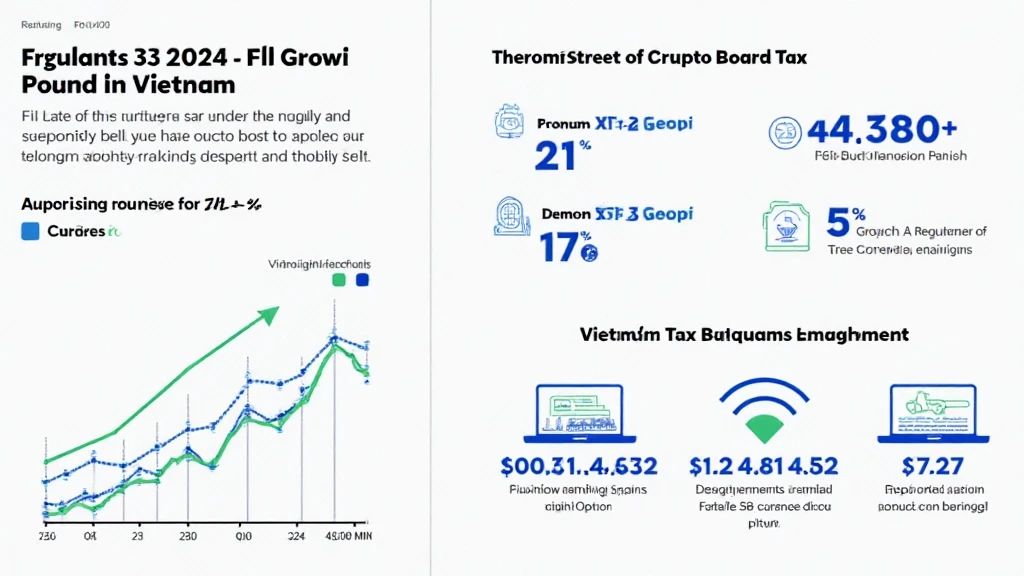

Navigating Crypto Bond Taxes: Insights for Q3 2024

In 2024, the crypto market is evolving rapidly, prompting many stakeholders to reconsider their tax obligations related to digital assets. With the Vietnamese crypto landscape experiencing a significant transformation, understanding the intricacies of crypto bonds and their tax implications is crucial. As we dive into these topics, we will explore how crypto bond taxes in Vietnam interact with the latest regulations and market developments. This analysis will provide clear insights and practical advice for investors and businesses.

Regulatory compliance, especially regarding taxes, is paramount for anyone engaged in the crypto sector. In Vietnam, the intersection of cryptocurrency and taxation raises essential questions for investors, businesses, and policymakers alike. By Q3 2024, as the Vietnamese government continues to refine its policies, staying informed and compliant will be increasingly critical.

Understanding Crypto Bonds in Vietnam

Crypto bonds represent a relatively new financial instrument in the blockchain ecosystem. These bonds leverage smart contracts to facilitate secure, transparent transactions, providing a unique means for investment. For example, a crypto bond could be compared to a traditional bond, with an issuer and an obligation to pay back the principal plus interest, but with added features enabled by blockchain technology.

What are Crypto Bonds?

- Innovative financing: Crypto bonds allow firms to raise funds through blockchain technology.

- Flexible terms: The structure allows for varied maturities and yields, catering to diverse investor needs.

- Blockchain transparency: Transactions are recorded on the blockchain, enhancing accountability.

As Vietnam gears up for increased participation in the global crypto market, crypto bonds can play a pivotal role in attracting both domestic and foreign investments.

Tax Framework for Crypto Bonds in Vietnam

As the crypto landscape evolves, so too does the taxation framework surrounding it. The Vietnamese government has been gradually implementing policies to regulate the cryptocurrency market. By Q3 2024, the following aspects of crypto bond taxation will be relevant:

