Introduction

As the cryptocurrency market continues to evolve, with billions of dollars allocated to digital assets, investors find themselves in a precarious position. With an alarming $4.1 billion lost to DeFi hacks in 2024 alone, the need for effective portfolio optimization has never been greater. In this article, we will delve into HIBT (Highly Innovative Blockchain Technology) crypto portfolio optimization and explore strategies that can help you navigate these treacherous waters wisely.

The value proposition of this article lies in its comprehensive breakdown of optimization techniques, tailored specifically for enthusiasts looking to bolster their portfolios amid increasing challenges. You will learn how to maximize gains while minimizing risks, ensuring the sustainability of your investments in this volatile market.

Understanding HIBT and Its Importance

HIBT stands for Highly Innovative Blockchain Technology, and it represents the cutting-edge advancements in the blockchain sphere. Its significance extends beyond simple transactions, impacting areas such as security, scalability, and interconnectivity within the crypto ecosystem. In this section, let’s explore what makes HIBT a critical player in portfolio optimization.

- Increased Security: HIBT incorporates advanced cryptographic measures that enhance transaction security, making it essential in mitigating hacking risks.

- Scalability: These technologies support higher transaction volumes without compromising performance, enabling investors to capitalize on market movements.

- Interoperability: HIBT facilitates seamless movements between different blockchain networks, adding liquidity to your portfolio.

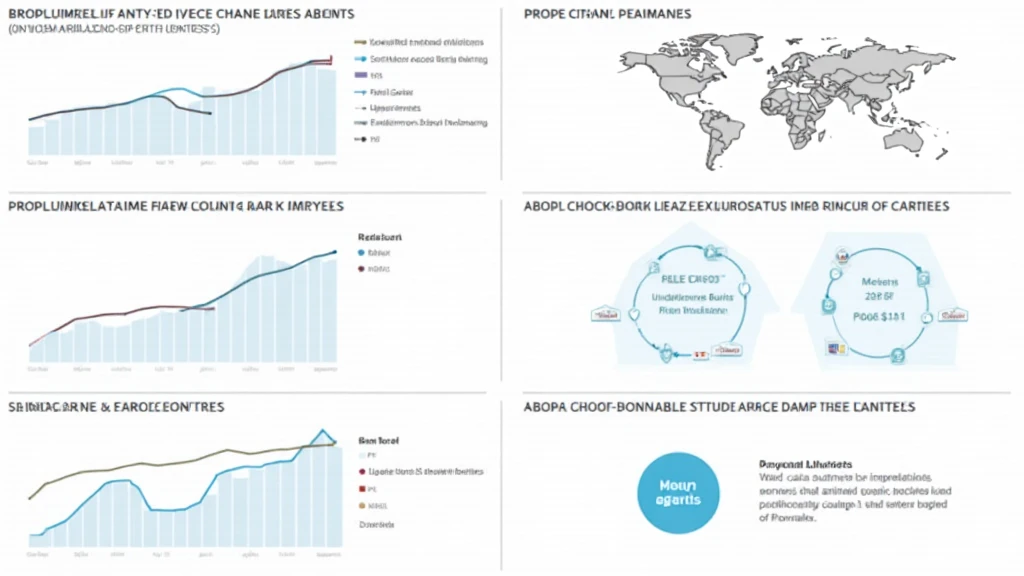

Key Strategies for HIBT Crypto Portfolio Optimization

Diversification of Assets

Diversifying your portfolio is akin to securing valuables in multiple safe deposit boxes rather than relying on a single vault. This strategy helps mitigate risks associated with price fluctuations in any single cryptocurrency.

For instance, by investing in a mix of established cryptocurrencies such as Bitcoin and Ethereum alongside emerging altcoins, you can protect your portfolio from dramatic downturns. Explore the most promising altcoins for 2025, ensuring a balanced distribution.

Regular Audits of Smart Contracts

Auditing your investments can be compared to performing regular maintenance on a vehicle. Neglecting this task can lead to undesired complications. Conduct periodic evaluations of smart contracts linked to your crypto assets to ensure security and integrity.

- Examine Code for Vulnerabilities: Utilize tools to scan for coding errors that might expose your assets to risks.

