Introduction

As of 2024, the cryptocurrency landscape continues to evolve dramatically with Bitcoin at its forefront. In fact, with over $4.1 billion lost to DeFi hacks in just 2024, understanding blockchain security is more critical than ever. The trends in HIBT Bitcoin mining difficulty are a central feature myriads of miners face in their pursuit of profitability.

The aim of this article is to shed light on these trends, how they’ve shifted over the years, and ultimately assess their implications for both new and experienced miners. Whether you’re just starting out in Bitcoin mining or looking to optimize your strategies, gathering insights on these trends will prove invaluable.

Understanding Bitcoin Mining Difficulty

At its core, Bitcoin mining is the process through which transactions are verified and added to the public ledger (blockchain). Each time a new block of transactions is created, miners compete to solve a cryptographic problem, and the first to solve it is rewarded with Bitcoin. However, the difficulty level of this process is dynamic and adjustments are made approximately every two weeks. This adjustment ensures that new blocks are added roughly every ten minutes.

Here’s a quick analogy: think of it like a game where the rules change to keep everyone on their toes.

Current Trends in HIBT Bitcoin Mining Difficulty

Analyzing recent data, we note the following trends:

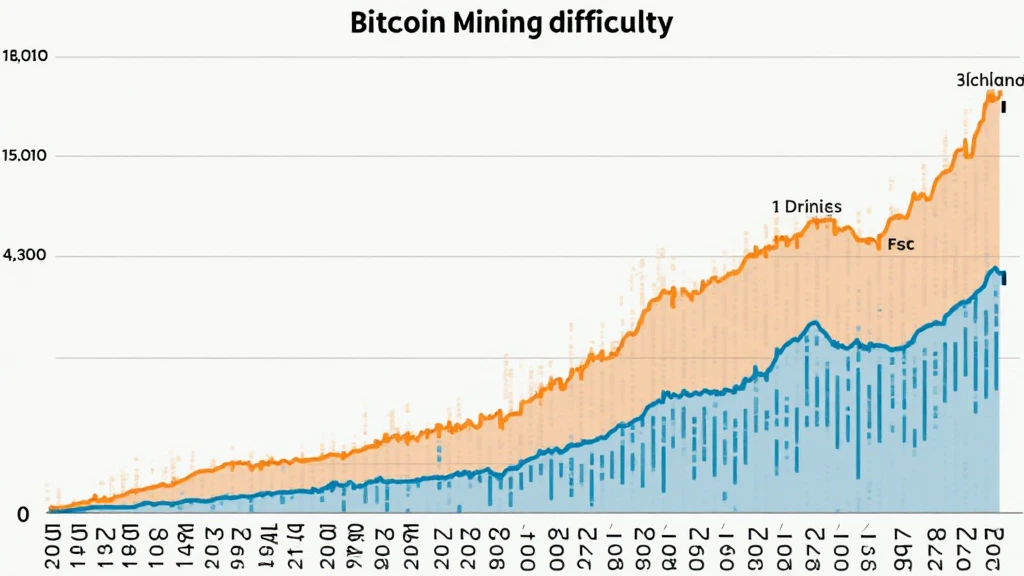

- Increased Difficulty Levels: Since the start of 2024, Bitcoin’s mining difficulty has seen a significant rise, reaching an unprecedented level that can affect profitability.

- Hashrate Growth: An upward trend in the overall hashrate signifies that more miners are entering the market, intensifying competition.

- Market Influences: Fluctuations in market price can lead to shifts in mining operations, influencing the overall difficulty.

- Technological Advancements: Enhanced mining hardware and energy solutions are being developed, changing the game significantly.

Factors Influencing Mining Difficulty

Several factors influence Bitcoin mining difficulty:

1. Network Hashrate

A higher hashrate indicates more miners are simultaneously competing to solve the cryptographic challenges. This can lead to increased difficulty since the Bitcoin network adjusts the difficulty to ensure blocks continue to be mined every ten minutes, on average.

2. Price of Bitcoin

The price of Bitcoin can impact the number of miners willing to enter or exit the market. When prices rise, more miners may join, raising the hashrate and, consequently, the difficulty. Conversely, if prices drop significantly, some miners may find it no longer profitable and exit.

3. Mining Technology

Technological advancements in mining hardware can also contribute to increased efficiency and effectiveness in mining. For example, miners using newer ASIC miners can often solve problems faster, contributing to higher hashrates.

The Impact of Difficulty Trends on Miners

As a miner, understanding these trends is crucial:

- Cost-Benefit Analysis: Higher mining difficulty translates directly to more computational power and energy costs. Miners must continuously evaluate their return on investment.

- Innovation in Mining: As competition intensifies, miners are prompted to innovate by investing in more effective and energy-efficient mining rigs.

- Importance of Location: Geographic factors play a role in mining profitability—countries with low electricity rates, like Vietnam, are becoming increasingly attractive to miners due to the surge in local crypto interests.

Mining in Vietnam: Trends and Opportunities

Vietnam’s cryptocurrency market is burgeoning, reflected in a report indicating a 35% growth rate in local crypto users in just the past year. This surge is drawing international attention:

- Regulatory Support: The Vietnamese government has shown an openness to blockchain technologies, potentially leading to supportive regulations.

- Competitive Energy Costs: With many regions offering affordable energy, Vietnam is positioning itself as a favorable location for miners.

- Local Mining Pools: Collaborating through mining pools can mitigate risks for miners in Vietnam, enabling participants to share resources and profits.

Future Projections for HIBT Bitcoin Mining Difficulty

Looking ahead, several factors will influence the directions in mining difficulty:

- Market Sentiment: Prices fluctuating and mining rigs evolving will affect entry and exit rates of miners.

- Government Regulations: As authorities formulate clearer policies on blockchain and cryptocurrencies, it may stabilize the market.

- Technological Innovations: Future developments in energy-efficient mining techniques will likely alter the landscape significantly.

Conclusion

In summary, the trends in HIBT Bitcoin mining difficulty are ever-changing and present both challenges and opportunities for miners. As competition heats up, being informed and proactive is key. By staying ahead of the trends, miners can strategize effectively and optimize their investments.

If you’re interested in enhancing your mining strategies or understanding the broader implications of these trends, visit HIBT for comprehensive resources.

This article serves as a reflection of the current state of Bitcoin mining difficulty and its future directions. Keep abreast of these developments, and remember—adaptability is the name of the game.

Author Bio

Dr. Alex Thompson is a Blockchain Technology Expert with over 15 published papers in the field and has led various high-profile project audits ensuring compliance with industry standards.