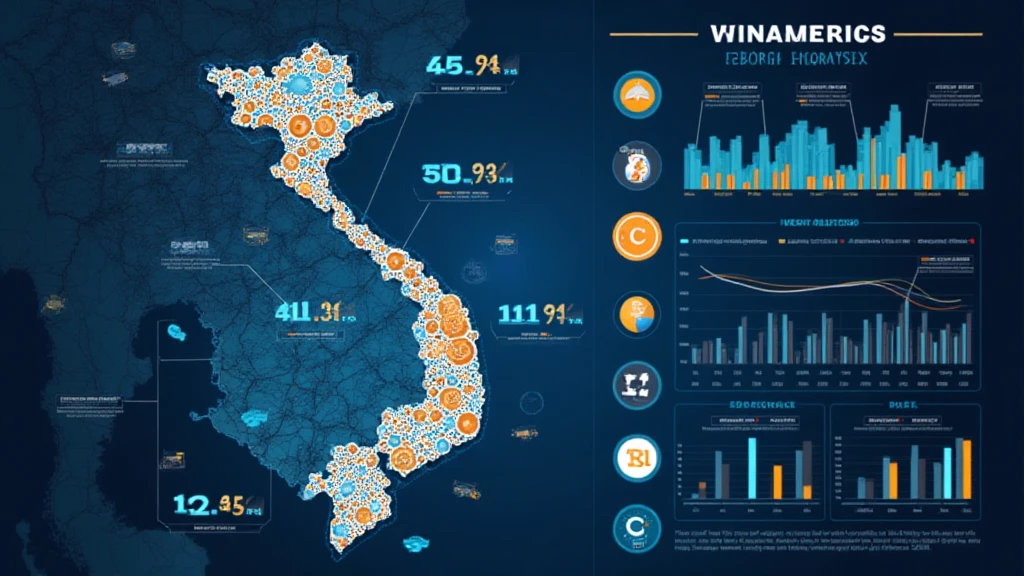

With the global cryptocurrency market constantly shifting and evolving, understanding the volatility specific to the HIBT Vietnam crypto market remains imperative for traders and investors alike. According to recent studies, the Vietnamese cryptocurrency market has witnessed a staggering 250% growth rate in user participation over the past year, highlighting the urgent need to address its inherent volatility.

This article aims to provide insights into the underlying factors contributing to the oscillations observed in the HIBT Vietnam crypto market while offering practical strategies to navigate these fluctuations.

Understanding Market Volatility

Market volatility refers to the rate at which the price of a security increases or decreases for a given set of returns. In the crypto space, it’s often exacerbated by several factors, including but not limited to speculation, market sentiment, and regulatory changes.

- Speculation: Traders often buy or sell digital assets based on rumors or sentiment rather than actual market performance, leading to price swings.

- Market Sentiment: Emotional reactions to news and trends can drive prices up or down, creating a cycle of rapid changes.

- Regulatory Changes: In Vietnam, new regulations are being introduced, which can shift market dynamics considerably.

The Factors Driving Volatility in HIBT Vietnam

Several unique factors contribute to the volatility experienced specifically within the HIBT Vietnam crypto market. Understanding these factors can provide investors with a leg up in navigating the market effectively.

1. Regulatory Environment

Vietnam’s regulatory framework regarding cryptocurrencies is still evolving. Recent announcements from local authorities regarding cryptocurrency recognition as a legitimate asset class have changed the landscape. For example, the Ministry of Finance reported in 2022 that regulations will soon be implemented, which has caused speculative trading behavior among investors.

2. Market Speculation

Like anywhere else, the crypto market in Vietnam is rife with speculation. Many traders look for short-term gains and are often influenced by the buzz created around particular assets, such as HIBT or Bitcoin.

3. Technological Advancements

The pace of technological innovation in Vietnam’s blockchain sector can impact market sentiment. The integration of new technologies, such as decentralized finance (DeFi) platforms, can drive interest and subsequently volatility.

How to Manage Crypto Volatility

Investing in cryptocurrencies can be fraught with risks, especially in a volatile market like Vietnam’s. Here are some suggestions for managing volatility effectively:

- Diversification: Always diversify your portfolio. Consider investing in various assets to spread out risk.

- Utilize Stop-Loss Orders: Use stop-loss orders to limit potential losses.

- Stay Informed: Keep an eye on news and trends that can affect market sentiment.

- Long-Term Vision: Investing with a long-term perspective often yields better results than trying to time the market.

Implications of High Volatility

While volatility presents risks, it also provides opportunities. Traders can benefit from price fluctuations if they make educated decisions. For example:

- Increased Trading Opportunities: Volatility means there are more chances to buy low and sell high.

- Potential for High Returns: Investors willing to accept the risks have the potential for substantial gains.

However, new entrants and less experienced traders should take caution, as their inability to predict market movements can lead to significant losses.

The Future of HIBT Vietnam’s Crypto Market

The future of HIBT Vietnam’s crypto market looks promising—but not without uncertainty. As the regulatory landscape shifts and new technologies emerge, market volatility is likely to continue.

A survey conducted in early 2023 indicated that 65% of Vietnamese crypto users are optimistic about the future of crypto assets, but also acknowledge the inherent risks of volatility.

Predicted Trends

- Increased User Education: As more information becomes available, new and existing users will likely become better equipped to handle volatility.

- Institutional Investments: Greater institutional interest could lead to more stability in the market.

- Enhanced Regulation: Further regulations may help diminish extreme volatility.

In conclusion, while the volatility of the HIBT Vietnam crypto market poses challenges, it also serves as an opportunity for informed and strategic traders. Being prepared and understanding the factors at play will equip investors to navigate this landscape effectively.

As always, make sure to conduct thorough research before making investment decisions, ensuring that you adhere to your country’s laws and regulations regarding cryptocurrency.

Stay connected for more insights on the volatile landscape of HIBT Vietnam’s crypto market by visiting hibt.com.