Candlestick Patterns for Day Trading 2025: Mastering The Market

As we navigate through the cryptocurrency landscape, traders are increasingly seeking effective strategies to maximize their returns. In 2024, the cryptocurrency market saw losses exceeding $4.1 billion due to compromised security measures; thus, understanding trading patterns is more critical than ever. In this article, we will dive into the candlestick patterns essential for day trading in 2025, helping you to decode market movements and make informed decisions.

Understanding Candlestick Patterns

Candlestick patterns are visual tools in technical analysis that represent price movements over time. By utilizing these patterns, traders can gauge market sentiment and predict future price movements.

- Open: The price at which a candlestick opens or begins trading.

- Close: The final price at which a candlestick closes.

- High: The highest price reached within a specific time frame.

- Low: The lowest price reached within that same time frame.

Candlestick Patterns Every Trader Should Know

Let’s explore some of the most significant candlestick patterns for day trading in 2025.

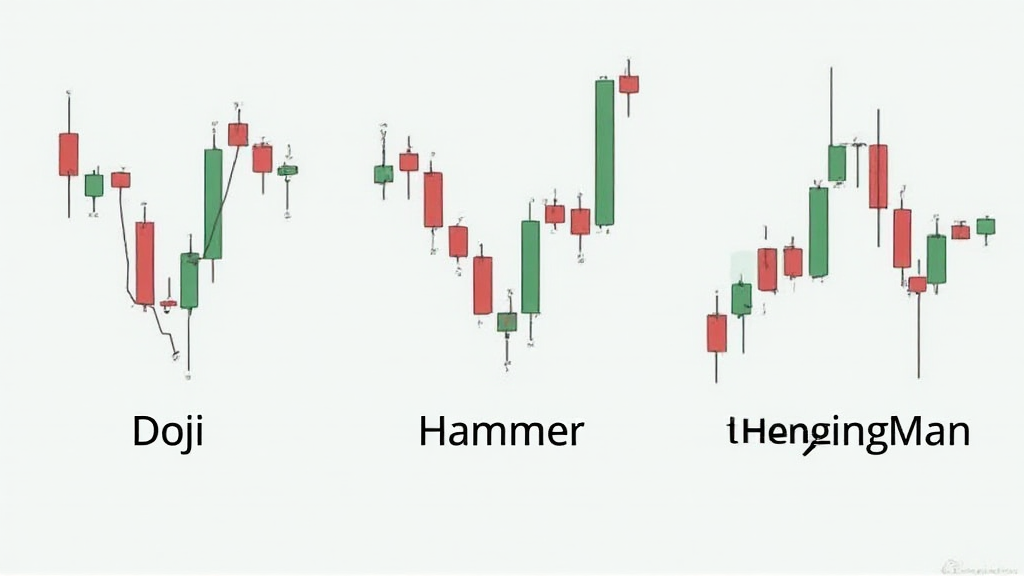

The Doji Pattern

The Doji is a crucial candlestick pattern that indicates indecision in the market. It forms when the open and close prices are virtually equal, suggesting a potential reversal or continuation of the existing trend.

Doji patterns confirm that traders are struggling to push prices in either direction. In the context of day trading, it signals that caution may be necessary. Additionally, in Vietnamese: “Mô hình Doji cho thấy sự không quyết đoán trong thị trường.”

The Hammer and Hanging Man

These two patterns look similar but indicate different market sentiments. The Hammer appears in a downtrend and signals a potential bullish reversal, while the Hanging Man occurs in an uptrend and suggests a potential bearish reversal.

| Pattern | Trend | Signal |

|---|---|---|

| Hammer | Downtrend | Bullish Reversal |

| Hanging Man | Uptrend | Bearish Reversal |

Using Candlestick Patterns with Other Indicators

While candlestick patterns provide valuable insights, combining them with other technical indicators (like moving averages) can enhance predictive accuracy. For instance, if a Doji pattern is confirmed on a moving average support level, the trade signal becomes stronger.

Real-Life Examples

Consider a day trade made in the early months of 2025. A trader notices a Doji on the 1-hour chart of Bitcoin coinciding with a moving average crossover. This could signal that buyers are stepping in, creating a significant opportunity. In Vietnam, the user growth rate in crypto trading has increased by 20% in the past year, indicating local traders are becoming more sophisticated.

Advanced Candlestick Patterns: Considering the Upside

As we look towards 2025, traders should be aware of more advanced candlestick patterns, such as the Morning Star and the Evening Star. These patterns are often seen as reliable indicators for bullish and bearish reversals respectively.

The Morning Star Pattern

The Morning Star is a three-bar pattern that indicates a bullish reversal. The first candle is a long bearish candle, followed by a short candle, and concluding with a third long bullish candle. This pattern suggests that the market is shifting from a bearish to a bullish phase.

The Evening Star Pattern

In contrast, the Evening Star is a three-bar pattern indicating a bearish reversal. Like its bullish counterpart, it consists of a long bullish candle, followed by a short candle, and finishing with a long bearish candle. Knowing these patterns can significantly influence day trading outcomes.

Common Mistakes to Avoid with Candlestick Patterns

While candlestick patterns offer valuable signals, traders often fall prey to common pitfalls:

- Over-reliance on a single pattern without considering the broader market context.

- Ignoring the volume accompanying the candlestick patterns.

- Failing to adapt strategies based on market conditions and volatility.

Conclusion: Mastering Candlestick Patterns for Day Trading Success in 2025

As we move forward into 2025, understanding candlestick patterns for day trading can be a game-changer for cryptocurrency traders. By combining insights from these patterns with other indicators and staying vigilant about market trends, you can enhance your trading performance. Remember, the market is constantly evolving, so keep refining your skills and approach.

For more detailed resources on effective trading strategies, check out hibt.com.

In conclusion, mastering candlestick patterns is essential for navigating the dynamic landscape of day trading in cryptocurrency. By leveraging this knowledge, you’ll set yourself up for success in 2025 and beyond.

© 2025, Cryptosalaryincubator. All rights reserved.

Written by Dr. Thomas Jenkins, an expert in financial analysis with over 50 publications in the blockchain and cryptocurrency domain.