HIBT Crypto Tax Reporting Features: Essential Guide for 2025

With approximately $4.1B lost to DeFi hacks in 2024, navigating the complexities of crypto tax reporting has become increasingly crucial for both investors and businesses. The rise of cryptocurrencies in Vietnam has driven a staggering 200% growth rate in local crypto users over the past year. As regulatory scrutiny intensifies, understanding HIBT crypto tax reporting features can help you stay compliant while optimizing your tax obligations.

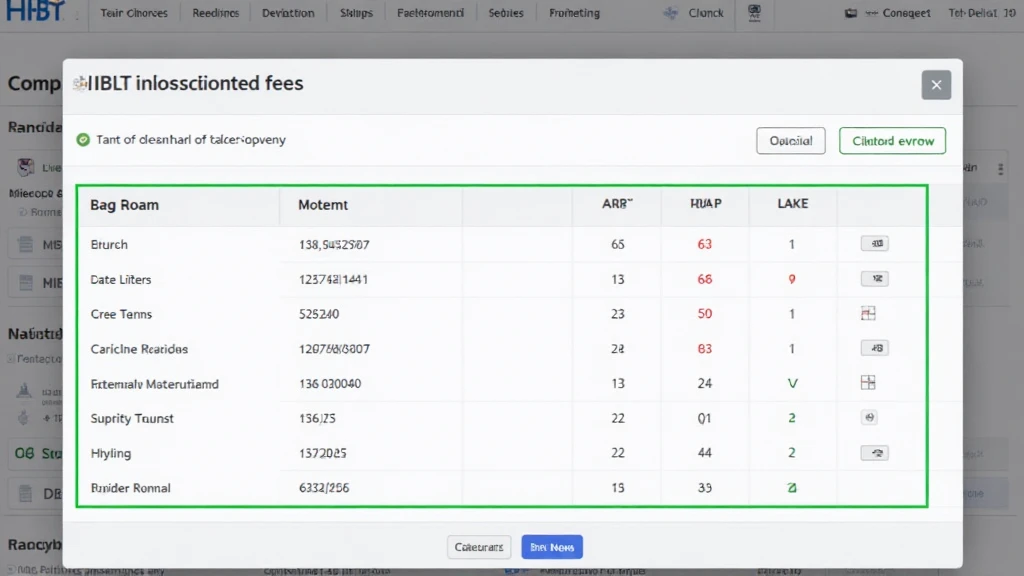

Understanding HIBT Crypto Tax Reporting Features

HIBT, or Hold, Invest, Buy, Trade, is revolutionizing how participants in the crypto space manage their tax reporting. With seamless integration of blockchain transactions and advanced algorithms, HIBT provides users with real-time and accurate tax liability calculations, enabling better financial planning.

How HIBT Works

Think of HIBT as your digital financial advisor specifically designed for cryptocurrency transactions. Similar to how a bank assesses your finances, HIBT evaluates your trading activity to compute your taxes intelligently. By aggregating data from various exchanges and tracking your crypto movements, HIBT automatically compiles your profits, losses, and taxable events.

Main Features

- Automatic Tax Calculations: No more manual calculations. HIBT offers instant tax estimates based on your holdings and transactions.

- Multi-platform Integration: Connect HIBT to multiple wallets and exchanges to consolidate all your crypto activities.

- Capital Gains Tracking: Easily identify long-term and short-term gains for accurate taxation.

- Real-time Updates: Stay updated on changes in tax regulations affecting cryptocurrency.

The Importance of Accurate Tax Reporting

Tax compliance is non-negotiable. Failing to report earnings can lead to severe penalties. In Vietnam, the tax authorities have become more vigilant, especially with the booming crypto scene. In fact, according to a recent report, the Vietnamese government is focusing on enhancing the legal framework surrounding cryptocurrencies to ensure all users comply with standard practices.

Real-life Analogies: Banks and Digital Assets

Imagine how banks use complex algorithms to monitor financial transactions and calculate interest. HIBT does something similar but for cryptocurrencies. The effective use of technology not only helps individuals but also businesses, avoiding unnecessary audits and penalties.

Impact of HIBT on the Vietnamese Market

With the growth of local crypto users in Vietnam, embracing simplified tax reporting tools like HIBT is becoming imperative. Users are now more proactive about understanding their tax implications, thus contributing to the transparency within the crypto economy.

Potential for Future Expansion

As the Vietnamese crypto landscape evolves, future enhancements to HIBT could include:

- Integration with DeFi Platforms: Streamlining tax calculations for yield farming and liquidity provision.

- More Comprehensive Analytical Tools: Offering deeper insights into market trends and their financial impacts.

- Local Partnerships: Collaborating with Vietnamese fintech firms to localize tax reporting features.

Conclusion: Make the Most of HIBT Crypto Tax Reporting Features

In an ever-growing crypto environment, utilizing HIBT crypto tax reporting features is essential for maintaining compliance and maximizing returns. By simplifying the reporting process, users can focus on their investments without the looming stress of tax obligations.

In closing, whether you’re a seasoned trader or new to the Vietnamese crypto market, adopting tools like HIBT can significantly help in navigating tax complexities. As always, make sure to consult with local regulators for compliance specifics and further information.

For more insights into crypto tax regulations, check our guide on Vietnam crypto taxes.