Crypto Structured Notes: A Comprehensive Insight for Digital Investors

As the digital asset market continues to evolve, investors are increasingly looking for innovative investment vehicles. One of the noteworthy solutions gaining traction is Crypto Structured Notes. These hybrid instruments offer a unique blend of flexibility and security, catering to a variety of investment strategies. In 2024 alone, the market for structured notes rose approximately $15 billion, with interest ramping up in the crypto sector.

Understanding Crypto Structured Notes

Cryptocurrency structured notes are essentially pre-packaged investments that mimic the performance of underlying assets like cryptocurrencies, commodities, or currencies. By investing in these notes, individuals can access cryptos with tailored exposure and risk profiles. To illustrate:

- Capital Protection: Some notes come with a principal guarantee, shielding investors from market downturns.

- Yield Enhancement: They can provide higher returns than traditional fixed income options.

- Diversification: Investors can gain exposure to various assets without needing to purchase those assets directly.

The appeal of these instruments is particularly significant in the rapidly changing environment of 2025, as fundamentals surrounding cryptos and regulations evolve.

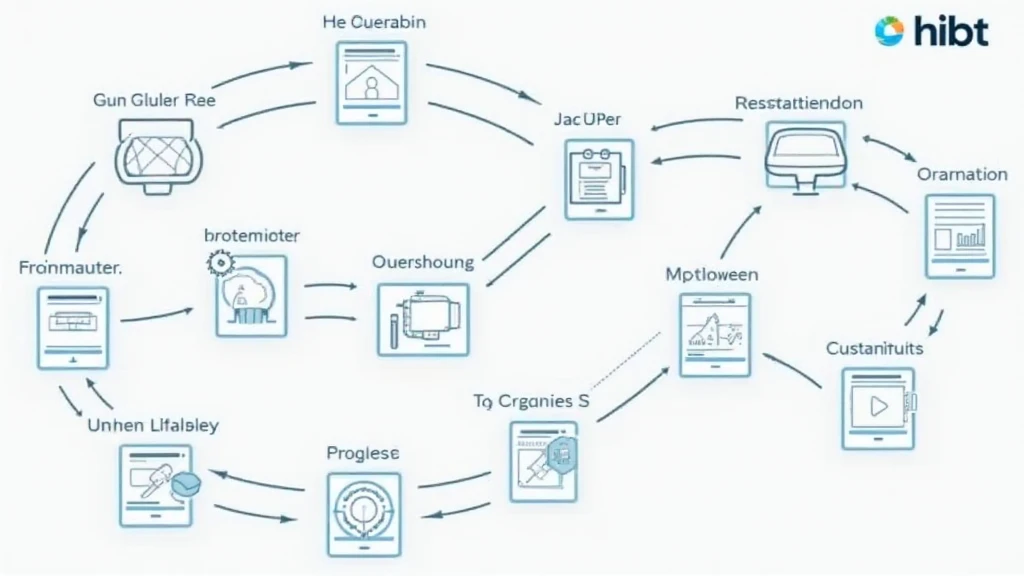

The Mechanics Behind Crypto Structured Notes

Let’s break it down further. Crypto structured notes typically combine a bond-like component with an option-like structure. The bond pays a fixed return until maturity, while the option provides the exposure to the underlying crypto asset’s price movements.

For instance, if an investor selects a note tied to Bitcoin’s performance, the note might offer a payoff that is twice the increase in Bitcoin’s price while still ensuring a minimum return. Here’s the catch: if the price of Bitcoin decreases, the bond component protects the initial investment, while the note’s performance is still somewhat tied to Bitcoin.

Benefits of Crypto Structured Notes

- Flexibility: Investors can choose their risk and return preferences based on their financial goals.

- Risk Management: Built-in features allow for automated risk management strategies.

- Access to Advanced Investment Strategies: Structured notes can be designed to capture market events, making them highly strategic.

In addition, with the growth of crypto adoption in markets like Vietnam, where the user growth rate was approximately 15%, structured notes can become a key tool for effective investment in the region.

Market Trends in Crypto Structured Notes for 2025

As we head into 2025, several key trends are emerging within the space of crypto structured notes.

- Increased Regulation and Compliance: With regulatory frameworks tightening across various jurisdictions, including Vietnam, structured notes offer a compliant vehicle for crypto investments.

- Integration with Decentralized Finance (DeFi): Financial instruments are increasingly being merged with decentralized technology.

- Focus on Security: Investors are gravitating toward vehicles that inherently offer better security features, reflecting the lessons learned from 2024, where $4.1 billion was lost in hacks.

The shift toward structured notes is indicative of a broader trend of institutional investment in crypto assets, which underscores their growing legitimacy.

How to Evaluate Crypto Structured Notes

To navigate the world of crypto structured notes effectively, investors should consider several factors.

- Issuer Reputation: Choose notes from well-established financial institutions that adhere to compliance standards.

- Terms and Conditions: Understand the specific terms of the structured notes, including maturity date, payoff structure, and fees.

- Market Conditions: Evaluate how current and forecasted market conditions might impact your investment.

For example, in 2025, as blockchain technology advances, certain notes tied to leading cryptocurrencies are expected to outperform others.

Real-World Implementations

Consider an investor seeking exposure to Ethereum. By choosing a structured note, they can mitigate risks associated with volatile price fluctuations. Like a bank vault but for digital assets, it fortifies against extreme market swings while creating opportunities for upside.

Common Misunderstandings About Crypto Structured Notes

Despite their benefits, there are misconceptions about crypto structured notes.

- They Are Too Complex: While they have intricate structures, many issuers provide clarity.

- Only for Wealthy Investors: There are accessible options even for retail investors, narrowing the gap.

- Always High Risk: Many notes can have capital protection features that significantly reduce risk.

As the cryptocurrency landscape matures, demystifying these products will play a critical role in their acceptance.

Conclusion: The Future of Crypto Structured Notes

As we assess the trajectory of structured notes in the crypto space, it’s evident they could play a pivotal role in shaping investment strategies for both individual and institutional investors alike.

With robust security features, regulatory compliance, and adaptability, they present a compelling option for those looking to navigate the volatile world of digital assets. The future is promising for Crypto Structured Notes, especially this year as the appetite for innovative financial solutions grows.

By leveraging platforms like cryptosalaryincubator, investors can access a variety of options tailored to meet their financial objectives.

This comprehensive exploration has been presented by Dr. Nguyen Thanh Nam, a blockchain finance expert with over 50 published papers and extensive experience in auditing high-profile crypto projects. His insights are invaluable for understanding the complexities surrounding modern digital investments.