Understanding HIBT Bitcoin Market Liquidity Metrics: A Comprehensive Guide

With over $4.1 billion lost to DeFi hacks in 2024, the cryptocurrency landscape is more challenging than ever. As a trader or investor venturing into Bitcoin, understanding HIBT Bitcoin market liquidity metrics is essential to ensure your assets are safe and your strategies are effective. In this article, we aim to provide you with a clear insight into liquidity metrics, what they mean for your trading activities, and crucial strategies to optimize your engagement in the volatile crypto market.

What is Market Liquidity?

Market liquidity refers to the ease with which assets can be bought or sold in the market without causing significant price changes. In the context of Bitcoin, liquidity plays a vital role because it determines how quickly you can enter or exit a position without negatively impacting the asset’s price. Let’s break it down further:

- High Liquidity: Allows for quick trades. Traders can buy/sell with minimal slippage.

- Low Liquidity: May cause price volatility. Large trades can lead to unfavorable price movements.

Understanding these dynamics helps in crafting customized trading strategies that align with your financial goals. According to recent data, liquidity has increased significantly in the Vietnamese market, where local crypto investors have grown by over 30% in the past year, emphasizing the importance of tracking HIBT Bitcoin market liquidity metrics.

Key Metrics for Measuring Bitcoin Liquidity

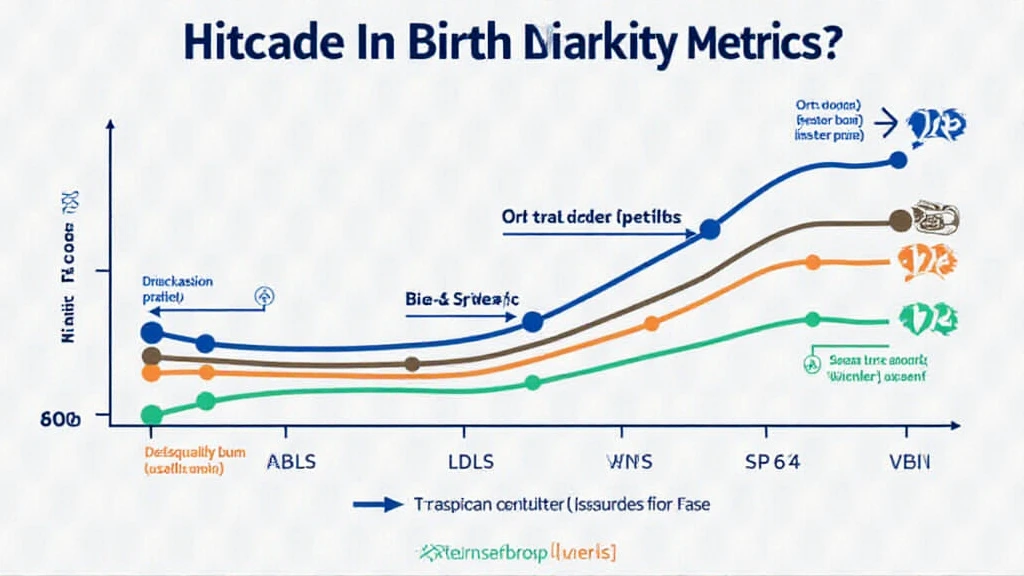

Several metrics can be used to evaluate the liquidity of Bitcoin markets effectively. Here are key metrics you should be aware of:

- Order Book Depth: This metric shows the number of buy and sell orders at various price levels. A deeper order book typically indicates higher liquidity.

- Bid-Ask Spread: The difference between the highest price a buyer is willing to pay and the lowest price a seller is willing to accept. A narrower spread usually signals a more liquid market.

- Trading Volume: This refers to the total amount of Bitcoin that is traded over a specific period. Higher trading volumes usually correlate with higher liquidity.

For Vietnamese investors, understanding these metrics is crucial, as fluctuating liquidity can directly impact your trading effectiveness. In an emerging market, optimizing these metrics can be the key differentiator.

How to Assess HIBT Bitcoin Market Liquidity

Evaluating liquidity metrics can seem daunting, but by breaking it into manageable chunks, it becomes easier. Here’s how to get started:

- Utilize Analytical Tools: Use platforms that provide comprehensive analytics on liquidity metrics. Tools such as HIBT can help investors access real-time data.

- Monitor Market Trends: Regularly reviewing market trends allows investors to gauge shifts in liquidity, especially important in a rapid-paced environment.

- Stay Informed: Following updates and news from credible sources will provide insights into market conditions and potential impacts on liquidity.

As Bitcoin becomes increasingly more integrated into the financial systems across different countries, leveraging these strategies will help enhance your trading outcomes.

The Role of HIBT in Enhancing Bitcoin Liquidity

HIBT (High-Interest Bitcoin Trading) is paving the way for enhanced liquidity in Bitcoin trading. By integrating innovative financial products, it provides traders and investors with more opportunities to capitalize on market conditions:

- Facilitating User Engagement: HIBT offers unique incentives for users to engage in high-volume trading, boosting overall liquidity.

- Creating Competitive Trading Platforms: With better liquidity metrics, HIBT enables users to access competitive trading conditions, minimizing risks associated with price volatility.

- Providing Educational Resources: HIBT focuses on educating traders about market trends and liquidity metrics to enhance their trading strategies.

The introduction of HIBT has proven to substantially influence liquidity metrics in the Bitcoin market, resulting in a more dynamic trading environment for all participants.

Conclusion: Mastering Market Liquidity for Successful Trading

In summary, understanding HIBT Bitcoin market liquidity metrics is crucial for anyone looking to thrive in the crypto market. Whether you’re a novice trader or a seasoned investor, familiarizing yourself with these discreet indicators can provide you with the upper hand essential for making informed trading decisions. As the liquidity landscape evolves, particularly in emerging markets like Vietnam, utilizing platforms like HIBT can make a significant difference in your trading success.

In the ever-changing world of cryptocurrencies, staying ahead means leveraging these insights and adapting to new market conditions to maximize your investment potential. Not financial advice. Consult local regulators.

For more information, visit cryptosalaryincubator.