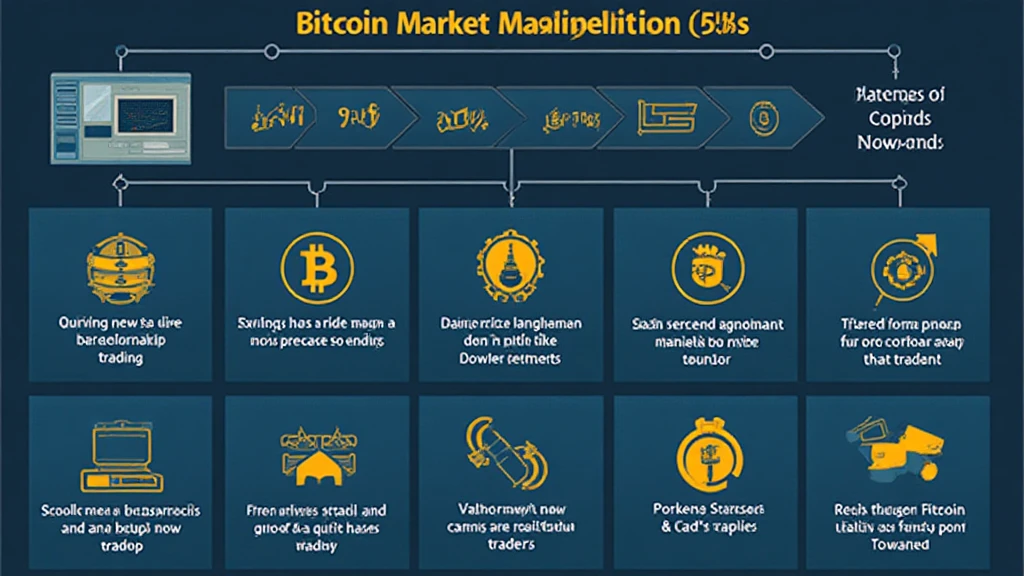

Understanding HIBT Bitcoin Market Manipulation Risks

In a world where the cryptocurrency market is positioned as a lucrative avenue for investment, the risks associated with Bitcoin market manipulation cannot be overstated. With approximately $4.1 Billion lost to various hacks and schemes in the DeFi space in 2024, understanding these risks has never been more critical. What does this mean for you and your investments? Let’s break it down.

The Nature of Market Manipulation

Market manipulation refers to the act of artificially affecting the price or volume of a security or asset through deceptive practices. In the case of Bitcoin and other cryptocurrencies, manipulation can be a significant concern, especially on less regulated exchanges. Here are some of the primary methods used:

- Wash Trading: This involves buying and selling the same asset to create an illusion of high trading volume.

- Pump and Dump: A scheme where the price of an asset is artificially inflated (pumped) before being sold off at a profit, leaving late investors with losses.

- Front Running: This involves traders anticipating large orders and trading before those orders go through, profiting from the price changes.

Real-life Examples of Market Manipulation

To illustrate these concepts, consider a scenario where a trader engages in wash trading to inflate Bitcoin’s volume on a smaller exchange. This creates a false perception of its legitimacy and demand, leading to unsuspecting investors to buy in. Once the price rises significantly due to this artificial demand, the manipulator sells off their holdings, resulting in significant losses for other investors.

Why HIBT is Prone to Manipulation

The HIBT Bitcoin operates within a volatile market. Being an emerging player, it often attracts speculative investments. This susceptibility to manipulation is exacerbated by:

- Low Trading Volume: New cryptocurrencies like HIBT often have low liquidity, making them easy targets for manipulators.

- Lack of Regulation: Many lesser-known exchanges do not enforce stringent controls, allowing manipulative activities to flourish.

- High Volatility: The inherent volatility in Bitcoin prices makes it easier for manipulators to exploit temporary price changes.

Case Study: A Real Threat to Investors

A notable example in Vietnam indicated a surge in trading of HIBT leading up to a major event. What seemed to be genuine investor interest was later revealed as a coordinated approach by a small group of traders.