- Stay Updated on Protocol Changes: Monitor updates in the smart contract environment to adapt your strategies accordingly.

Adopting Risk Management Protocols

Implementing a risk management strategy is paramount in HIBT crypto portfolio optimization. Just like insuring valuable assets, safeguarding your crypto investments ensures longevity.

- Setting Stop-Loss Orders: Determine the maximum amount of loss you’re willing to accept and set stop-loss orders to prevent further deterioration.

- Utilizing Hedging Techniques: Enter into offsetting positions to protect against unfavorable market moves.

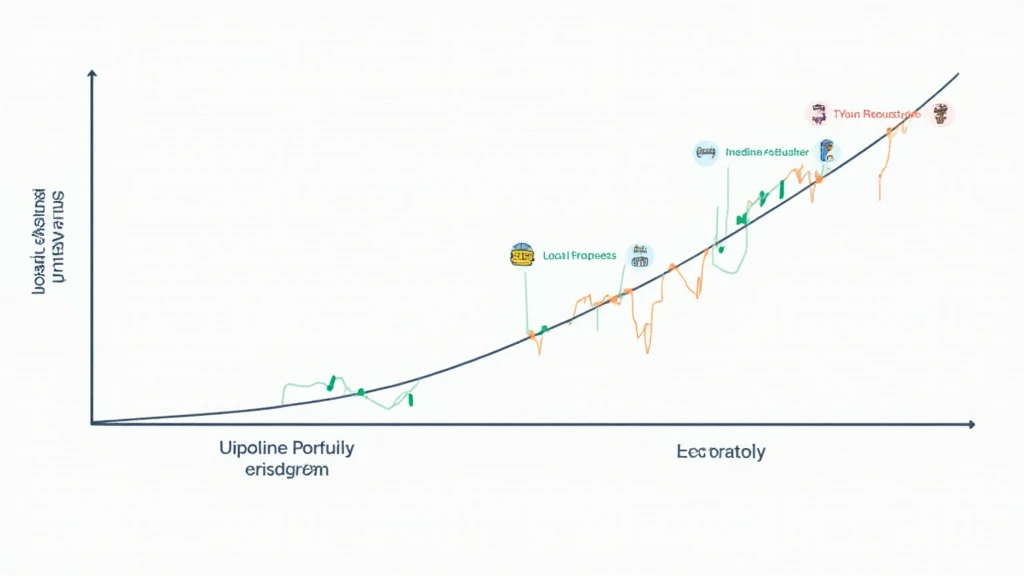

The Role of Local Market Trends: Focus on Vietnam

Recent data from CoinMarketCap indicates a remarkable growth rate of 45% among cryptocurrency users in Vietnam alone, underscoring the urgency to capitalize on emerging markets.

Enhancing your portfolio optimization strategies in accordance with these regional trends can also lead to better alignment with local preferences and economic conditions.

Leveraging Local Insights

To optimize your portfolio for the Vietnamese market, consider integrating local preferences and service providers. Deploy local exchanges that facilitate better trading experiences, effectively addressing the needs of this growing demographic.

The Future of HIBT Crypto Portfolio Optimization

As the cryptocurrency industry continues to shape the global economy, staying informed of technological developments related to HIBT will be essential. Integrating adaptive strategies that evolve in tandem with technology ensures a competitive edge amid an ever-changing landscape.

Continuous Education and Resource Utilization

Attending workshops and webinars designed for the crypto community will keep you abreast of the latest trends. Resources like hibt.com offer insights that can prove invaluable.

Conclusion

In conclusion, HIBT crypto portfolio optimization represents an essential aspect of successful investing in a rapidly evolving landscape. By following the strategies outlined in this article, you can significantly increase the robustness of your crypto investments. Balancing security, diversification, regular audits, and integrating local trends will prepare you to tackle the challenges and seize the opportunities presented by this unique market.

As always, this is not financial advice. Consult local regulators and experts before making investment decisions. Remember, the key to success in the cryptocurrency realm lies not in singular assets but in how well you manage your broader portfolio with an informed and strategic approach.

Author: Dr. Jane Smith, a blockchain technology researcher and expert who has published over 30 papers and led audits for prominent crypto projects.