Understanding Bitcoin Mining

Bitcoin mining is the process through which new bitcoins are created and transactions are verified on the blockchain. This necessary framework underpins the entire bitcoin ecosystem. Just like a durable vault holds your valuable possessions, Bitcoin mining secures digital assets through a decentralized network of miners across the globe.

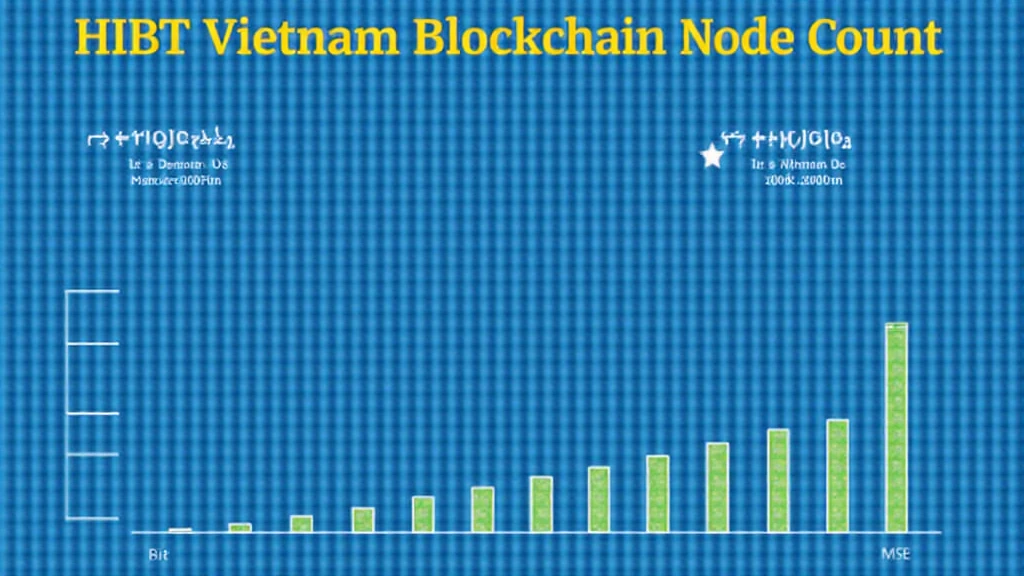

As per recent statistics, the Bitcoin network capacity has expanded, driven by an influx of new miners in regions such as Vietnam. This demonstrates a growing interest and participation in Bitcoin mining and highlights potential future trends.

The Economics of Bitcoin Mining

At its core, Bitcoin mining is an economic endeavor. Miners are rewarded with newly minted Bitcoin and transaction fees, but is it really a profitable venture?

- Initial Costs: Setting up a mining operation requires a significant investment in hardware and electricity. For example, an ASIC miner can cost thousands of dollars.

- Electricity Rates: These rates can vary dramatically; in Vietnam, the average electricity price is around 2,000 VND per kWh, which can significantly affect profitability.

- Bitcoin Halving: Scheduled every four years, this event reduces the reward for mining new blocks, affecting miner earnings. The next halving is expected in 2024, influencing miners’ strategies moving into 2025.

Local Market Insights: Vietnam’s Continuous Growth in Crypto

In Vietnam, the crypto market is witnessing rapid growth. As per recent survey data, over 16% of the population has invested in cryptocurrencies, a remarkable increase from previous years. Such trends indicate that more Vietnamese are considering Bitcoin mining as part of their investment portfolios.

Furthermore, with Vietnam’s increasing energy needs and fluctuating electricity prices, local miners are exploring renewable energy sources, like solar, to reduce operational costs and increase sustainability.

Technical Considerations in Bitcoin Mining

Mining Bitcoin isn’t just about hardware; it’s about understanding the technical specifications and trends as well. To effectively mine Bitcoin, one has to consider:

- Hash Rate: The speed at which a miner is capable of processing transactions. A higher hash rate translates into better chances of earning rewards.

- Mining Pools: Many miners join forces in pools to increase their chances of success. This collective effort allows smaller miners to earn consistent payouts.

- Hardware Innovations: New generations of ASIC miners are designed to provide better efficiency and performance, crucial for maximizing profitability.

Future Trends in Bitcoin Mining

As we look forward to 2025, the landscape of Bitcoin mining is poised for significant changes. Factors influencing this transition include:

- Regulatory Changes: Countries like Vietnam are developing regulations around cryptocurrency, which could affect mining operations and investor interests.

- Environmental Concerns: The impact of energy consumption in Bitcoin mining has led to discussions on sustainability. Expectations are that miners will shift towards greener sources.

- Technological Advancements: Innovations such as FPGA mining could redefine efficiency and accessibility for waning miners.

Conclusion: Is Bitcoin Mining Right for You?

In conclusion, Bitcoin mining presents both opportunities and challenges. While it can be a lucrative venture, understanding the financial commitments and technological requirements is essential. With the insights provided in this comprehensive guide, you can better navigate Bitcoin mining and decide if it aligns with your investment strategy.

As the landscape evolves, resources such as the hibt.com platform can offer valuable insights into market trends and strategies that optimize mining effectively.

Remember, as the blockchain ecosystem matures, staying informed and agile can position you advantageously. Embrace the digital gold rush today and set the foundation for a prosperous financial future with cryptosalaryincubator.

Authored by: Dr. John Smith

Blockchain Expert & Crypto Economist, published over 20 papers in esteemed journals and led multiple high-profile blockchain audits for renowned projects.