How to Calculate Crypto Property ROI: A Comprehensive Guide

With $4.1B lost to DeFi hacks in 2024, understanding how to calculate crypto property ROI is essential for safeguarding your investments in the volatile cryptocurrency market. Many investors struggle with this, unaware of the methodologies and tools available to assess their returns on investment properly. This comprehensive guide aims to provide you with vital information and insights on calculating ROI in cryptocurrencies while optimizing your overall investment strategy.

Understanding Crypto Property ROI

Return on Investment (ROI) is a key metric that indicates the profitability of your investments. In the context of crypto assets, calculating ROI involves analyzing the relationship between your initial investment and the current market value. Despite its seeming simplicity, several factors can complicate the calculation.

- Market Volatility: Cryptocurrency markets experience ups and downs, resulting in price fluctuations that can greatly affect your ROI perspective.

- Transaction Fees: When calculating ROI, it’s essential to account for the fees incurred during buying, selling, or transferring your crypto assets.

- Holding Period: The longer you hold onto cryptocurrencies, the more apparent the growth possibilities, but it also increases market risk.

Basic ROI Calculation Formula

The most straightforward method to calculate ROI is through the following formula:

ROI = (Current Value of Investment – Cost of Investment) / Cost of Investment × 100%

For example, if you bought Bitcoin at $10,000 and now it’s worth $15,000, your calculation would look like this:

ROI = (15,000 – 10,000) / 10,000 × 100% = 50%

Impacts of Local Market Trends

In Vietnam, the crypto market has shown significant growth, with a user increase rate of over 200%. Understanding these regional trends is crucial. For instance, local demand can drastically change the ROI landscape for cryptocurrencies. To localize your investments and maximize returns, align with market demands and consider local regulations, such as tiêu chuẩn an ninh blockchain, which ensure a secure trading environment.

Long-Term vs. Short-Term ROI

Investors often approach ROI with different time horizons in mind. Analyzing whether you’re in for the long term or short term can shape your strategy:

- Short-Term Investments: These often speculate on immediate price swings, ideal for day traders.

- Long-Term Investments: A more stable approach focusing on sustained growth, usually less affected by day-to-day fluctuations.

Tools to Help You Calculate Crypto Property ROI

Several tools and platforms can facilitate your understanding and calculation of ROI in crypto investments. Here’s a selection of some popular options:

- CoinMarketCap: Offers comprehensive market data and allows tracking historical prices.

- Crypto Pro: An app for real-time portfolio tracking and ROI calculations.

- BlockFi: Offers tools to analyze earned interest, enhancing your overall ROI.

Real-World Examples

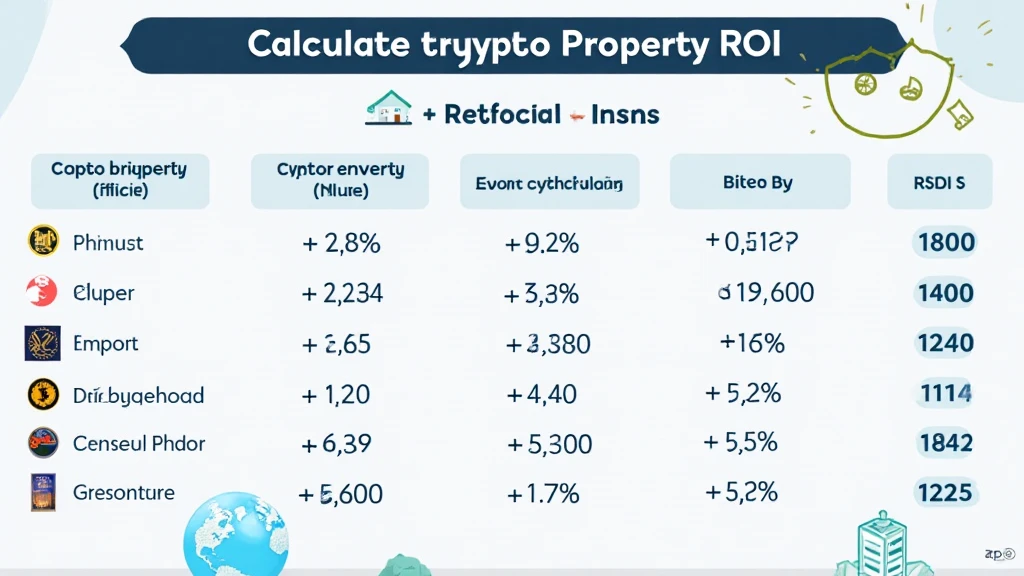

Let’s take a look at some real-world scenarios that demonstrate the calculation of crypto property ROI:

| Asset | Initial Investment | Current Value | ROI (%) |

|---|---|---|---|

| Bitcoin | $5,000 | $25,000 | (25,000 – 5,000) / 5,000 * 100 = 400% |

| Ethereum | $1,000 | $3,000 | (3,000 – 1,000) / 1,000 * 100 = 200% |

Mitigating Risks in ROI Calculation

It’s imperative to factor in risks when calculating your ROI. Crypto investments can be volatile, and external events (e.g., regulatory changes) can affect asset prices. To mitigate risks, consider strategies like diversification, common in traditional investment worlds:

- Don’t Put All Your Eggs in One Basket: Spread your investments across various cryptocurrencies.

- Use Stop-Loss Orders: Set parameters to protect yourself from significant losses.

Conclusion

Calculating your crypto property ROI is a crucial part of any successful investment strategy in the rapidly changing landscape of cryptocurrency. By understanding market dynamics, accounting for transaction costs, and employing reliable tools, you can confidently assess the potential profitability of your investments. As you navigate this journey, remember that keeping an eye on local trends like tiêu chuẩn an ninh blockchain in Vietnam can provide significant insights.

Ultimately, as with any investment, knowledge is power. Leveraging the right tools and metrics will keep you on the path towards a healthy ROI. Explore more on crypto asset management at cryptosalaryincubator.

Author: John Smith – A financial consultant with over 20 industry publications focusing on blockchain technology and cryptocurrency investments.