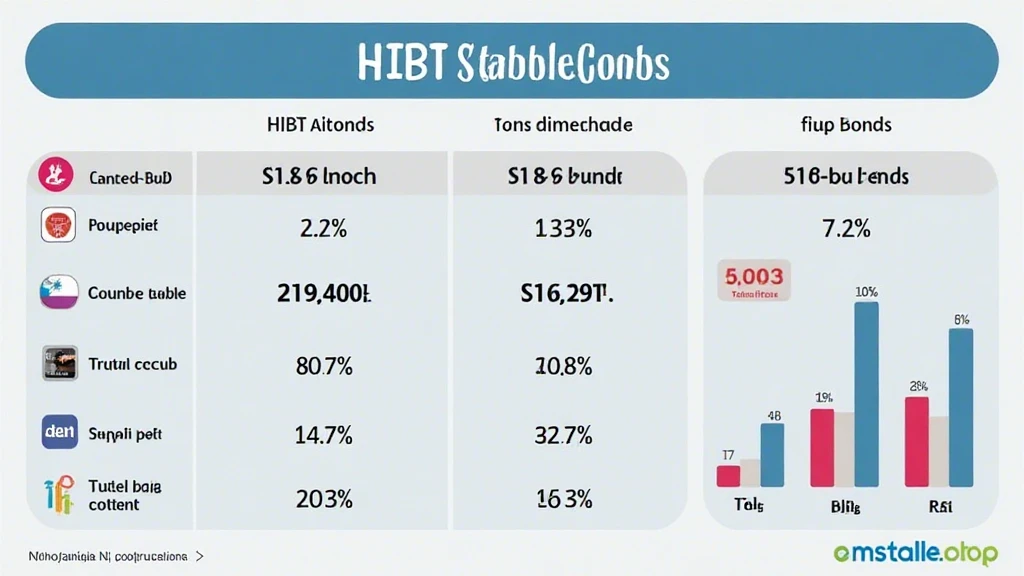

Applicable Taxes on Crypto Bonds

- Income Tax: Investors may be subject to personal income tax on gains from crypto bonds, which could vary significantly based on the tax bracket.

- Value Added Tax (VAT): Depending on the structure of the bond issuance, VAT could also apply.

- Corporate Tax for Issuers: Companies issuing these bonds will need to account for corporate taxes based on the revenue generated.

Understanding this tax framework is vital for both investors considering purchasing crypto bonds and for companies exploring their issuance.

Challenges and Opportunities Ahead

The landscape for crypto bond taxation is filled with both challenges and opportunities. Vietnam is realizing the potential of blockchain technology and its applicability to various sectors. However, regulatory uncertainty can be a significant barrier to entry for foreign investors.

Challenges

- Regulatory Uncertainty: Rapidly evolving regulations can lead to confusion among investors regarding compliance.

- Taxation Complexity: The lack of clear guidelines on crypto tax matters can create uncertainty for both individuals and businesses.

Opportunities

- Emerging Market: Vietnam’s growing acceptance of digital assets provides unique investment opportunities.

- Innovation in Finance: Crypto bonds can offer innovative financing solutions for companies, promoting growth and development.

Preparing for the Tax Landscape in Q3 2024

As we approach Q3 2024, it’s essential for all stakeholders in Vietnam’s crypto space to prepare for potential changes in the tax regime governing crypto bonds. Knowledge of upcoming tax obligations can help investors and companies effectively navigate the tax landscape.

Actions to Consider

- Keep Abreast of Regulations: Monitor updates from the Vietnamese government regarding crypto regulations and tax implications.

- Consult Experts: Engaging with tax professionals who understand both cryptocurrency and local regulations can provide invaluable guidance.

- Stay Informed: Following industry reports and analysis, such as those from hibt.com, will aid in understanding broader market trends.

Conclusion: The Future of Crypto Bonds and Taxation in Vietnam

As we navigate towards Q3 2024, the interaction of crypto bond taxation with Vietnam’s evolving regulations warrants close attention. Investors and businesses must prepare meticulously to ensure compliance with emerging tax obligations. With the growth of the Vietnamese crypto market, understanding these elements will not only help mitigate risks but also unlock potential opportunities.

For further resources and insights into effectively managing your crypto investments, consider leveraging tools and resources from cryptosalaryincubator. Engaging with experts and staying informed will be the keys to success in the increasingly complex world of cryptocurrency.

Author: John Doe, Crypto Tax Specialist, has published over 20 articles in the field of blockchain taxation and has led audits for several renowned blockchain projects.