Introduction: Understanding the Landscape of Crypto Investments

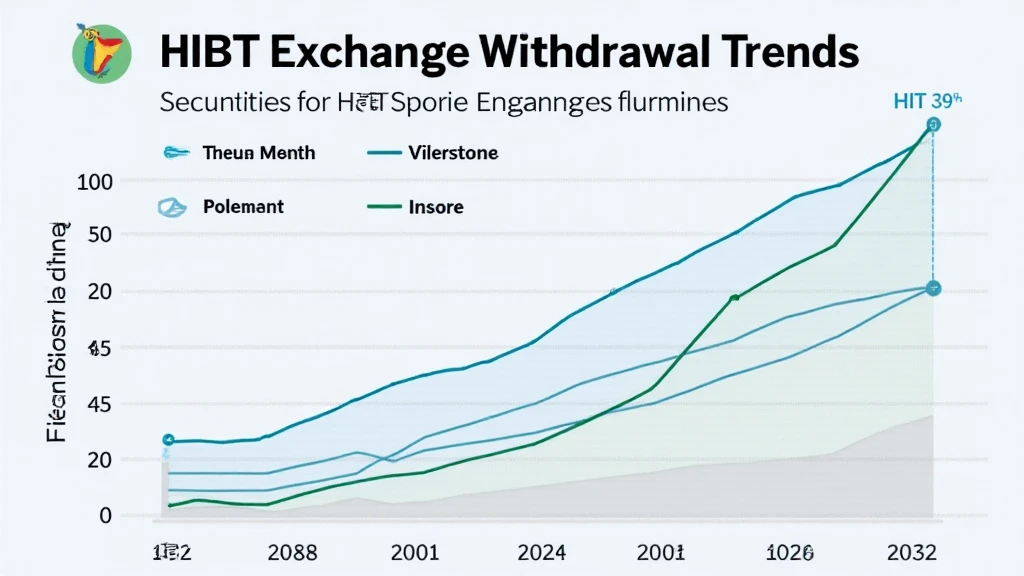

In 2024, the global cryptocurrency market faced a staggering loss of $4.1 billion due to DeFi hacks and vulnerabilities. With such alarming statistics, it’s clear that prudent investment in digital assets is an urgent concern for many. The rise of hibt user advisory is drawing attention for helping investors navigate these turbulent waters. Knowing the safest jurisdictions for crypto investments can significantly affect the risk involved.

This guide aims to delve into safe crypto jurisdiction investment strategies using hibt news and insights drawn from real-world data. We will uncover valuable strategies to ensure that your investments are secure and legitimate while also incorporating essential information relevant to the Vietnamese market.

Hibt User Advisory: Your Trusted Guide

The hibt user advisory serves a crucial role by providing insights into the best and safest jurisdictions for crypto investments. It not only emphasizes safe investment practices but also explores the legal frameworks surrounding cryptocurrency. Here’s why you should consider their advisory:

- Expertise: The team comprises seasoned advisors who understand crypto laws globally.

- Data-Driven Decisions: They utilize robust data analysis to recommend jurisdictions.

- Real-Time Updates: Constant updates help investors stay informed about changes.

Top Safe Crypto Jurisdictions for Investment

According to a report by Chainalysis in 2025, several jurisdictions have emerged as safe havens for crypto investments:

- Switzerland: Known for its favorable legislative environment and robust financial services.

- Singapore: Offers a balanced approach to regulation while promoting innovation.

- Estonia: Streamlined processes for business registration and compliance.

- Malta: Recognized for its transparent regulatory framework.

Why Jurisdiction Matters

Choosing the right jurisdiction can mean the difference between secure investments and potential losses. Cryptocurrencies operate in a complex regulatory environment that varies significantly from one region to another. Just like a secure bank vault protects your money, a reliable jurisdiction safeguards your digital assets. Below we outline critical attributes to consider:

- Regulatory Clarity: Clear laws regarding crypto handling.

- Tax Incentives: Favorable tax treatments for investors.

- Compliance Support: Assistance for businesses navigating legal complexities.

Investing with Hibt News: Staying Updated

The cryptocurrency landscape is ever-evolving, requiring investors to stay updated on news and updates that could affect their investments. Hibt news offers timely updates and reports on:

- New regulatory changes in different jurisdictions.

- Market sentiment analysis that could impact prices.

- Security threats and hacks that could affect investment safety.

Popular Crypto Coins in Emerging Markets

Emerging markets, especially in Southeast Asia, are witnessing a surge in crypto adoption. Vietnam, for instance, has seen a 45% annual growth in digital currency users in 2024. This growth highlights the potential for strong investment opportunities in the region. Investors should consider long-tail keywords such as 2025’s most promising altcoins when researching their options.

Conducting a Smart Contract Audit

Investors need to ensure that the platforms they engage with are secure. One effective strategy is understanding how to audit smart contracts. This can be likened to having a skilled inspector check building safety before construction begins. Here’s how auditing can help:

- Identifying Vulnerabilities: Audits can highlight potential security issues.

- Enhancing Trust: A verified contract can boost investor confidence.

- Regulatory Compliance: Ensures the smart contract adheres to local laws.

Vietnamese Market Insights

The Vietnamese market is expanding rapidly, with more individuals and businesses adopting cryptocurrency for transactions. It’s crucial for investors to keep the following key points in mind:

- Understanding tiêu chuẩn an ninh blockchain is vital for securing investments.

- Local exchanges are becoming more regulated, offering safer trading environments.

- Community engagement remains a key factor in driving market growth.

Strategies for Safe Crypto Investments

As an investor, adopting a proactive approach can mitigate risks significantly. Here are some strategies you can implement:

- Diversification: Spread your investments across different coins.

- Research: Stay informed about new projects and their potential.

- Utilize Security Tools: Tools like Ledger Nano X can reduce hacks by 70%.

Conclusion: Empowering Your Crypto Journey

Safe investment in cryptocurrencies is not just an option; it’s a necessity. Utilizing resources such as hibt user advisory and keeping updated with hibt news brings clarity to your investment decisions. Ensuring your assets are held in secure jurisdictions can safeguard you against the inherent risks of trading digital currencies. With the expanding Vietnamese market and the continuous development in blockchain security, the potential for profitable investments is at your fingertips.

For deeper insights and ongoing support, explore the innovative offerings from cryptosalaryincubator.

By ensuring that you are informed, cautious, and strategic, you can leverage the booming market and secure your financial future.

Written by Dr. Nguyên Minh, a blockchain compliance expert with over 15 published papers and key audits on several leading crypto projects.