Measuring Risks: The Role of Tools and Techniques

To safeguard against HIBT market manipulation risks, utilizing various tools can be essential. Here are some recommended strategies:

- Technical Analysis: Familiarizing yourself with charts can help you identify abnormal trading volumes or sudden price spikes.

- Using Alerts: Many trading platforms like Binance or Coinbase Pro allow users to set alerts for significant price changes.

- Fundamental Analysis: Keeping abreast of news in the crypto world could help you avoid sentiments created by market manipulators.

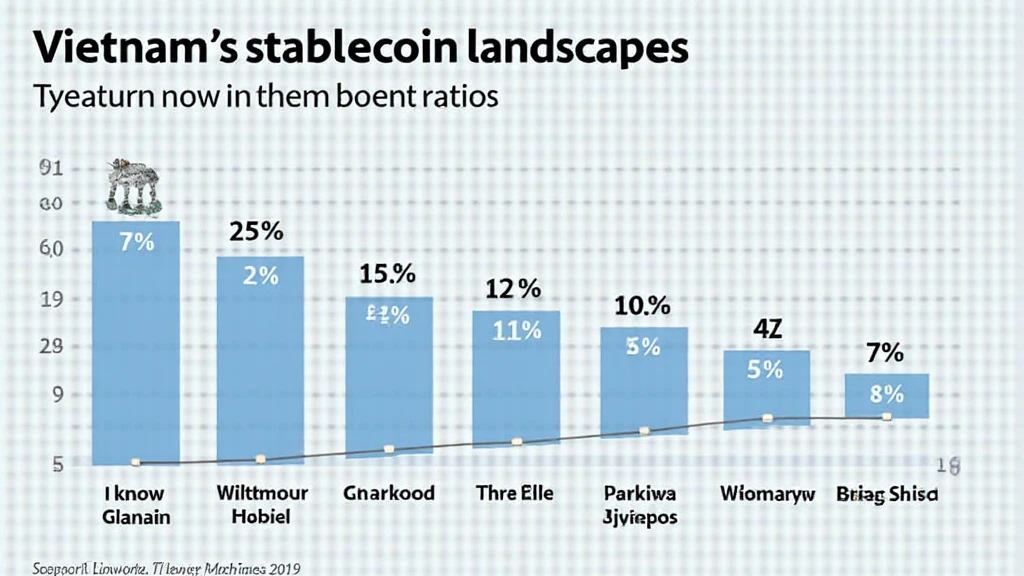

Local Market Trends: Vietnam’s Crypto Landscape

According to recent data, Vietnam’s crypto user growth has reached an astonishing 70% in 2023, making it a burgeoning hub for many emerging cryptocurrencies like HIBT. This growth also attracts opportunistic market manipulators looking to prey on naive investors. Educating oneself is key in this fast-paced market.

Regulatory Measures and Their Importance

With the increasing sophistication of market manipulation techniques, regulators worldwide are starting to take significant action. However, given the decentralized nature of cryptocurrencies, enforcing regulations remains a challenge. Here are some actions being pursued:

- Enhanced Surveillance: Many countries are adopting advanced technologies to monitor trading activities.

- Compliance Frameworks: Implementing measures to ensure exchanges follow fair trading practices.

- Investor Education: Raising awareness among investors about potential risks associated with digital assets.

What Can You Do?

As an investor, protecting yourself against risks associated with HIBT market manipulation is vital. Here are some practical steps:

- Research Thoroughly: Always keep an eye on legitimate news and trends in the market.

- Diverse Investments: Don’t put all your eggs in one basket; diversifying can help mitigate risks.

- Stay Informed: Follow reliable platforms for updates on regulations and manipulative tactics.

Conclusion

In conclusion, understanding the risks associated with HIBT Bitcoin market manipulation is critical for anyone aiming to invest in cryptocurrencies. As the market evolves, so too must your strategies for safeguarding your investments. Always stay alert, do your research, and utilize the available tools and resources to navigate this landscape responsibly.

For more information on market analysis and investment strategies, visit hibt.com. Remember, investing in cryptocurrencies is not without risks. Always consult with financial advisors and adhere to local regulations to make informed decisions!

Author: John Smith, a cryptocurrency analyst, has published over 50 articles and led the audit for several significant projects in the blockchain space.