Hanoi Crypto Bond Market Surveillance: Navigating Trends and Risks

In recent years, the integration of blockchain technology in financial markets has paved the way for innovative solutions, including the emergence of the crypto bond market. With the growing number of fraud cases, market volatility, and uncertainties surrounding regulations, effective surveillance has become a prerequisite in this evolving landscape. In Vietnam, the expansion of digital assets poses both opportunities and challenges. As we venture into the implications of the Hanoi crypto bond market surveillance, we will take a closer look at how this trend is shaping the future of digital finance in the region.

The Current State of Crypto Bonds in Vietnam

As of 2024, Vietnam has witnessed an impressive growth rate in crypto adoption, with approximately 15% of the population engaging with digital assets. This surge indicates a need for comprehensive frameworks to monitor and regulate this emerging market. A recent report from hibt.com revealed that the total market capitalization of cryptocurrencies in Vietnam reached $10 billion in early 2024, illustrating significant engagement from local investors.

Understanding Crypto Bonds

Crypto bonds represent a new financial instrument combining traditional bond features with the innovative advantages of blockchain technology. These bonds are digitally issued, enabling easier traceability and management. However, as with any financial asset, risks are associated, including price volatility and regulatory scrutiny.

Market Dynamics: Opportunities and Risks

- Investment Opportunities: Crypto bonds provide investors access to new asset classes and diversification.

- Risks of Fraud: The absence of robust surveillance can lead to increased fraud cases.

- Regulatory Changes: As governments scramble to catch up with technological advancements, changes in regulations can significantly affect market dynamics.

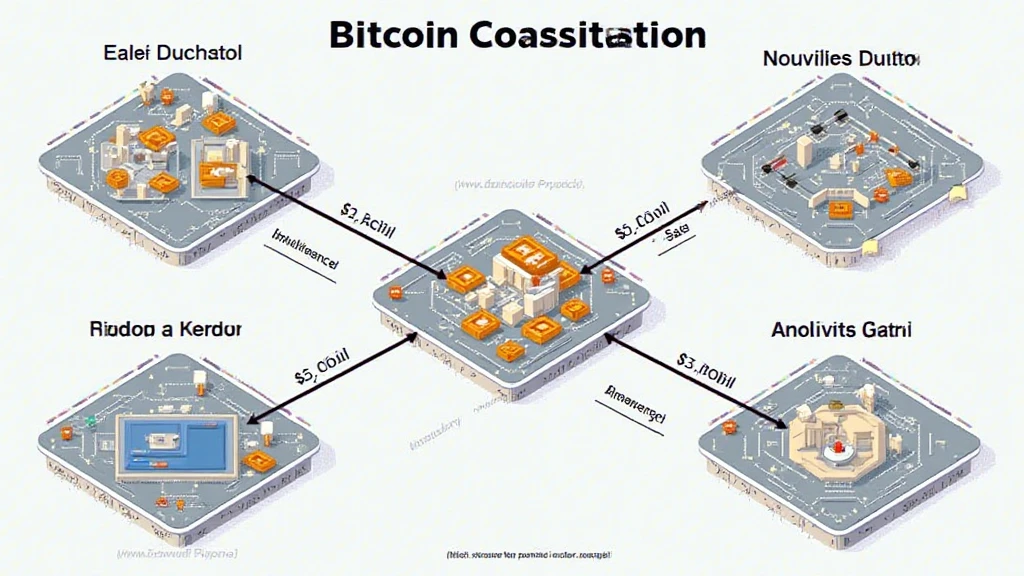

Surveillance Mechanisms in the Hanoi Crypto Bond Market

To ensure the integrity of the Hanoi crypto bond market, effective surveillance mechanisms must be in place. Here’s a breakdown of the primary components involved:

Regulatory Bodies Involved

The State Securities Commission of Vietnam (SSC) and the Ministry of Finance are critical players in regulating and overseeing the crypto bond market. Their guidelines will shape the standards for market practices. Concepts such as tiêu chuẩn an ninh blockchain (blockchain security standards) are crucial to mitigating risks.

Technological Tools for Surveillance

Advanced tools and platforms can facilitate the monitoring of transactions within the crypto bond market. These include:

- Blockchain Analytics: Tools like Chainalysis provide insights into transaction flow, helping to identify suspicious activities.

- Smart Contract Audits: Conducting regular audits can uncover vulnerabilities, ensuring that protocols are secure and compliant.

The Road Ahead: Future Trends and Predictions

As we look ahead, several trends are poised to shape the Hanoi crypto bond market:

- Increased Institutional Investment: As the regulatory landscape stabilizes, we expect more institutional players to enter the crypto bond market.

- Focus on Compliance: Emphasis on compliance will drive transparency and investor confidence.

To capitalize on these trends, investors must stay informed about ongoing developments and regulatory changes. According to recent forecasts, by 2025, Vietnam could see a 20% increase in crypto bond issuance due to rising demand from both local and international investors.

Practical Steps for Investors in the Hanoi Crypto Bond Market

Investors must approach the Hanoi crypto bond market with caution and informed judgment. Here are some practical tips:

- Conduct Thorough Research: Understand the history and performance of crypto bonds before investing.

- Avoid Scams: Stay away from projects that lack transparency and robust audits.

- Engage with Professionals: Consult experts and financial advisors familiar with cryptocurrencies.

Conclusion: Embracing the Future of Finance

The Hanoi crypto bond market surveillance is a critical component as Vietnam embraces the digital asset revolution. By prioritizing transparency, compliance, and effective monitoring, stakeholders can foster a secure environment for investors. As the landscape evolves, the potential for growth remains strong, making it an exciting time for both local and global investors. Adapting to these changes will ultimately define the success of crypto bonds in the region.

For further insights and updates on Vietnam’s digital asset market, visit cryptosalaryincubator.

Meet our Expert

Dr. Anh Nguyen is a blockchain researcher with over 15 published papers in the field of digital finance and serves as a lead auditor for several high-profile crypto projects. An advocate for cryptocurrency integration into traditional financial systems, he has a deep understanding of the Southeast Asian market trends.