Navigating HIBT Vietnam Crypto Investment Portfolios: A Strategic Guide

As we dive deeper into the world of cryptocurrencies, particularly in the vibrant landscape of Vietnam, the importance of smart and tailored crypto investment portfolios cannot be overstated. With a reported loss of $4.1 billion due to DeFi hacks in 2024, it’s essential to adopt robust strategies to protect assets and maximize opportunities in this volatile market.

This article offers valuable insights into HIBT Vietnam crypto investment portfolios, exploring the key elements that define successful investment strategies within Vietnam’s burgeoning digital asset ecosystem.

Understanding the Growth of Crypto in Vietnam

Vietnam has emerged as a significant player in the global crypto market. Recent statistics show a staggering user growth rate of 40% year-on-year, with nearly 4 million active cryptocurrency users in 2024. The appeal of blockchain technology and its applications in diverse industries has fueled this trend, paving the way for innovative investment opportunities.

Key Factors Contributing to This Growth:

- Government Regulations: Local regulations, such as the new tiêu chuẩn an ninh blockchain, are creating a more secure investment environment.

- Community Engagement: The rise of local blockchain communities has facilitated education and awareness, attracting more investors.

- Access to Technology: Increased smartphone penetration and availability of internet services have made cryptocurrency trading more accessible.

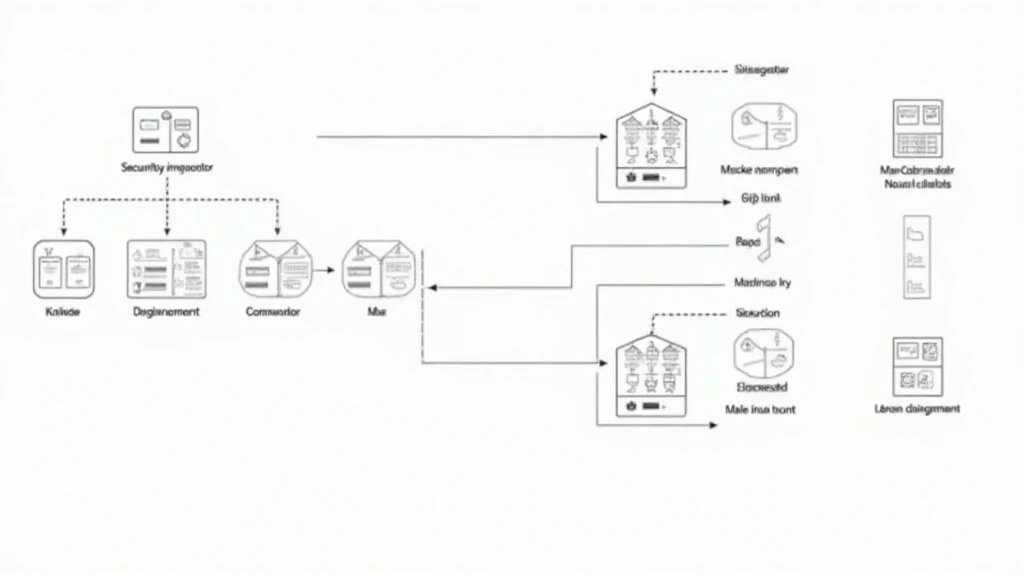

Strategic Elements of HIBT Vietnam Crypto Investment Portfolios

Building a successful crypto investment portfolio hinges on several critical strategies. Here’s a breakdown of the most effective approaches to optimizing HIBT Vietnam crypto investments:

Diversification is Key

Just like spreading investments in stocks across various sectors minimizes risk, diversifying your crypto holdings across established coins like Bitcoin and Ethereum, alongside promising altcoins, can protect your investment against market volatility. For example, in 2025, 2025年最具潜力的山寨币 are set to dominate discussions as investors look for the next big opportunity.

Conducting Thorough Research

Before diving into an investment, it’s vital to research potential assets thoroughly. This includes understanding their use cases, underlying technology, and development teams. Resources such as hibt.com can provide insights into market trends and analytical data to help inform your decisions.

Risk Management Strategies

Implementing robust risk management strategies is crucial in the face of potential losses. Utilizing tools like stop-loss orders, regularly reviewing portfolio performance, and understanding market dynamics can help minimize risk exposure significantly.

Innovative Investment Strategies for HIBT Portfolios in Vietnam

With the landscape constantly evolving, innovative investment strategies are emerging to enhance portfolio performance:

Staking and Yield Farming

Many cryptocurrencies offer staking options, allowing investors to earn passive income through their holdings. Additionally, yield farming can provide high returns, but involves a greater degree of risk. Engaging with these services can optimize the potential of HIBT Vietnam crypto investment portfolios.

Participating in Initial Coin Offerings (ICOs)

Investors looking to capitalize early on promising projects might consider participating in ICOs. This strategy can yield significant returns if the project succeeds. However, it’s vital to conduct due diligence to identify viable projects.

Assessing the Current Market Landscape

As of early 2025, the crypto market is experiencing fluctuations. According to Chainalysis, the total market capitalization for cryptocurrencies has reached $1.5 trillion. However, investor sentiment remains positive, with projections indicating a recovery and growth for the year.

Market Trends to Watch:

- Increased Institutional Investment: More institutions are entering the crypto market, leading to further maturity and stability.

- Technological Advances: Innovations in blockchain technology, like Ethereum 2.0, are paving the way for improved transaction speeds and lower costs.

- Regulatory Developments: Keeping track of local regulations, which continue to evolve, is essential for maintaining compliance.

Conclusion

Successfully navigating the landscape of HIBT Vietnam crypto investment portfolios requires a combination of strategy, vigilance, and adaptability. By embracing diversification, conducting thorough research, and staying informed about market trends, investors can position themselves advantageously in this dynamic environment.

As you explore various investment opportunities, always remember to prioritize security and adhere to local regulations. The insights provided in this guide should empower you to make informed decisions and drive your investment success in Vietnam’s flourishing crypto market.

For more resources and guidance, visit cryptosalaryincubator.

Author: Dr. Lien Nguyen – A leading expert in blockchain innovation and investment strategies, with over 20 published papers in the field and a reputation for conducting thorough project audits for renowned firms.