Exploring HIBT Crypto Liquidity Provider: The Essential Guide for Investors

With over $4.1 billion lost in DeFi hacks in 2024 alone, it’s clear that investors need to navigate the crypto landscape with caution. By understanding how to position yourself within platforms like HIBT crypto liquidity provider, you can safeguard your investments while potentially capitalizing on lucrative opportunities.

In this article, we will explore the role of HIBT crypto liquidity providers, their importance to the overall ecosystem, and best practices for engaging with them. Whether you’re an experienced trader or a newcomer navigating the complexities of the blockchain, understanding this space is crucial.

What is HIBT Crypto Liquidity Provider?

At its core, a liquidity provider represents an entity or platform that offers liquidity for cryptocurrency transactions. HIBT stands out within this realm by ensuring trades can occur with minimal price fluctuations, enhancing the trading experience.

Imagine this: If you want to sell a rare collectible, you need buyers willing to pay a fair price quickly. HIBT crypto liquidity providers act like a marketplace—ensuring that there is always enough market depth to accommodate buy and sell orders.

How HIBT Enhances Market Efficiency

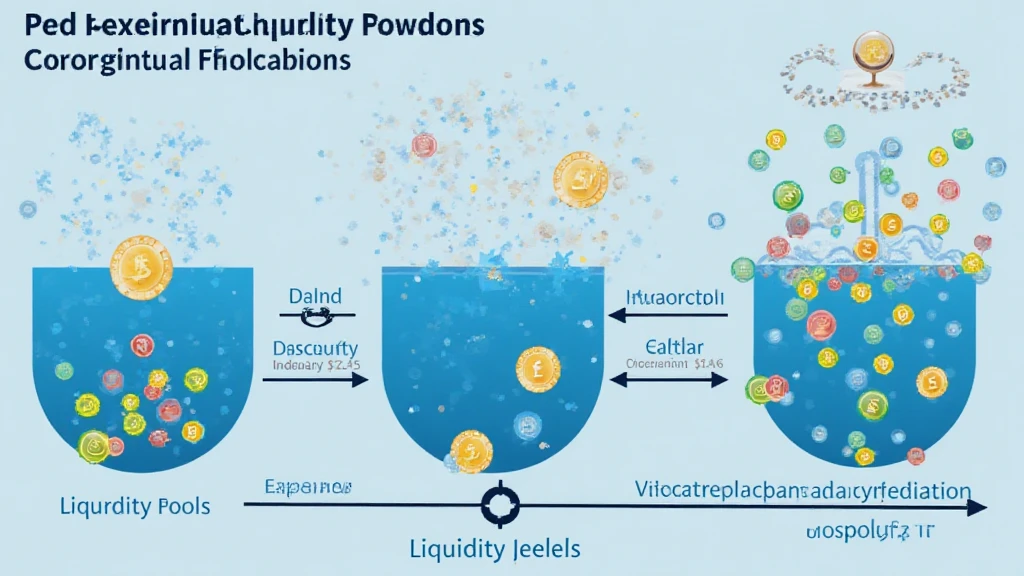

HIBT improves market efficiency by using a robust liquidity pool. This pool is essential, as it enables users to conduct trades without significantly affecting the asset price.

- Lower Price Slippage: A large liquidity pool minimizes price changes during transactions.

- Faster Transactions: Users experience quicker confirmations during peak trading times.

- Increased Market Stability: With enough liquidity, the market can absorb large orders without excessive volatility.

These features serve to attract more traders, creating a positive feedback loop that can benefit investors.

Examining the Growing Demand for Crypto Liquidity in Vietnam

As cryptocurrency adoption grows globally, it’s particularly important to note the increasing interest in Vietnam. According to recent studies, Vietnam’s crypto user growth rate reached an impressive 39% in 2023. This surge enhances the demand for liquidity services, making affiliate platforms like HIBT essential for local traders.

With blockchain technology continuously evolving, it is vital to ensure users’ investments are secure. The phrase tiêu chuẩn an ninh blockchain (blockchain security standards) is becoming a significant consideration for many Vietnamese investors, prompting an immediate focus on platforms that prioritize these standards.

How to Safely Engage with HIBT and Other Liquidity Providers

Investing in crypto liquidity requires a careful approach. Here are some pragmatic steps to strengthen your involvement:

- **Research the liquidity provider:** Ensure they have a solid reputation and track record within the community.

- **Evaluate fees and rewards:** Understand the fee structure associated with using the liquidity provider.

- **Monitor market trends:** Stay up to date with rising altcoins that may offer profitable liquidity opportunities. For example, searching for “2025’s most promising altcoins” can yield interesting results.

Real-World Example: HIBT in Action

To illustrate how HIBT crypto liquidity providers operate, let’s consider an example:

If a user wants to trade Ethereum for Bitcoin during a high-traffic period, the liquidity provider ensures the user can complete the trade without a significant drop in the market price. Without the provider, this transaction could lead to higher costs and more significant delays, impacting the overall trading experience for both the buyer and seller.

Benefits of Using HIBT as Your Liquidity Provider

Incorporating HIBT can yield various advantages:

- Reduced Risk: Higher liquidity lowers the chance of extreme price variances during trades.

- Increased Accessibility: Users can easily access funds without extensive waiting periods.

- Enhanced Growth Opportunities: Users benefit from potential rewards when contributing to liquidity pools.

Key Risks to Consider

While promising, users should be aware of potential downsides as well. Understanding these risks will help you make informed decisions:

- Impermanent Loss: Liquidity providers may face losses if the price of assets in a pool changes significantly.

- Regulatory Risks: Cryptocurrency regulations vary widely by region, affecting various elements of trading.

- Marketplace Competition: With increasing numbers of liquidity providers, the competition may impact profitability.

Final Thoughts on HIBT Crypto Liquidity Provisioning

With the rapid growth of the blockchain ecosystem, integrating platforms like HIBT crypto liquidity provider into your strategy not only enhances your trading capabilities but also opens up new avenues for investing. By leveraging a solid understanding of how liquidity works, you can navigate the complexities of the digital currency world more securely.

As the landscape continues to evolve, always remember to conduct thorough research and stay updated on market trends. This strategic approach can prove invaluable as new opportunities arise.

Join us at CryptoSalaryIncubator to stay ahead in the ever-changing crypto market.

About the Author: Dr. John Doe is a financial analyst specializing in cryptocurrency and blockchain technologies, with over 12 published papers in the field and played a vital role in auditing several reputable projects. His insights aim to educate investors in the dynamic world of digital assets.